- Canada

- /

- Oil and Gas

- /

- TSX:VLE

Exploring 3 Promising Undervalued Small Caps With Insider Action In Global

Reviewed by Simply Wall St

In the current global market landscape, U.S. stocks have shown resilience with positive returns despite ongoing trade policy uncertainties and fluctuating inflation expectations, while smaller-cap indexes have lagged but still managed to post gains. As investors navigate these complex dynamics, identifying promising small-cap stocks with insider activity can offer unique opportunities for growth potential amid broader market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Tristel | 26.8x | 3.8x | 14.45% | ★★★★☆☆ |

| Sing Investments & Finance | 7.2x | 3.7x | 39.63% | ★★★★☆☆ |

| AKVA group | 15.8x | 0.7x | 45.82% | ★★★★☆☆ |

| Eastnine | 18.2x | 8.8x | 40.64% | ★★★★☆☆ |

| Savills | 24.7x | 0.6x | 41.68% | ★★★☆☆☆ |

| Absolent Air Care Group | 22.3x | 1.8x | 49.40% | ★★★☆☆☆ |

| Italmobiliare | 11.9x | 1.6x | -219.73% | ★★★☆☆☆ |

| SmartCraft | 42.3x | 7.6x | 32.44% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.3x | 0.4x | -41.50% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.3x | 45.51% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

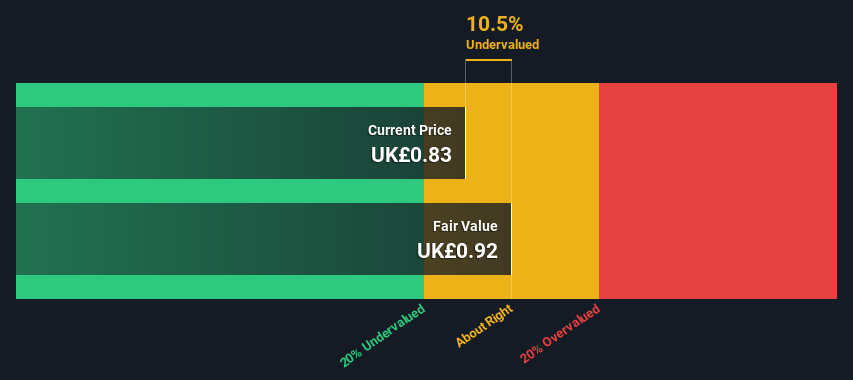

dotdigital Group (AIM:DOTD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dotdigital Group is a company specializing in data-driven omni-channel marketing automation, with a market capitalization of approximately £0.34 billion.

Operations: The company generates revenue primarily from its data-driven omni-channel marketing automation services, with a reported revenue of £82.59 million. The cost of goods sold (COGS) amounts to £17.41 million, resulting in a gross profit margin of 78.92%. Operating expenses are significant at £51.86 million, which includes general and administrative costs.

PE: 22.9x

Dotdigital Group, a software company, stands out in the small-cap sector with its earnings projected to grow by 11% annually. Despite relying solely on external borrowing for funding, insider confidence is evident with recent share purchases. The appointment of Tom Mullan as CFO in April 2025 could steer strategic growth given his track record at Gresham Technologies. While financial risks exist due to funding structure, the company's potential for growth remains noteworthy amidst these challenges.

- Navigate through the intricacies of dotdigital Group with our comprehensive valuation report here.

Explore historical data to track dotdigital Group's performance over time in our Past section.

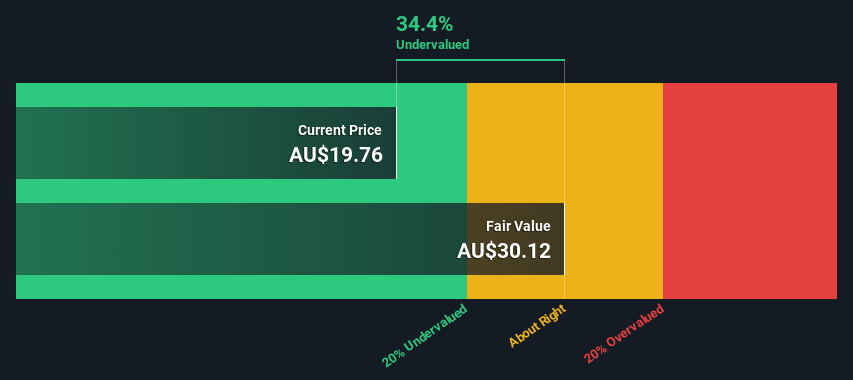

Perpetual (ASX:PPT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Perpetual is a diversified financial services company operating primarily in asset management and wealth management, with a market capitalization of A$1.90 billion.

Operations: The company generates revenue primarily from Asset Management and Wealth Management, with Asset Management contributing significantly to its income. Over recent periods, the gross profit margin has shown a downward trend, reaching 39.09% by the end of 2025. Operating expenses have been increasing steadily, impacting overall profitability.

PE: -4.1x

Perpetual is currently in the spotlight with M&A rumors swirling around its wealth management unit, potentially selling for A$500 million to A$1 billion. This move could reduce their debt of A$569 million. Despite some adviser departures, they've bolstered their team with new hires. Insider confidence is evident as Christopher Mark Jones increased their stake by 105%, purchasing 8,000 shares for roughly A$159,420 in April 2025. While earnings are expected to grow by 77% annually, reliance on external borrowing highlights funding risks.

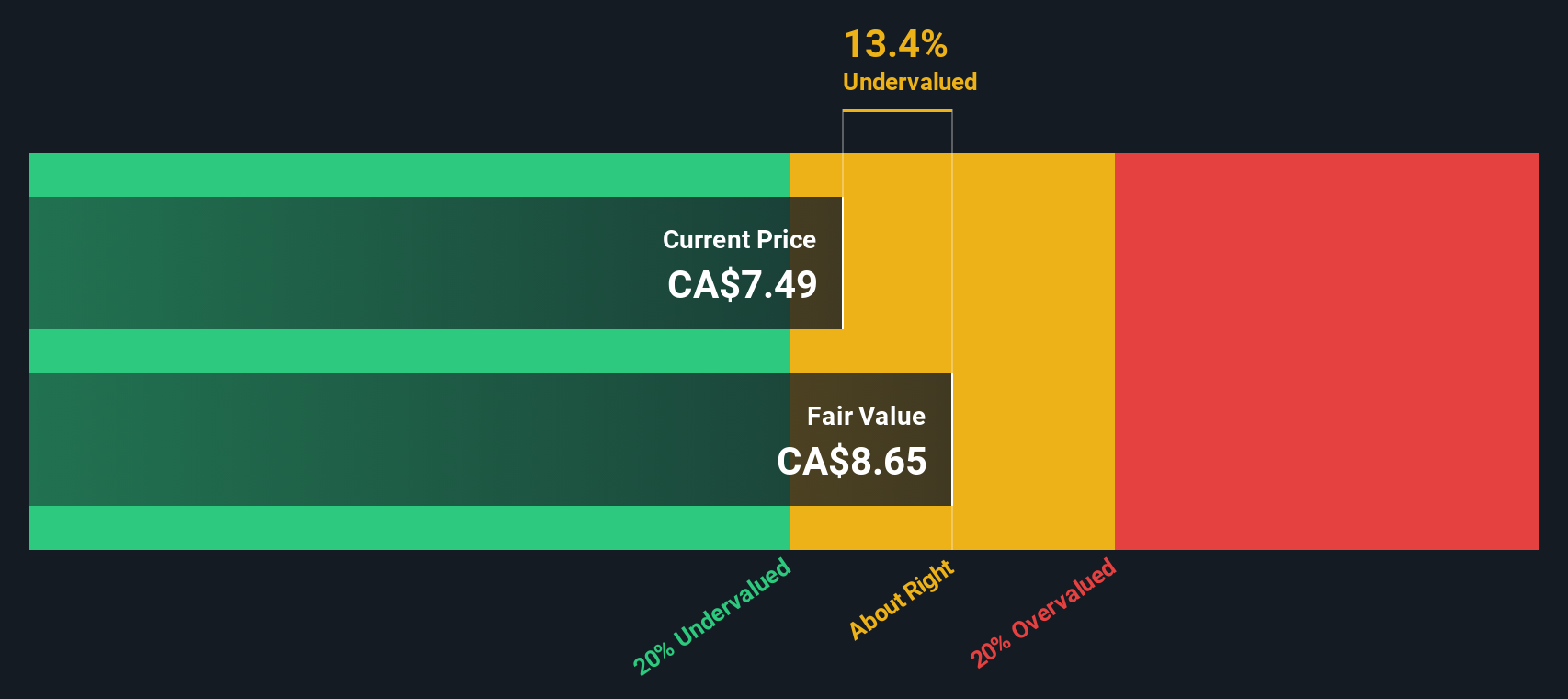

Valeura Energy (TSX:VLE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Valeura Energy is an oil and gas company focused on exploration and production, with a market capitalization of approximately $2.68 billion.

Operations: Valeura Energy's revenue primarily stems from its oil and gas exploration and production activities, with recent quarterly figures reaching $682.54 million. The company's gross profit margin has shown a notable upward trend, reaching 73.12% as of the latest period. Operating expenses are significant, including depreciation and amortization costs of $195.47 million in the most recent quarter, impacting overall profitability.

PE: 2.4x

Valeura Energy, a smaller player in the energy sector, is actively enhancing its asset portfolio in the Gulf of Thailand. Recently completing an eight-well drilling campaign at Licence B5/27, they exceeded expectations with oil pay nearly double pre-drill estimates. The company also made strategic moves like electing Chalermchai Mahagitsiri to their board and pursuing M&A opportunities for transformational growth. Despite a slight dip in Q1 2025 earnings to US$14 million from US$19 million a year prior, Valeura's focus on redevelopment projects like Wassana suggests potential for significant shareholder value creation.

- Click to explore a detailed breakdown of our findings in Valeura Energy's valuation report.

Understand Valeura Energy's track record by examining our Past report.

Summing It All Up

- Get an in-depth perspective on all 177 Undervalued Global Small Caps With Insider Buying by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VLE

Valeura Energy

Engages in the exploration, development, and production of petroleum and natural gas in Thailand and in Turkey.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion