- United Kingdom

- /

- Metals and Mining

- /

- AIM:JLP

dotdigital Group Leads These 3 UK Penny Stocks To Consider

Reviewed by Simply Wall St

The London stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting ongoing global economic uncertainties. Despite such fluctuations, investors often look beyond large-cap stocks to explore opportunities in smaller companies. Penny stocks, though an older term, still capture interest for their potential affordability and growth prospects; this article examines three UK penny stocks that may offer financial resilience amidst current market conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.455 | £356.81M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.815 | £211.65M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.865 | £384.4M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.91 | £68.92M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.485 | £189.12M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.35 | £208.21M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.43 | £438.91M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.35 | £207.28M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.46 | $267.41M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

dotdigital Group (AIM:DOTD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: dotdigital Group Plc provides intuitive software as a service (SaaS) and managed services for digital marketing professionals globally, with a market capitalization of £298.56 million.

Operations: No specific revenue segments are reported for dotdigital Group.

Market Cap: £298.56M

dotdigital Group Plc, with a market capitalization of £298.56 million, presents a mixed picture for investors interested in penny stocks. The company reported sales of £78.97 million for the fiscal year ending June 30, 2024, but experienced a decline in net income to £11.07 million from the previous year’s £12.6 million. Despite negative earnings growth over the past year and a low return on equity at 11.6%, dotdigital maintains high-quality earnings and is debt-free with strong asset coverage over liabilities. Its management team is experienced, and it offers relatively good value compared to industry peers with stable weekly volatility at 5%.

- Click here to discover the nuances of dotdigital Group with our detailed analytical financial health report.

- Explore dotdigital Group's analyst forecasts in our growth report.

Jubilee Metals Group (AIM:JLP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jubilee Metals Group plc is a diversified metals processing and recovery company with a market cap of £142.77 million.

Operations: The company's revenue is primarily derived from its PGM and Chrome segment, which generated $186.92 million, and its Copper and Cobalt segment, contributing $18.49 million.

Market Cap: £142.77M

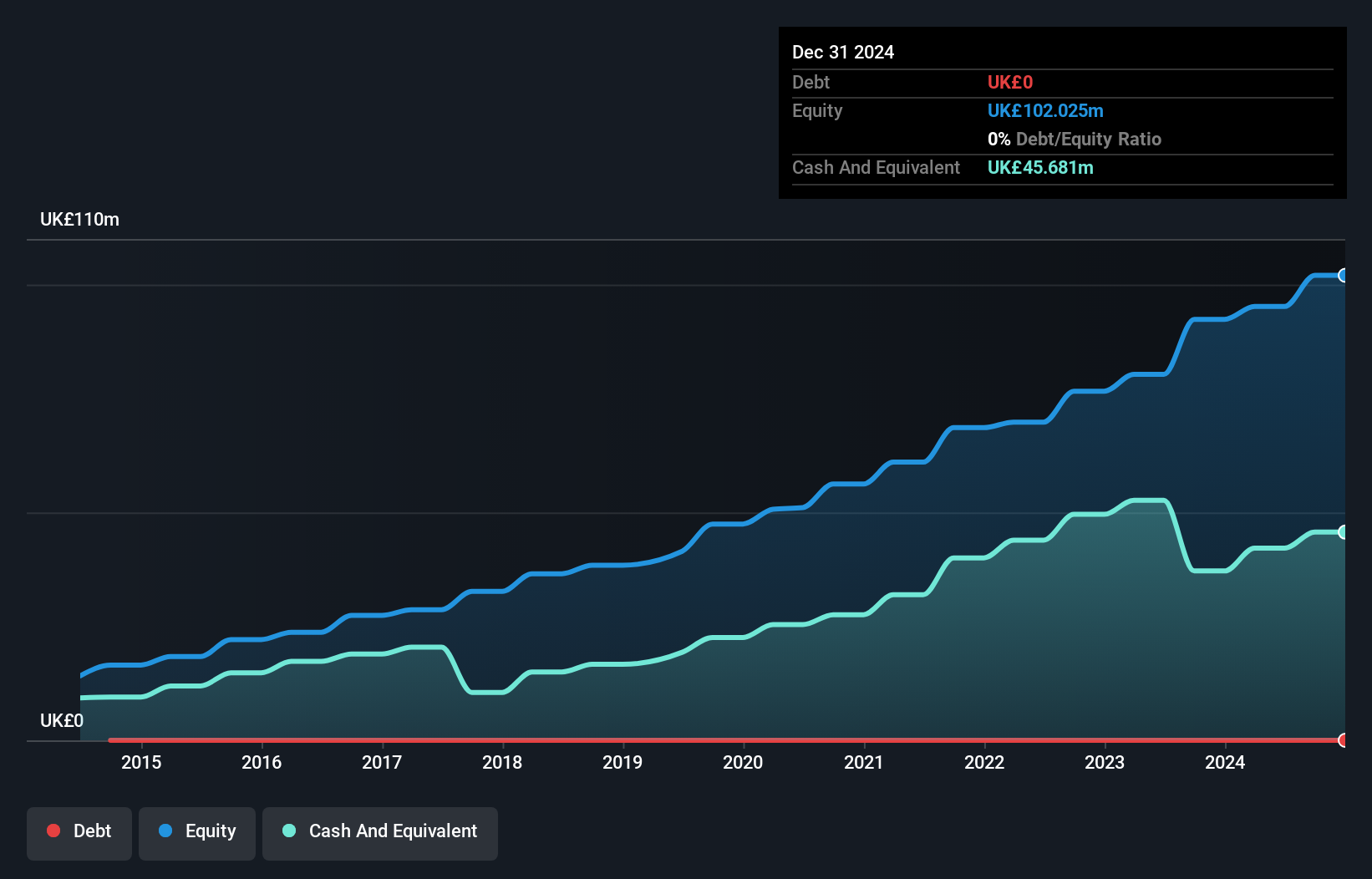

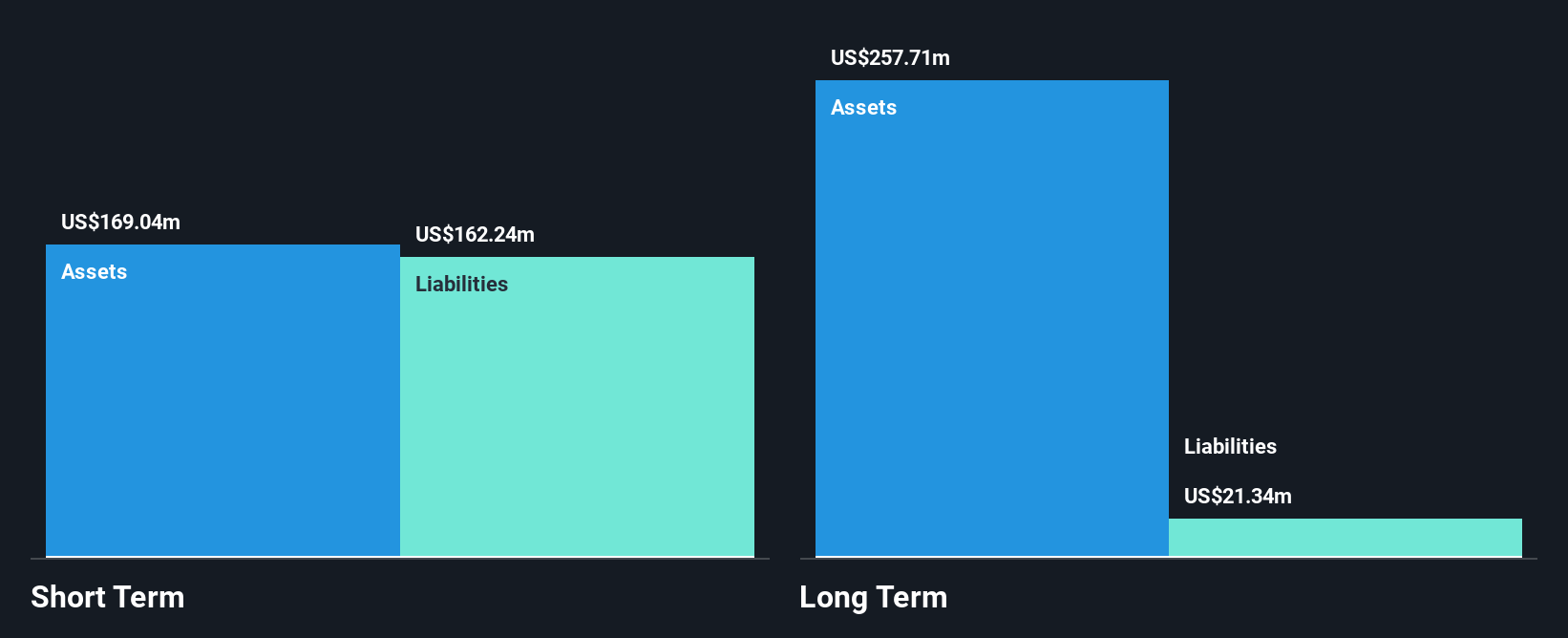

Jubilee Metals Group plc, with a market cap of £142.77 million, shows both potential and challenges as a penny stock. The company reported revenue of US$205.4 million for the year ending June 30, 2024, primarily from its PGM and Chrome segment. Despite this, net income decreased to US$5.95 million from US$15.55 million the previous year, reflecting lower profit margins at 2.9%. Recent strategic expansions in Zambia aim to boost copper production capacity significantly but have yet to translate into improved earnings growth or return on equity, which remains low at 2.5%. Management changes could impact future execution and governance stability.

- Take a closer look at Jubilee Metals Group's potential here in our financial health report.

- Learn about Jubilee Metals Group's future growth trajectory here.

Luceco (LSE:LUCE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Luceco plc manufactures and distributes wiring accessories, LED lighting, and portable power products across various regions including the UK, Europe, the Middle East, the Americas, Asia Pacific, and Africa with a market cap of £208.21 million.

Operations: The company's revenue is divided into three segments: LED Lighting (£77.5 million), Portable Power (£49.6 million), and Wiring Accessories (£90.4 million).

Market Cap: £208.21M

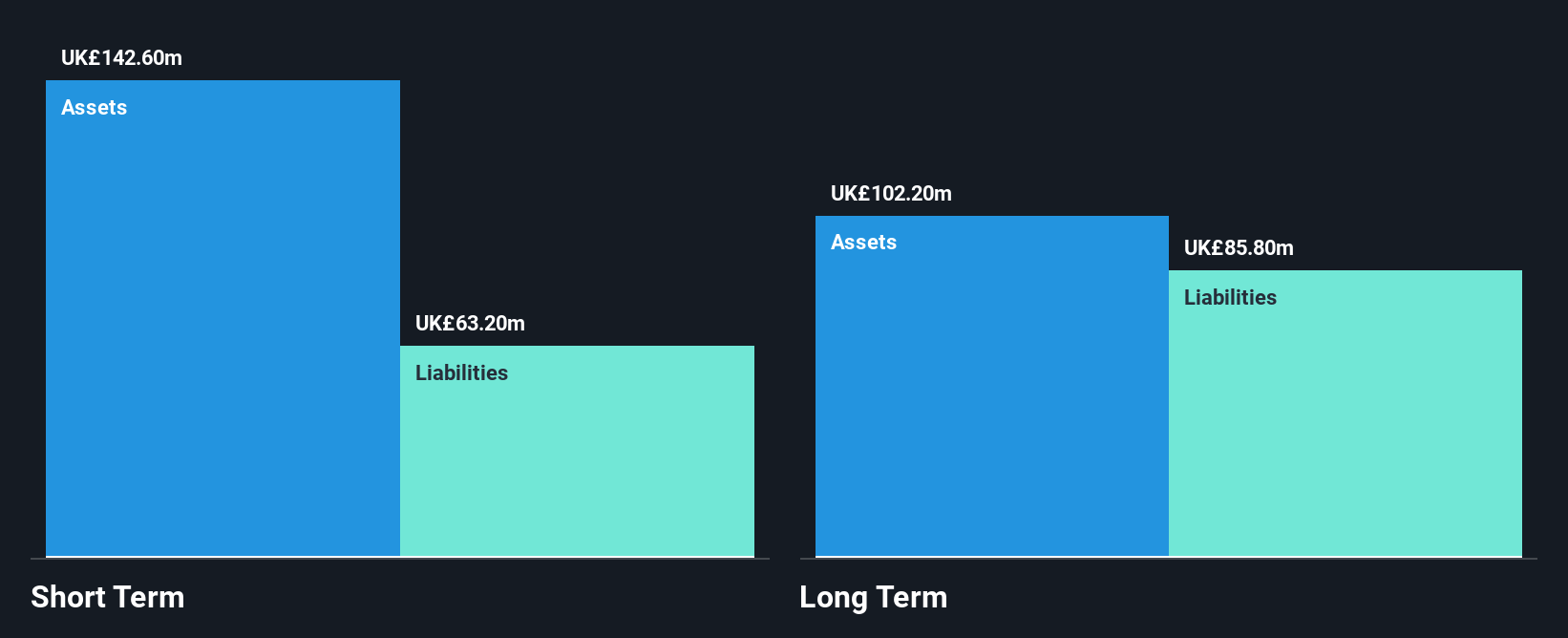

Luceco plc, with a market cap of £208.21 million, presents a mixed picture for investors interested in penny stocks. The company has demonstrated strong earnings growth over the past year at 51.2%, surpassing industry averages, and maintains stable profit margins at 8.4%. However, it faces challenges with an unstable dividend track record and significant insider selling recently. Luceco's debt position has improved over time but remains high relative to equity at 42.7%. The company's proactive approach to mergers and acquisitions signals potential strategic growth opportunities supported by its strong cash flow generation and balance sheet strength.

- Unlock comprehensive insights into our analysis of Luceco stock in this financial health report.

- Review our growth performance report to gain insights into Luceco's future.

Make It Happen

- Reveal the 470 hidden gems among our UK Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JLP

Jubilee Metals Group

Jubilee Metals Group plc operates as a diversified metals processing and recovery company.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives