- United Kingdom

- /

- Semiconductors

- /

- LSE:AWE

Market Participants Recognise Alphawave IP Group plc's (LON:AWE) Revenues Pushing Shares 28% Higher

Alphawave IP Group plc (LON:AWE) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

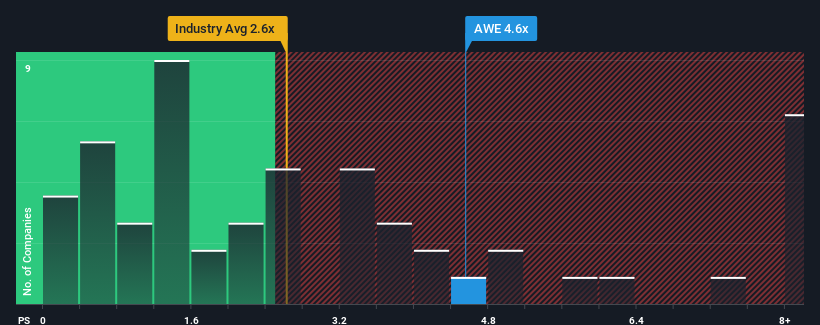

Since its price has surged higher, when almost half of the companies in the United Kingdom's Semiconductor industry have price-to-sales ratios (or "P/S") below 2.6x, you may consider Alphawave IP Group as a stock probably not worth researching with its 4.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Alphawave IP Group

What Does Alphawave IP Group's P/S Mean For Shareholders?

Alphawave IP Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Alphawave IP Group.Is There Enough Revenue Growth Forecasted For Alphawave IP Group?

The only time you'd be truly comfortable seeing a P/S as high as Alphawave IP Group's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 74%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 20% per annum over the next three years. That's shaping up to be materially higher than the 15% per annum growth forecast for the broader industry.

With this information, we can see why Alphawave IP Group is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in Alphawave IP Group's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Alphawave IP Group shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 2 warning signs for Alphawave IP Group that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:AWE

Alphawave IP Group

Develops and sells wired connectivity solutions in North America, China, the Asia Pacific, Europe, the Middle East, Africa, and the United Kingdom.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives