Here's Why Some Shareholders May Not Be Too Generous With Marks and Spencer Group plc's (LON:MKS) CEO Compensation This Year

The underwhelming performance at Marks and Spencer Group plc (LON:MKS) recently has probably not pleased shareholders. At the upcoming AGM on 06 July 2021, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. From our analysis below, we think CEO compensation looks appropriate for now.

View our latest analysis for Marks and Spencer Group

Comparing Marks and Spencer Group plc's CEO Compensation With the industry

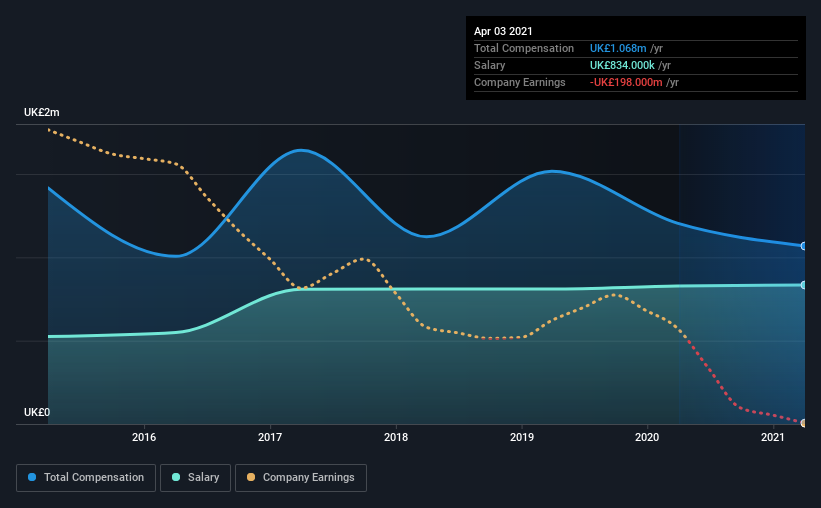

At the time of writing, our data shows that Marks and Spencer Group plc has a market capitalization of UK£2.9b, and reported total annual CEO compensation of UK£1.1m for the year to April 2021. We note that's a decrease of 11% compared to last year. We note that the salary portion, which stands at UK£834.0k constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between UK£1.4b and UK£4.6b, we discovered that the median CEO total compensation of that group was UK£1.7m. This suggests that Steve Rowe is paid below the industry median. Furthermore, Steve Rowe directly owns UK£847k worth of shares in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£834k | UK£828k | 78% |

| Other | UK£234k | UK£377k | 22% |

| Total Compensation | UK£1.1m | UK£1.2m | 100% |

Speaking on an industry level, nearly 78% of total compensation represents salary, while the remainder of 22% is other remuneration. Although there is a difference in how total compensation is set, Marks and Spencer Group more or less reflects the market in terms of setting the salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Marks and Spencer Group plc's Growth Numbers

Marks and Spencer Group plc has reduced its earnings per share by 99% a year over the last three years. It saw its revenue drop 9.9% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Marks and Spencer Group plc Been A Good Investment?

With a total shareholder return of -43% over three years, Marks and Spencer Group plc shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Marks and Spencer Group that you should be aware of before investing.

Important note: Marks and Spencer Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Marks and Spencer Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:MKS

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives