- United Kingdom

- /

- Retail Distributors

- /

- LSE:HEAD

Shareholders Of Headlam Group (LON:HEAD) Have Received 6.9% On Their Investment

While it may not be enough for some shareholders, we think it is good to see the Headlam Group plc (LON:HEAD) share price up 17% in a single quarter. But that doesn't change the fact that the returns over the last five years have been less than pleasing. You would have done a lot better buying an index fund, since the stock has dropped 14% in that half decade.

View our latest analysis for Headlam Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

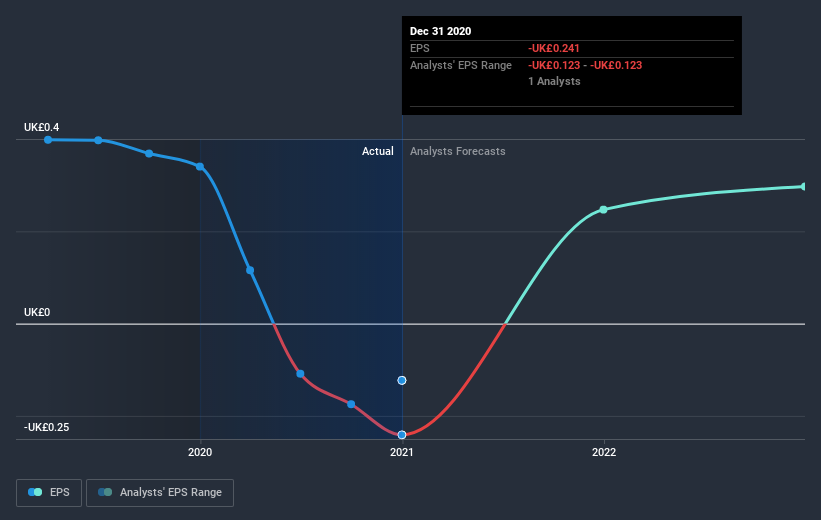

Over five years Headlam Group's earnings per share dropped significantly, falling to a loss, with the share price also lower. This was, in part, due to extraordinary items impacting earnings. At present it's hard to make valid comparisons between EPS and the share price. But we would generally expect a lower price, given the situation.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Headlam Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Headlam Group the TSR over the last 5 years was 6.9%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Headlam Group shareholders gained a total return of 1.6% during the year. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 1.3% per year over five year. It is possible that returns will improve along with the business fundamentals. You could get a better understanding of Headlam Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Headlam Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you’re looking to trade Headlam Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Headlam Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:HEAD

Headlam Group

Engages in the sale, marketing, supply, and distribution of floorcovering and other ancillary products in the United Kingdom and Continental Europe.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives