David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Nanoco Group plc (LON:NANO) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Nanoco Group

What Is Nanoco Group's Net Debt?

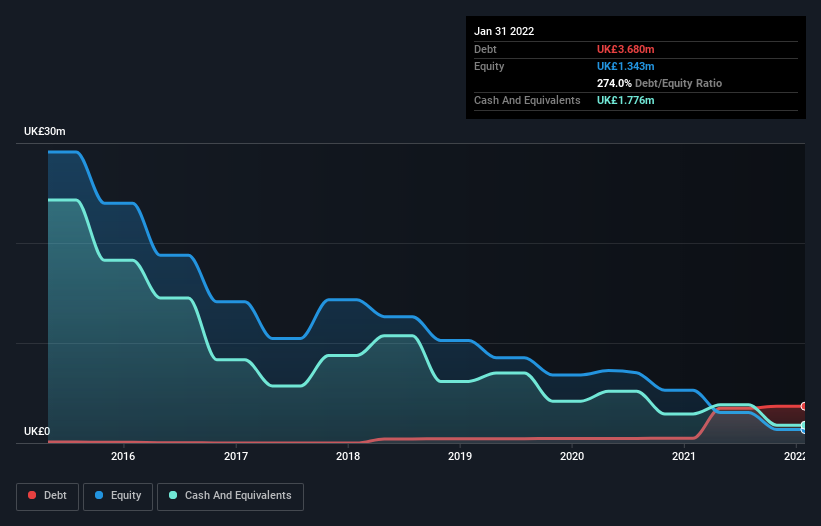

You can click the graphic below for the historical numbers, but it shows that as of January 2022 Nanoco Group had UK£3.68m of debt, an increase on UK£477.0k, over one year. On the flip side, it has UK£1.78m in cash leading to net debt of about UK£1.90m.

How Strong Is Nanoco Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Nanoco Group had liabilities of UK£1.55m due within 12 months and liabilities of UK£3.79m due beyond that. Offsetting this, it had UK£1.78m in cash and UK£1.98m in receivables that were due within 12 months. So it has liabilities totalling UK£1.58m more than its cash and near-term receivables, combined.

Having regard to Nanoco Group's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the UK£89.1m company is struggling for cash, we still think it's worth monitoring its balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Nanoco Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Nanoco Group wasn't profitable at an EBIT level, but managed to grow its revenue by 9.2%, to UK£2.2m. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, Nanoco Group had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at UK£4.2m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled UK£3.6m in negative free cash flow over the last twelve months. So suffice it to say we do consider the stock to be risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Nanoco Group you should be aware of, and 1 of them is a bit concerning.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Nanoco Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:NANO

Nanoco Group

Engages in the research, development, manufacture, and licensing of novel nanomaterials for use in various commercial applications in the United Kingdom and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.