- United Kingdom

- /

- Diversified Financial

- /

- AIM:FNX

Fonix Mobile's (LON:FNX) Upcoming Dividend Will Be Larger Than Last Year's

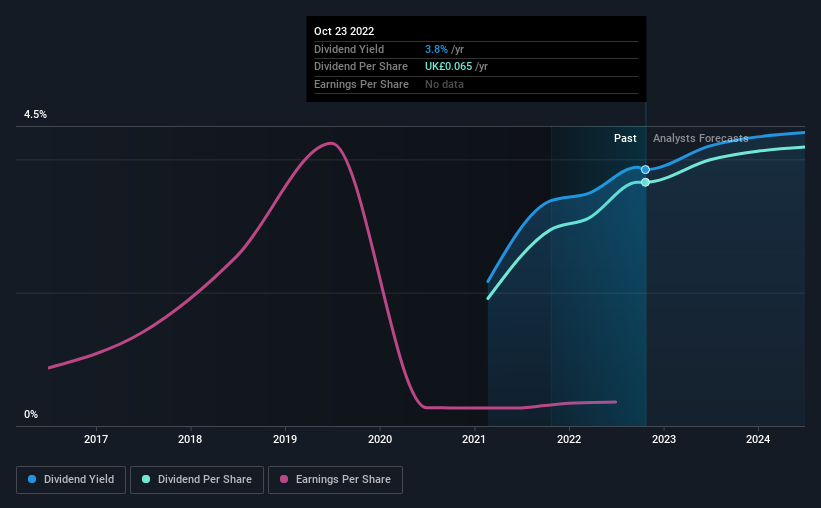

Fonix Mobile plc's (LON:FNX) dividend will be increasing from last year's payment of the same period to £0.045 on 30th of November. Based on this payment, the dividend yield for the company will be 3.8%, which is fairly typical for the industry.

Our analysis indicates that FNX is potentially undervalued!

Fonix Mobile's Payment Has Solid Earnings Coverage

We aren't too impressed by dividend yields unless they can be sustained over time. At the time of the last dividend payment, Fonix Mobile was paying out a very large proportion of what it was earning and 132% of cash flows. This is certainly a risk factor, as reduced cash flows could force the company to pay a lower dividend.

The next year is set to see EPS grow by 27.5%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 43% which brings it into quite a comfortable range.

Fonix Mobile Doesn't Have A Long Payment History

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. Since 2020, the annual payment back then was £0.034, compared to the most recent full-year payment of £0.065. This means that it has been growing its distributions at 38% per annum over that time. The dividend has been growing rapidly, however with such a short payment history we can't know for sure if payment can continue to grow over the long term, so caution may be warranted.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. However, initial appearances might be deceiving. Earnings per share has been sinking by 24% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

The Dividend Could Prove To Be Unreliable

Overall, we always like to see the dividend being raised, but we don't think Fonix Mobile will make a great income stock. The payments are bit high to be considered sustainable, and the track record isn't the best. We don't think Fonix Mobile is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Fonix Mobile that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:FNX

Fonix

Provides mobile payments and messaging, and managed services for media, charity, gaming, e-mobility, and other digital service businesses in the United Kingdom and the rest of Europe.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion