- United Kingdom

- /

- IT

- /

- AIM:CLCO

CloudCoCo Group plc (LON:CLCO) Stock's 50% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, CloudCoCo Group plc (LON:CLCO) shares are down a considerable 50% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 67% loss during that time.

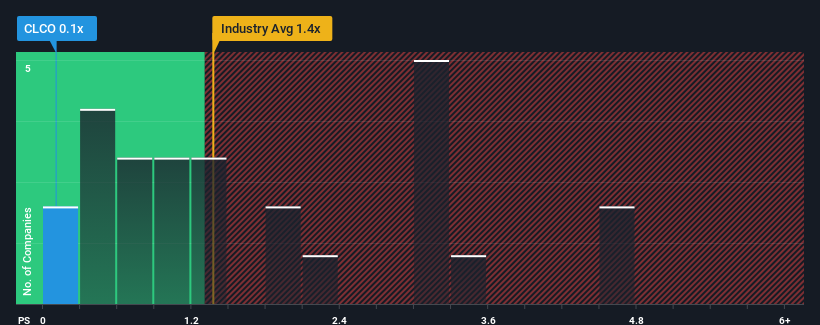

Following the heavy fall in price, CloudCoCo Group's price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the IT industry in the United Kingdom, where around half of the companies have P/S ratios above 1.4x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for CloudCoCo Group

What Does CloudCoCo Group's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, CloudCoCo Group has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on CloudCoCo Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

CloudCoCo Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 7.3% gain to the company's revenues. Pleasingly, revenue has also lifted 226% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 10% during the coming year according to the only analyst following the company. With the industry only predicted to deliver 5.4%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that CloudCoCo Group's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From CloudCoCo Group's P/S?

CloudCoCo Group's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at CloudCoCo Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you settle on your opinion, we've discovered 3 warning signs for CloudCoCo Group (2 are a bit concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on CloudCoCo Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CLCO

CloudCoCo Group

Provides IT and communications solutions in the United Kingdom.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026