ECSC Group plc (LON:ECSC) shareholders will doubtless be very grateful to see the share price up 75% in the last quarter. But that doesn't change the reality of under-performance over the last twelve months. After all, the share price is down 12% in the last year, significantly under-performing the market.

See our latest analysis for ECSC Group

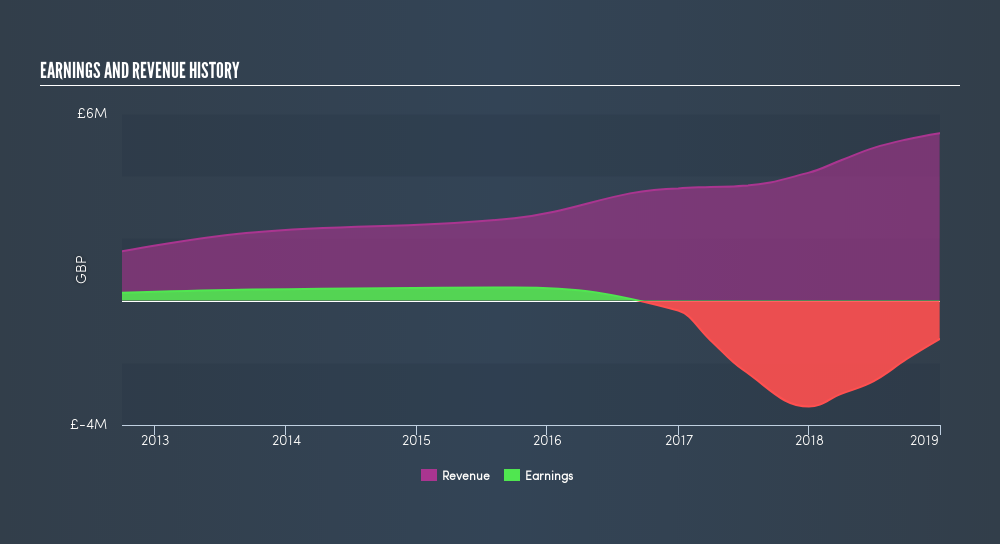

ECSC Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

ECSC Group grew its revenue by 31% over the last year. That's definitely a respectable growth rate. Unfortunately that wasn't good enough to stop the share price dropping 12%. This implies the market was expecting better growth. However, that's in the past now, and it's the future that matters most.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this freereport showing consensus forecasts

A Different Perspective

While ECSC Group shareholders are down 12% for the year, the market itself is up 3.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 75%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of ECSC Group by clicking this link.

ECSC Group is not the only stock that insiders are buying. For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:ECSC

ECSC Group

ECSC Group plc, together with its subsidiaries, provides information and cyber security services in the United Kingdom, rest of Europe, the United States, Channel Islands, and internationally.

Slightly overvalued with concerning outlook.

Market Insights

Community Narratives