- United Kingdom

- /

- Diversified Financial

- /

- AIM:BOKU

The Boku (LON:BOKU) Share Price Is Down 27% So Some Shareholders Are Getting Worried

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Boku, Inc. (LON:BOKU) share price is down 27% in the last year. That falls noticeably short of the market return of around 10%. We wouldn't rush to judgement on Boku because we don't have a long term history to look at. Shareholders have had an even rougher run lately, with the share price down 22% in the last 90 days.

Check out our latest analysis for Boku

Because Boku is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Boku increased its revenue by 35%. That's definitely a respectable growth rate. Meanwhile, the share price is down 27% over twelve months, which is disappointing given the progress made. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

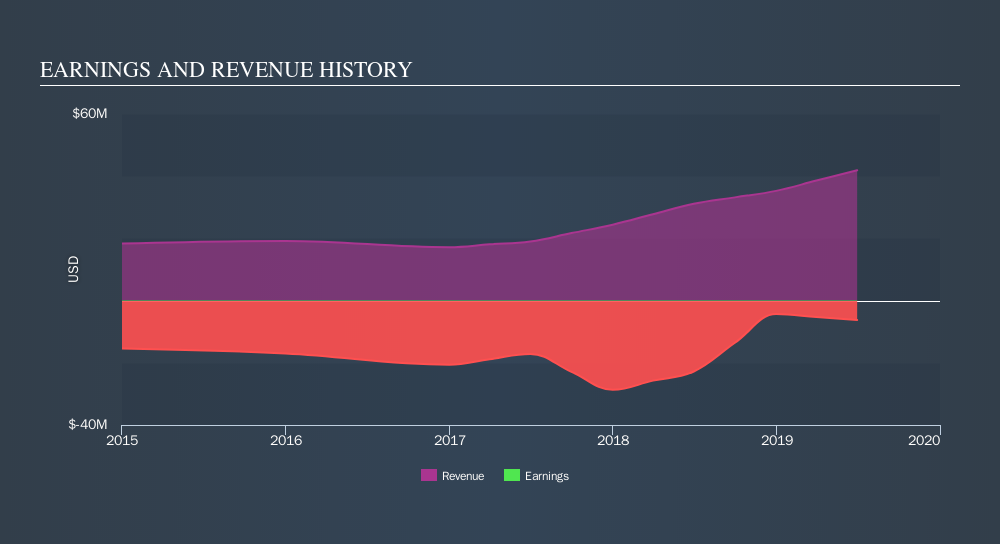

The company's revenue and earnings (over time) are depicted in the image below.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Boku will earn in the future (free profit forecasts).

A Different Perspective

While Boku shareholders are down 27% for the year, the market itself is up 10%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 22% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Boku by clicking this link.

Boku is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:BOKU

Boku

Provides local payment solutions for merchants in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives