- United Kingdom

- /

- Software

- /

- AIM:ACT

Is Actual Experience's (LON:ACT) Share Price Gain Of 156% Well Earned?

It might be of some concern to shareholders to see the Actual Experience plc (LON:ACT) share price down 12% in the last month. On the other hand, over the last twelve months the stock has delivered rather impressive returns. Indeed, the share price is up an impressive 156% in that time. So some might not be surprised to see the price retrace some. The real question is whether the business is trending in the right direction.

View our latest analysis for Actual Experience

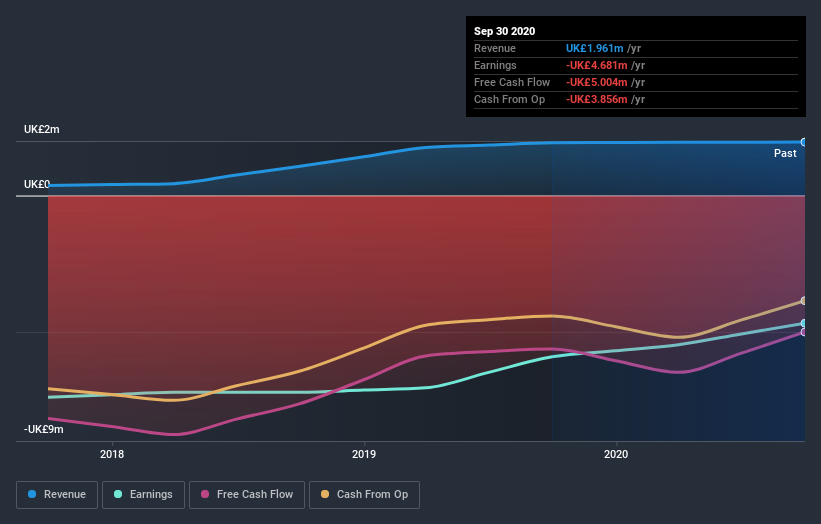

Actual Experience wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last twelve months, Actual Experience's revenue grew by 1.4%. That's not great considering the company is losing money. So we wouldn't have expected the share price to rise by 156%. The business will need a lot more growth to justify that increase. It's quite likely that the market is considering other factors, not just revenue growth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Actual Experience's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Actual Experience has rewarded shareholders with a total shareholder return of 156% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 9% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Actual Experience better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 6 warning signs with Actual Experience (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

We will like Actual Experience better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you’re looking to trade Actual Experience, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:ACT

Actual Experience

Actual Experience plc, a human experience management company, provides hybrid workplace Analytics as a service and associated consultancy services in the United Kingdom and the United States.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives