- United Kingdom

- /

- Semiconductors

- /

- AIM:KMK

Kromek Group plc's (LON:KMK) Revenues Are Not Doing Enough For Some Investors

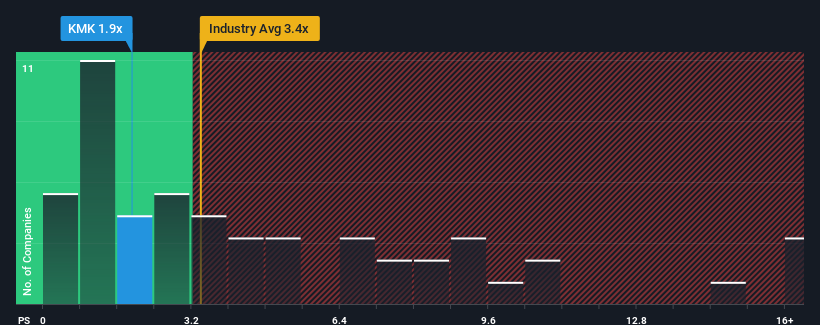

You may think that with a price-to-sales (or "P/S") ratio of 1.9x Kromek Group plc (LON:KMK) is definitely a stock worth checking out, seeing as almost half of all the Semiconductor companies in the United Kingdom have P/S ratios greater than 4.5x and even P/S above 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Kromek Group

How Kromek Group Has Been Performing

Kromek Group could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kromek Group.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Kromek Group would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. Still, revenue has fallen 13% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 38% during the coming year according to the two analysts following the company. With the industry predicted to deliver 82% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Kromek Group's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Kromek Group's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Kromek Group maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 3 warning signs for Kromek Group you should be aware of, and 1 of them is a bit concerning.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kromek Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:KMK

Kromek Group

Develops, manufactures, and sells radiation detection components and bio-detection technology solutions for the advanced imaging, CBRN detection, and biological threat detection markets.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.