- United Kingdom

- /

- Specialty Stores

- /

- LSE:DNLM

3 Top Dividend Stocks In UK Yielding Up To 6.4%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced downward pressure, influenced by weak trade data from China and sluggish global economic cues. Despite these challenges, dividend stocks remain an attractive option for investors seeking steady income in volatile markets. A good dividend stock typically offers a reliable payout history and resilience in fluctuating market conditions, making them particularly appealing amid the current economic uncertainties.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.04% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.50% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.50% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.63% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.74% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.67% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.23% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.84% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.40% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

BP (LSE:BP.)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BP p.l.c. is a company that provides carbon products and services, with a market cap of £69.76 billion.

Operations: BP p.l.c.'s revenue segments include Customers & Products ($164.28 billion), Gas & Low Carbon Energy ($36.47 billion), and Oil Production & Operations ($26.07 billion).

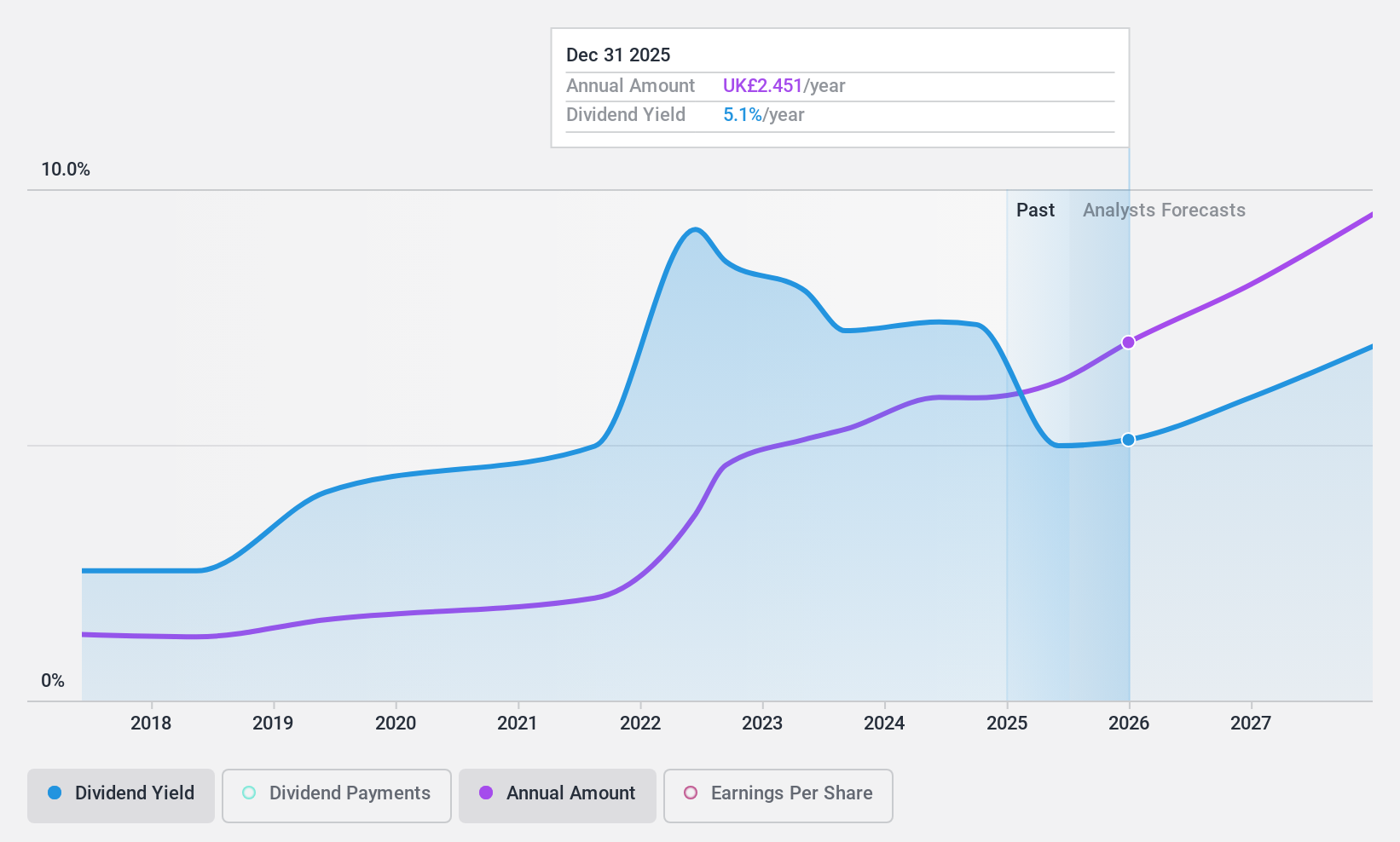

Dividend Yield: 5.6%

BP's dividend payments are well-covered by both earnings (68.1% payout ratio) and cash flows (31.4% cash payout ratio), making them sustainable despite a volatile track record over the past decade. Recent results show mixed production figures, with some increases in oil production but overall lower gas & low carbon energy outputs compared to last year. BP announced an interim dividend of $0.08 per share, reflecting its commitment to returning value to shareholders amidst fluctuating earnings and strategic buybacks totaling £748 million recently completed.

- Navigate through the intricacies of BP with our comprehensive dividend report here.

- Our valuation report here indicates BP may be undervalued.

Dunelm Group (LSE:DNLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dunelm Group plc is a UK-based retailer specializing in homewares with a market cap of £2.53 billion.

Operations: Dunelm Group plc generates £1.68 billion in revenue from the retail of homewares in the United Kingdom.

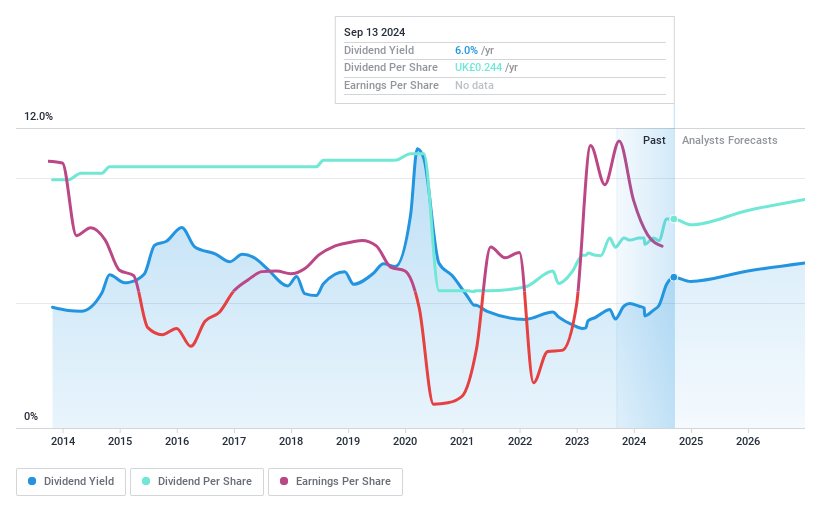

Dividend Yield: 6.2%

Dunelm Group's dividend payments have been volatile over the past decade, though they are well-covered by earnings (58.1% payout ratio) and cash flows (74.8% cash payout ratio). Despite a recent sales report showing £399 million for Q4 and £1.71 billion for the year, board changes may impact future stability. Trading at 23.1% below its estimated fair value, Dunelm's dividend yield of 6.23% is among the top 25% in the UK market but lacks consistency in growth history.

- Dive into the specifics of Dunelm Group here with our thorough dividend report.

- The analysis detailed in our Dunelm Group valuation report hints at an inflated share price compared to its estimated value.

TBC Bank Group (LSE:TBCG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TBC Bank Group PLC, with a market cap of £1.74 billion, offers banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

Operations: TBC Bank Group PLC generates revenue from its operations in Uzbekistan, which amount to GEL 236.42 million.

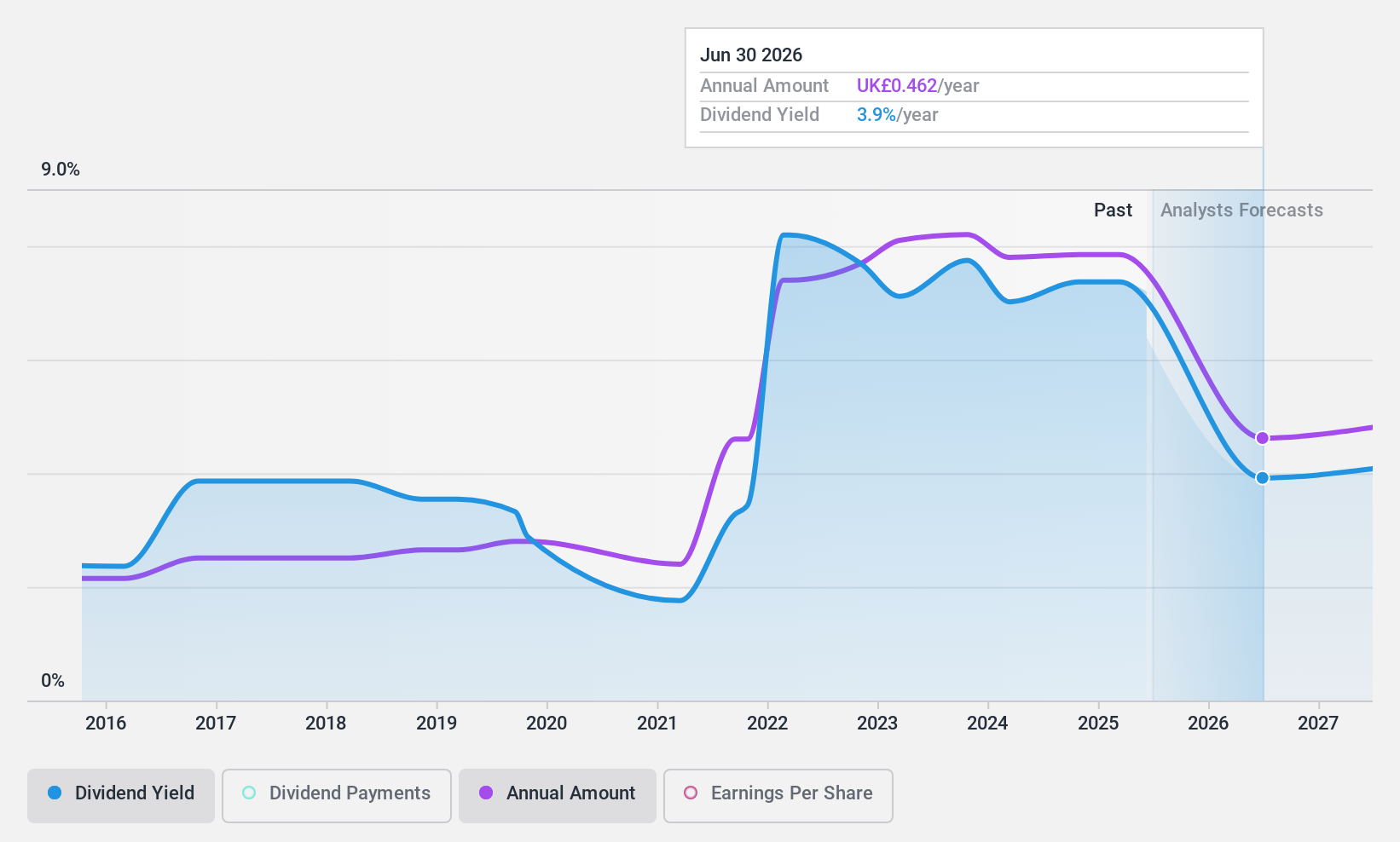

Dividend Yield: 6.5%

TBC Bank Group's dividend yield of 6.45% places it in the top 25% of UK dividend payers, with a payout ratio of 32.6%, indicating strong coverage by earnings. Although dividends have been stable and growing, the company has only a seven-year track record of payments. Recent earnings for H1 2024 showed net income growth to GEL 617.4 million, supporting future payouts. However, shareholders experienced dilution over the past year.

- Delve into the full analysis dividend report here for a deeper understanding of TBC Bank Group.

- Our comprehensive valuation report raises the possibility that TBC Bank Group is priced lower than what may be justified by its financials.

Taking Advantage

- Get an in-depth perspective on all 57 Top UK Dividend Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DNLM

Established dividend payer and good value.