- United Kingdom

- /

- Semiconductors

- /

- AIM:KMK

Kromek Group plc (LON:KMK) Soars 46% But It's A Story Of Risk Vs Reward

Kromek Group plc (LON:KMK) shareholders have had their patience rewarded with a 46% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 13% in the last twelve months.

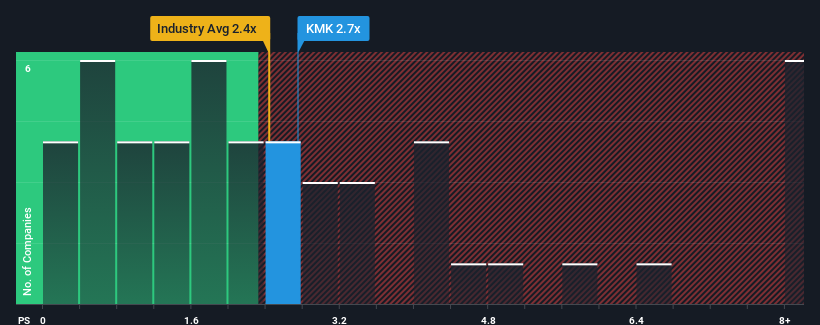

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Kromek Group's P/S ratio of 2.7x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in the United Kingdom is also close to 2.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Kromek Group

What Does Kromek Group's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Kromek Group has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kromek Group.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Kromek Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 25% gain to the company's top line. Pleasingly, revenue has also lifted 43% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 32% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 20%, which is noticeably less attractive.

With this information, we find it interesting that Kromek Group is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Kromek Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Kromek Group's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 5 warning signs for Kromek Group (1 can't be ignored!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kromek Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:KMK

Kromek Group

Develops, manufactures, and sells radiation detection components and bio-detection technology solutions for the advanced imaging, CBRN detection, and biological threat detection markets.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026