- United Kingdom

- /

- Specialty Stores

- /

- LSE:PETS

These 4 Measures Indicate That Pets at Home Group (LON:PETS) Is Using Debt Reasonably Well

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Pets at Home Group Plc (LON:PETS) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Pets at Home Group

How Much Debt Does Pets at Home Group Carry?

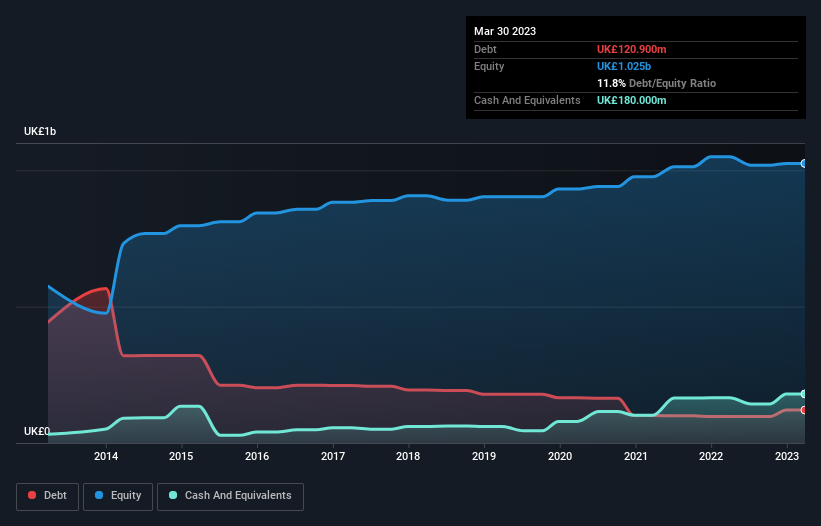

You can click the graphic below for the historical numbers, but it shows that as of March 2023 Pets at Home Group had UK£120.9m of debt, an increase on UK£96.9m, over one year. But on the other hand it also has UK£180.0m in cash, leading to a UK£59.1m net cash position.

A Look At Pets at Home Group's Liabilities

The latest balance sheet data shows that Pets at Home Group had liabilities of UK£353.6m due within a year, and liabilities of UK£470.7m falling due after that. Offsetting this, it had UK£180.0m in cash and UK£37.1m in receivables that were due within 12 months. So it has liabilities totalling UK£607.2m more than its cash and near-term receivables, combined.

Pets at Home Group has a market capitalization of UK£1.80b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, Pets at Home Group also has more cash than debt, so we're pretty confident it can manage its debt safely.

Pets at Home Group's EBIT was pretty flat over the last year, but that shouldn't be an issue given the it doesn't have a lot of debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Pets at Home Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Pets at Home Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Pets at Home Group actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

Although Pets at Home Group's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of UK£59.1m. The cherry on top was that in converted 138% of that EBIT to free cash flow, bringing in UK£176m. So we are not troubled with Pets at Home Group's debt use. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 1 warning sign we've spotted with Pets at Home Group .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:PETS

Pets at Home Group

Engages in the omnichannel retailing of pet food, pet related products, and pet accessories in the United Kingdom.

6 star dividend payer with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.