- United Kingdom

- /

- Software

- /

- LSE:GBG

The five-year shareholder returns and company earnings persist lower as GB Group (LON:GBG) stock falls a further 9.8% in past week

Generally speaking long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. To wit, the GB Group plc (LON:GBG) share price managed to fall 64% over five long years. That's an unpleasant experience for long term holders. And it's not just long term holders hurting, because the stock is down 29% in the last year. Furthermore, it's down 17% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

GB Group became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

The modest 1.8% dividend yield is unlikely to be guiding the market view of the stock. In contrast to the share price, revenue has actually increased by 7.6% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

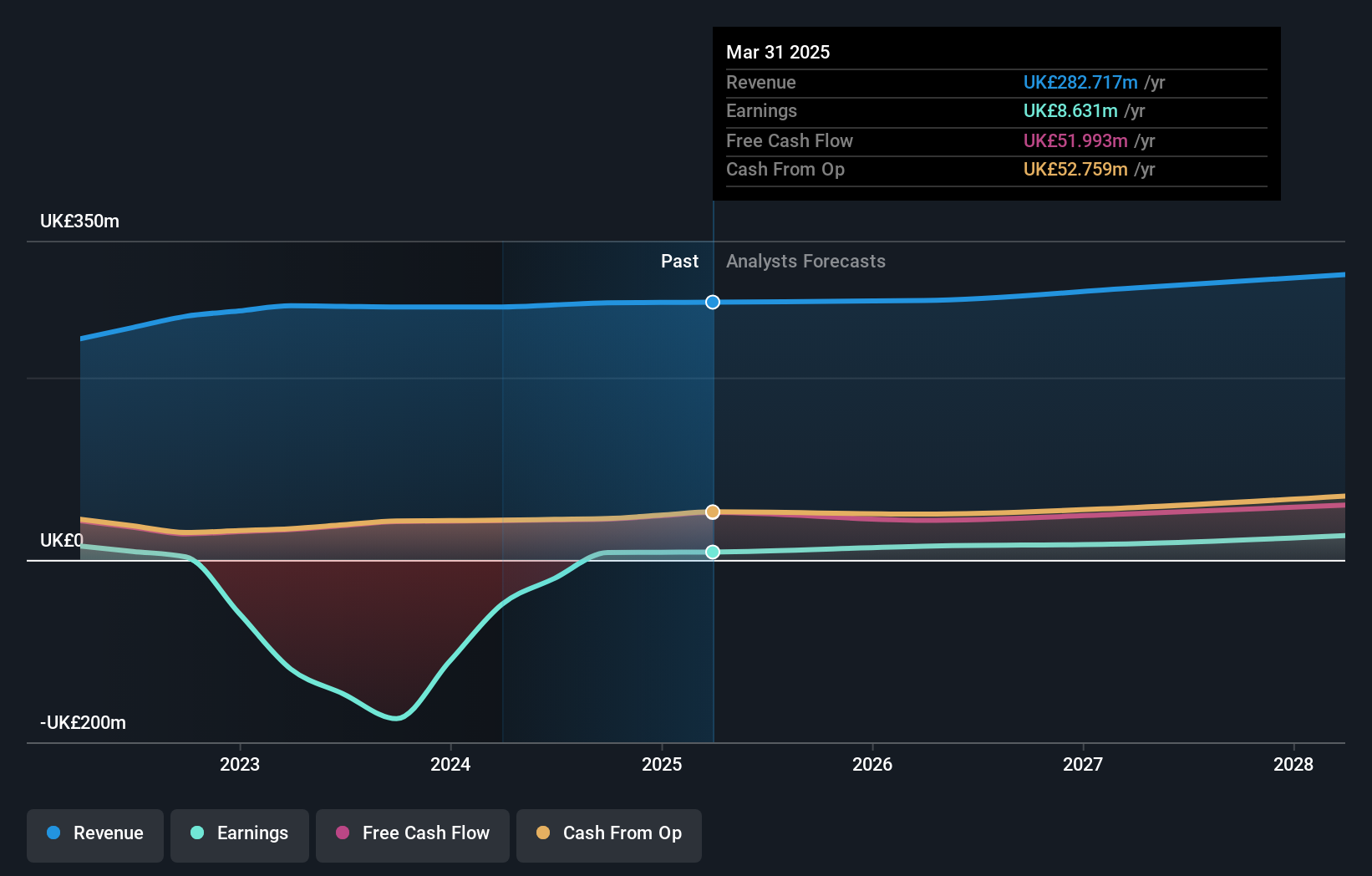

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think GB Group will earn in the future (free profit forecasts).

A Different Perspective

While the broader market gained around 9.7% in the last year, GB Group shareholders lost 28% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. If you would like to research GB Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: GB Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:GBG

GB Group

Provides identity data intelligence products and services in the United Kingdom, the United States, Australia, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives