- United Kingdom

- /

- Specialty Stores

- /

- LSE:KGF

Investors Appear Satisfied With Kingfisher plc's (LON:KGF) Prospects As Shares Rocket 26%

The Kingfisher plc (LON:KGF) share price has done very well over the last month, posting an excellent gain of 26%. Looking further back, the 17% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

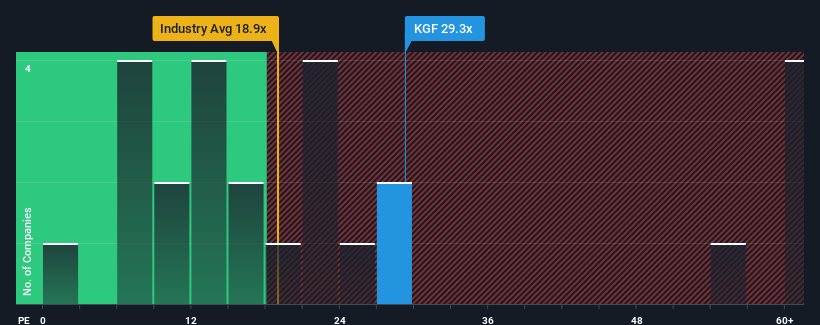

Following the firm bounce in price, given close to half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") below 16x, you may consider Kingfisher as a stock to avoid entirely with its 29.3x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 3 warning signs investors should be aware of before investing in Kingfisher. Read for free now.While the market has experienced earnings growth lately, Kingfisher's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Kingfisher

Does Growth Match The High P/E?

Kingfisher's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 45%. The last three years don't look nice either as the company has shrunk EPS by 74% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 45% per year over the next three years. With the market only predicted to deliver 15% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why Kingfisher is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Kingfisher's P/E?

Kingfisher's P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Kingfisher maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Kingfisher, and understanding them should be part of your investment process.

If you're unsure about the strength of Kingfisher's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kingfisher might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:KGF

Kingfisher

Supplies home improvement products and services in the United Kingdom, Ireland, France, Poland, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives