- United Kingdom

- /

- Software

- /

- LSE:PINE

Pendragon PLC (LON:PDG) Just Reported And Analysts Have Been Lifting Their Price Targets

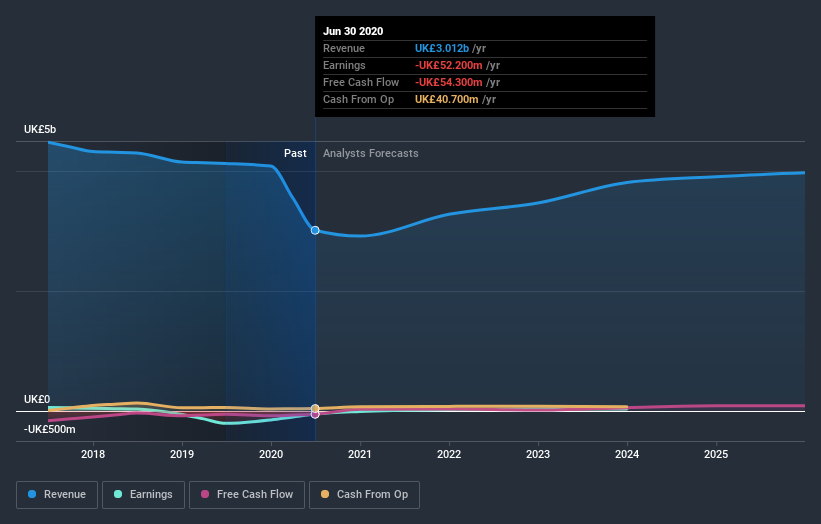

Pendragon PLC (LON:PDG) shareholders are probably feeling a little disappointed, since its shares fell 7.9% to UK£0.17 in the week after its latest full-year results. Revenues of UK£3.0b beat expectations by a respectable 3.3%, although statutory losses per share increased. Pendragon lost UK£0.018, which was 200% more than what the analysts had included in their models. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

View our latest analysis for Pendragon

After the latest results, the four analysts covering Pendragon are now predicting revenues of UK£3.28b in 2021. If met, this would reflect a decent 8.8% improvement in sales compared to the last 12 months. Earnings are expected to improve, with Pendragon forecast to report a statutory profit of UK£0.018 per share. Before this earnings report, the analysts had been forecasting revenues of UK£3.39b and earnings per share (EPS) of UK£0.018 in 2021. It's pretty clear that pessimism has reared its head after the latest results, leading to a weaker revenue outlook and a small dip in earnings per share estimates.

What's most unexpected is that the consensus price target rose 44% to UK£0.19, strongly implying the downgrade to forecasts is not expected to be more than a temporary blip. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Pendragon analyst has a price target of UK£0.25 per share, while the most pessimistic values it at UK£0.12. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Pendragon's past performance and to peers in the same industry. For example, we noticed that Pendragon's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 8.8% growth to the end of 2021 on an annualised basis. That is well above its historical decline of 27% a year over the past year. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 6.4% annually. Not only are Pendragon's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Pendragon. They also downgraded their revenue estimates, although industry data suggests that Pendragon's revenues are expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for Pendragon going out to 2025, and you can see them free on our platform here.

It is also worth noting that we have found 2 warning signs for Pendragon (1 is significant!) that you need to take into consideration.

When trading Pendragon or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:PINE

Pinewood Technologies Group

Operates as a cloud-based dealer management software provider in the United Kingdom, rest of Europe, Africa, Asia, the Middle East, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026