- United Kingdom

- /

- Software

- /

- AIM:DOTD

European Undervalued Small Caps With Insider Action For April 2025

Reviewed by Simply Wall St

In April 2025, European markets have shown resilience with the pan-European STOXX Europe 600 Index rising by 2.77%, buoyed by easing trade tensions between the U.S. and China and positive signals from key European economies like Germany and France. Despite some economic uncertainties, such as tariff impacts on Germany's export sector, the overall sentiment remains cautiously optimistic, providing a fertile ground for investors exploring opportunities in small-cap stocks. In this environment, identifying promising small-cap stocks often involves looking at companies with strong fundamentals that can weather economic fluctuations and benefit from insider confidence.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.7x | 0.5x | 42.85% | ★★★★★★ |

| Tristel | 27.2x | 3.8x | 27.77% | ★★★★★☆ |

| Kitwave Group | 13.9x | 0.3x | 48.00% | ★★★★★☆ |

| J D Wetherspoon | 11.5x | 0.3x | 35.37% | ★★★★★☆ |

| Savills | 23.5x | 0.5x | 43.89% | ★★★★☆☆ |

| Speedy Hire | NA | 0.2x | 4.59% | ★★★★☆☆ |

| Norcros | 24.2x | 0.6x | 28.17% | ★★★☆☆☆ |

| FRP Advisory Group | 12.7x | 2.3x | 7.32% | ★★★☆☆☆ |

| Italmobiliare | 11.1x | 1.5x | -263.56% | ★★★☆☆☆ |

| Arendals Fossekompani | NA | 1.6x | 44.29% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

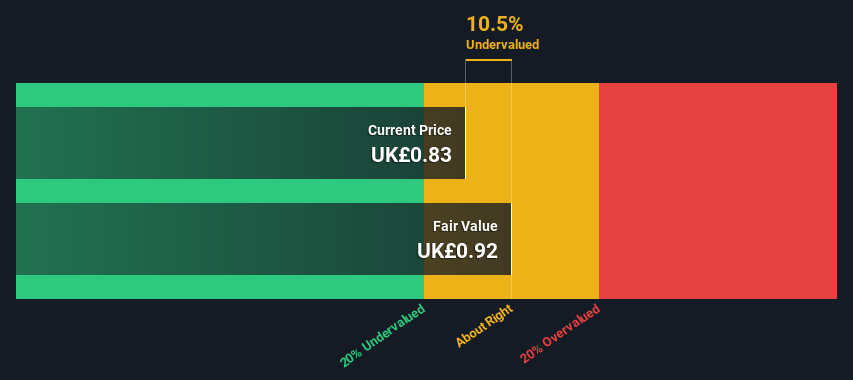

dotdigital Group (AIM:DOTD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dotdigital Group operates in the provision of data-driven omni-channel marketing automation, with a market cap of approximately £0.33 billion.

Operations: The company generates revenue primarily from data-driven omni-channel marketing automation services, with recent figures showing £82.59 million in revenue. The cost of goods sold (COGS) is £17.41 million, leading to a gross profit of £65.18 million and a gross profit margin of 78.92%. Operating expenses are significant at £51.86 million, which impacts the net income figure of £11.34 million and results in a net income margin of 13.73%.

PE: 22.1x

Dotdigital Group, a dynamic player in the software sector, showcases potential as an undervalued investment. With earnings forecast to grow 11% annually, the company reported half-year sales of £42.37 million, up from £38.75 million previously. Insider confidence is evident with recent share purchases by executives in early 2025. The new CFO, Tom Mullan, brings substantial SaaS and M&A experience from Gresham Technologies, aligning with Dotdigital's acquisition strategy and growth ambitions within its expanding digital marketing platform offerings.

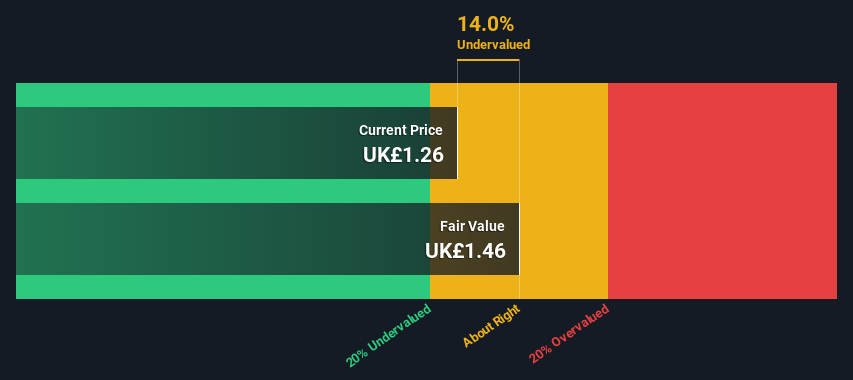

FRP Advisory Group (AIM:FRP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: FRP Advisory Group provides specialist business advisory services and has a market capitalization of approximately £0.39 billion.

Operations: The company generates revenue primarily from the provision of specialist business advisory services, with recent figures showing a revenue of £147.1 million. The gross profit margin has shown an upward trend, reaching 45.96% as of October 2024, indicating improved cost management relative to revenue growth. Operating expenses are a significant component of costs, totaling £30.7 million in the latest period, alongside non-operating expenses and depreciation and amortization costs contributing to overall financial performance.

PE: 12.7x

FRP Advisory Group, a smaller player in Europe's financial advisory sector, is catching attention due to insider confidence shown through recent share purchases. Earnings are projected to grow by 2.41% annually, despite the company's reliance on higher-risk external borrowing for funding. In February 2025, FRP affirmed its commitment to shareholders with an increased interim dividend of £0.0095 per share, up from £0.009 in Q3 2024. These factors contribute to its potential as an undervalued investment opportunity within the market landscape.

- Click to explore a detailed breakdown of our findings in FRP Advisory Group's valuation report.

Explore historical data to track FRP Advisory Group's performance over time in our Past section.

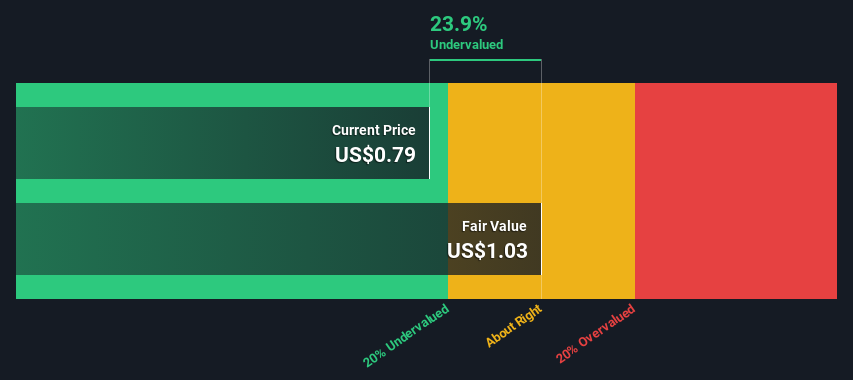

Taylor Maritime (LSE:TMI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Taylor Maritime operates in the shipping industry, focusing on generating investment returns through its fleet of vessels, with a market capitalization of approximately £0.28 billion.

Operations: Taylor Maritime's revenue primarily comes from its shipping vessels, with a gross profit margin consistently at 100%. The company has experienced fluctuations in net income margins, ranging from 54.30% to 139.48%, reflecting variations in profitability over different periods. Operating expenses have shown a gradual increase, reaching $9.92 million by the latest period reported.

PE: 3.3x

Taylor Maritime, a smaller European stock, shows potential for value-focused investors. Despite relying solely on external borrowing for funding, the company maintains insider confidence with recent share purchases by executives in March 2025. Their strategic moves include appointing seasoned professionals like Matt Falla as Group Company Secretary and expanding their executive team in February 2025. Additionally, they declared a dividend of 2 US cents per share for March 2025, indicating commitment to shareholder returns amidst evolving governance and management strategies.

- Click here to discover the nuances of Taylor Maritime with our detailed analytical valuation report.

Review our historical performance report to gain insights into Taylor Maritime's's past performance.

Summing It All Up

- Unlock more gems! Our Undervalued European Small Caps With Insider Buying screener has unearthed 64 more companies for you to explore.Click here to unveil our expertly curated list of 67 Undervalued European Small Caps With Insider Buying.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:DOTD

dotdigital Group

Engages in the provision of intuitive software as a service (SaaS) and managed services to digital marketing professionals worldwide.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives