- United Kingdom

- /

- Specialty Stores

- /

- LSE:PETS

Volatility 101: Should at Home Group Shares Have Dropped 45%?

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

While not a mind-blowing move, it is good to see that the Pets at Home Group Plc (LON:PETS) share price has gained 23% in the last three months. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 45% in the last three years, significantly under-performing the market.

Check out our latest analysis for at Home Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

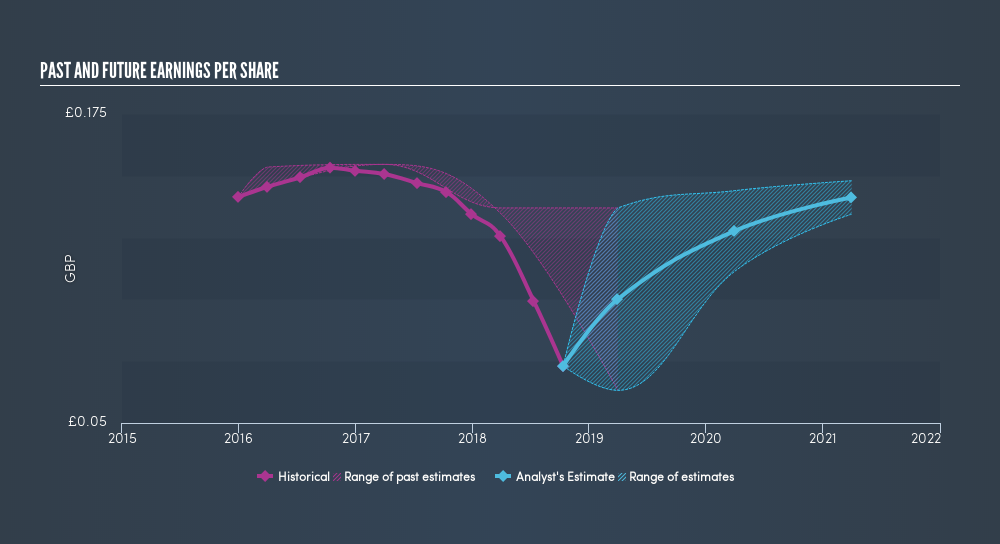

During the three years that the share price fell, at Home Group's earnings per share (EPS) dropped by 20% each year. This fall in EPS isn't far from the rate of share price decline, which was 18% per year. That suggests that the market sentiment around the company hasn't changed much over that time, despite the disappointment. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of at Home Group's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for at Home Group the TSR over the last 3 years was -37%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

at Home Group shareholders are down 11% for the year (even including dividends), but the broader market is up 1.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, the longer term story isn't pretty, with investment losses running at 14% per year over three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:PETS

Pets at Home Group

Engages in the omnichannel retailing of pet food, pet related products, and pet accessories in the United Kingdom.

Very undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives