- United Kingdom

- /

- Professional Services

- /

- AIM:IBPO

Do iEnergizer's (LON:IBPO) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like iEnergizer (LON:IBPO). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for iEnergizer

How Quickly Is iEnergizer Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that iEnergizer has managed to grow EPS by 31% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

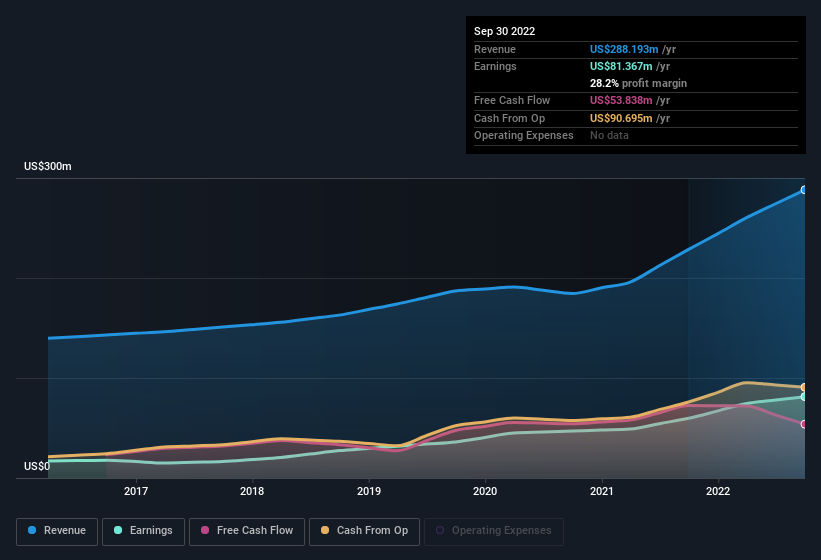

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. iEnergizer shareholders can take confidence from the fact that EBIT margins are up from 31% to 33%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of iEnergizer's forecast profits?

Are iEnergizer Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that iEnergizer insiders own a significant number of shares certainly is appealing. In fact, they own 83% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. at the current share price. That level of investment from insiders is nothing to sneeze at.

Does iEnergizer Deserve A Spot On Your Watchlist?

You can't deny that iEnergizer has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in iEnergizer's continuing strength. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. Even so, be aware that iEnergizer is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

Although iEnergizer certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if iEnergizer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:IBPO

iEnergizer

iEnergizer Limited provides business process outsourcing (BPO) and content transformation services in the United Kingdom, India, the United States, and internationally.

Established dividend payer and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success