- United Kingdom

- /

- IT

- /

- AIM:CLCO

Is CloudCoCo Group (LON:CLCO) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, CloudCoCo Group plc (LON:CLCO) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for CloudCoCo Group

What Is CloudCoCo Group's Net Debt?

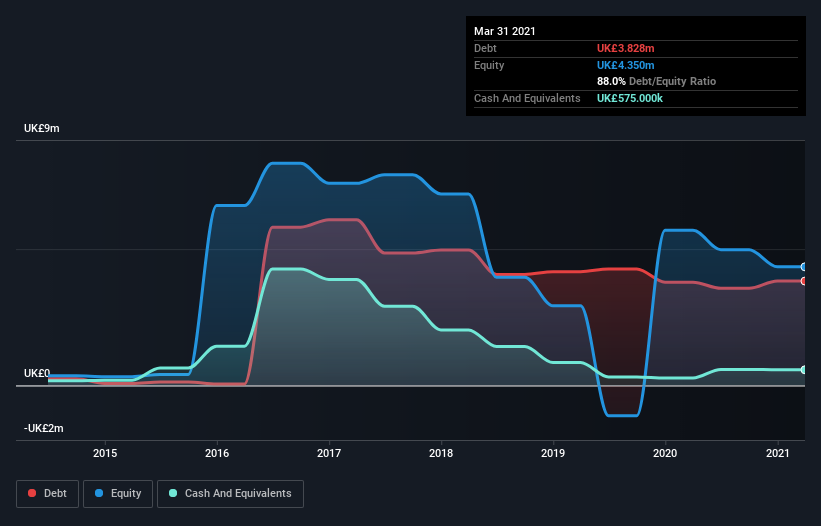

The chart below, which you can click on for greater detail, shows that CloudCoCo Group had UK£3.83m in debt in March 2021; about the same as the year before. However, because it has a cash reserve of UK£575.0k, its net debt is less, at about UK£3.25m.

A Look At CloudCoCo Group's Liabilities

According to the last reported balance sheet, CloudCoCo Group had liabilities of UK£3.64m due within 12 months, and liabilities of UK£4.83m due beyond 12 months. Offsetting these obligations, it had cash of UK£575.0k as well as receivables valued at UK£1.26m due within 12 months. So it has liabilities totalling UK£6.64m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of UK£7.30m, so it does suggest shareholders should keep an eye on CloudCoCo Group's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since CloudCoCo Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year CloudCoCo Group wasn't profitable at an EBIT level, but managed to grow its revenue by 2.4%, to UK£7.7m. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, CloudCoCo Group had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost a very considerable UK£1.7m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. We would feel better if it turned its trailing twelve month loss of UK£1.8m into a profit. So to be blunt we do think it is risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example CloudCoCo Group has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading CloudCoCo Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:CLCO

CloudCoCo Group

Provides IT and communications solutions in the United Kingdom.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Why I invest in Sofina (Dividend growth)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion