CML Microsystems plc (LON:CML), is not the largest company out there, but it saw significant share price movement during recent months on the LSE, rising to highs of UK£2.58 and falling to the lows of UK£2.29. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether CML Microsystems' current trading price of UK£2.29 reflective of the actual value of the small-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at CML Microsystems’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

View our latest analysis for CML Microsystems

What is CML Microsystems worth?

Good news, investors! CML Microsystems is still a bargain right now. According to my valuation, the intrinsic value for the stock is £3.74, but it is currently trading at UK£2.29 on the share market, meaning that there is still an opportunity to buy now. CML Microsystems’s share price also seems relatively stable compared to the rest of the market, as indicated by its low beta. If you believe the share price should eventually reach its true value, a low beta could suggest it is unlikely to rapidly do so anytime soon, and once it’s there, it may be hard to fall back down into an attractive buying range.

What does the future of CML Microsystems look like?

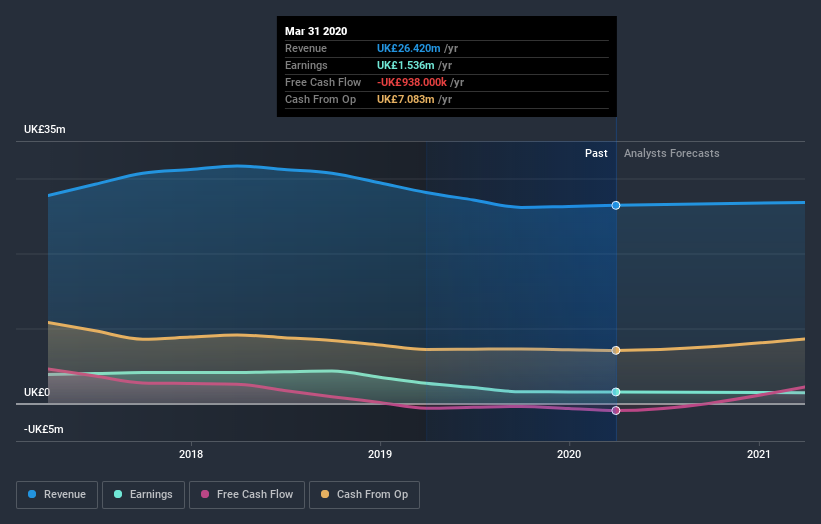

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. However, with a negative profit growth of -6.4% expected next year, near-term growth certainly doesn’t appear to be a driver for a buy decision for CML Microsystems. This certainty tips the risk-return scale towards higher risk.

What this means for you:

Are you a shareholder? Although CML is currently undervalued, the adverse prospect of negative growth brings about some degree of risk. I recommend you think about whether you want to increase your portfolio exposure to CML, or whether diversifying into another stock may be a better move for your total risk and return.

Are you a potential investor? If you’ve been keeping an eye on CML for a while, but hesitant on making the leap, I recommend you dig deeper into the stock. Given its current undervaluation, now is a great time to make a decision. But keep in mind the risks that come with negative growth prospects in the future.

So while earnings quality is important, it's equally important to consider the risks facing CML Microsystems at this point in time. For example, CML Microsystems has 5 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you are no longer interested in CML Microsystems, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

When trading CML Microsystems or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:CML

CML Microsystems

Through its subsidiaries, designs, manufactures, and semiconductor products for industrial, professional and commercial applications in the Americas, Europe, Far East, and internationally.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion