- United Kingdom

- /

- Semiconductors

- /

- LSE:NANO

Why Investors Shouldn't Be Surprised By Nanoco Group plc's (LON:NANO) 32% Share Price Surge

Despite an already strong run, Nanoco Group plc (LON:NANO) shares have been powering on, with a gain of 32% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.5% in the last twelve months.

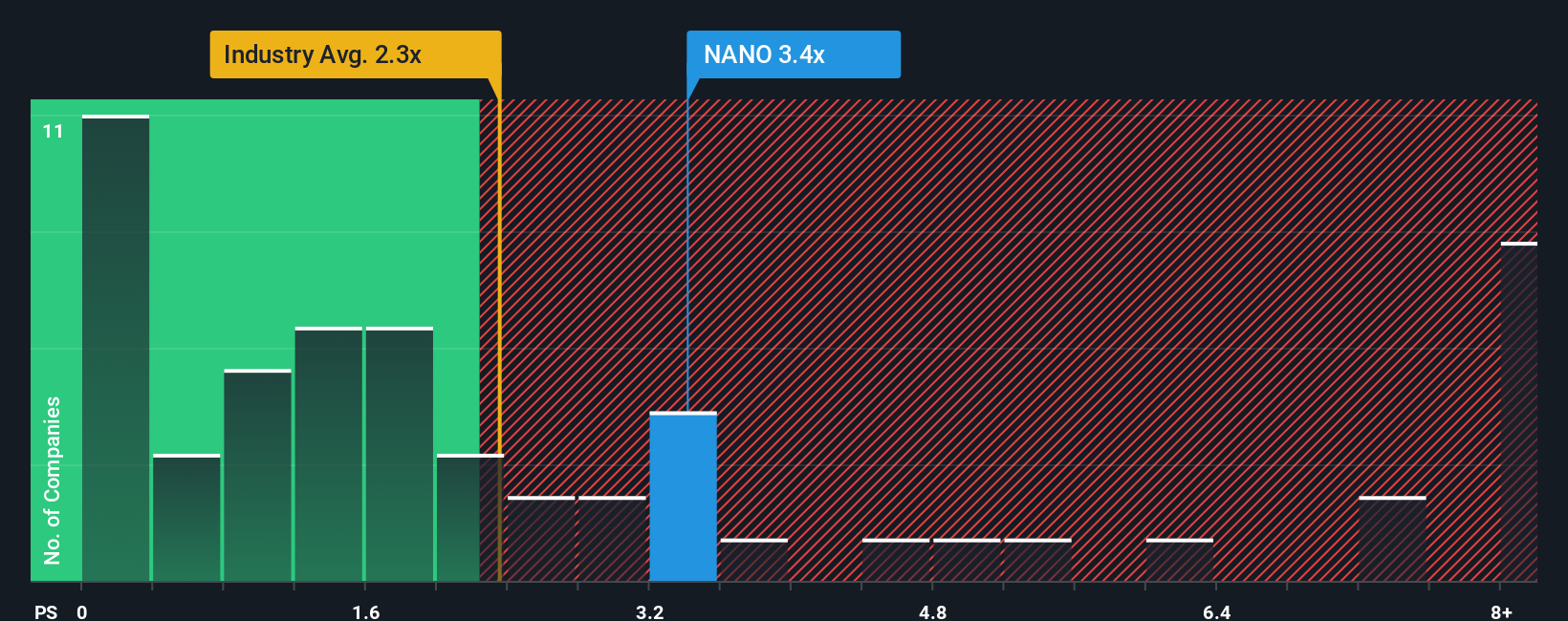

After such a large jump in price, you could be forgiven for thinking Nanoco Group is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.4x, considering almost half the companies in the United Kingdom's Semiconductor industry have P/S ratios below 1.8x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Nanoco Group

What Does Nanoco Group's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Nanoco Group over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Nanoco Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Nanoco Group's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.1%. Even so, admirably revenue has lifted 237% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 23%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Nanoco Group's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Nanoco Group's P/S Mean For Investors?

Nanoco Group's P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Nanoco Group can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Nanoco Group (including 1 which is a bit unpleasant).

If you're unsure about the strength of Nanoco Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nanoco Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:NANO

Nanoco Group

Engages in the research, development, manufacture, and licensing of novel nanomaterials for use in various commercial applications in the United Kingdom and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026