The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Eckoh plc (LON:ECK) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Eckoh

What Is Eckoh's Net Debt?

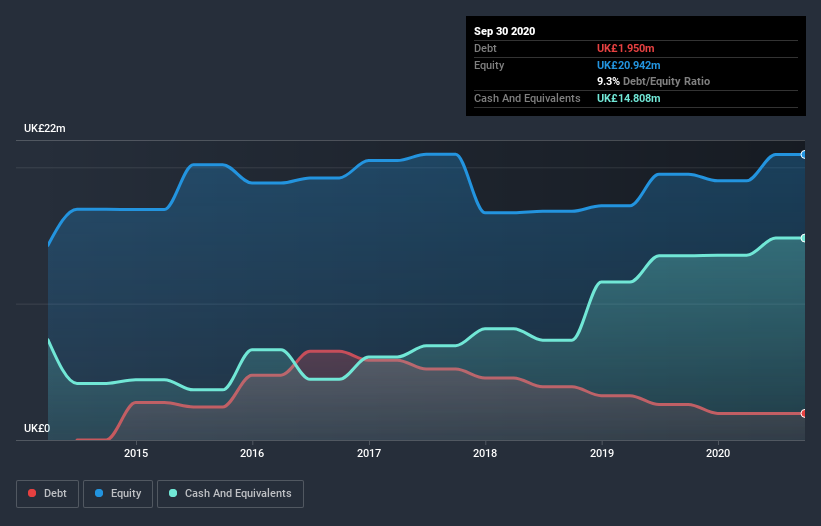

As you can see below, Eckoh had UK£1.95m of debt at September 2020, down from UK£2.60m a year prior. But on the other hand it also has UK£14.8m in cash, leading to a UK£12.9m net cash position.

How Strong Is Eckoh's Balance Sheet?

We can see from the most recent balance sheet that Eckoh had liabilities of UK£19.9m falling due within a year, and liabilities of UK£1.27m due beyond that. Offsetting this, it had UK£14.8m in cash and UK£12.3m in receivables that were due within 12 months. So it can boast UK£6.01m more liquid assets than total liabilities.

This short term liquidity is a sign that Eckoh could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Eckoh boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, Eckoh's EBIT dived 17%, over the last year. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Eckoh's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Eckoh may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Eckoh actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Eckoh has net cash of UK£12.9m, as well as more liquid assets than liabilities. And it impressed us with free cash flow of UK£4.5m, being 212% of its EBIT. So we don't have any problem with Eckoh's use of debt. We'd be motivated to research the stock further if we found out that Eckoh insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Eckoh, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eckoh might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:ECK

Eckoh

Provides customer engagement data and payment security solutions in the United Kingdom, the United States, Canada, Ireland, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Lexaria Bioscience's Breakthrough with DehydraTECH to Revolutionize Drug Delivery

SIrios Resources (SOI) is significantly undervalued on a risk-adjusted basis.

BSX after Penumbra ?

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.