- United Kingdom

- /

- Specialty Stores

- /

- LSE:CURY

Dixons Carphone plc (LON:DC.) Investors Should Think About This Before Buying It For Its Dividend

Is Dixons Carphone plc (LON:DC.) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

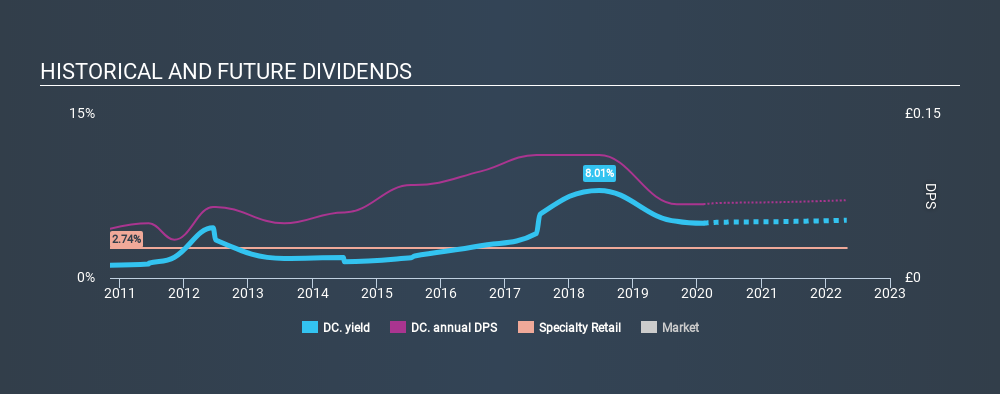

In this case, Dixons Carphone likely looks attractive to dividend investors, given its 5.0% dividend yield and nine-year payment history. It sure looks interesting on these metrics - but there's always more to the story . Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Dixons Carphone paid out 99% of its profit as dividends. This is quite a high payout ratio that suggests the dividend is not well covered by earnings.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Dixons Carphone paid out a conservative 31% of its free cash flow as dividends last year. While the dividend was not well covered by profits, at least they were covered by free cash flow. Still, if the company continues paying out such a high percentage of its profits, the dividend could be at risk if business turns sour.

Is Dixons Carphone's Balance Sheet Risky?

As Dixons Carphone's dividend was not well covered by earnings, we need to check its balance sheet for signs of financial distress. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. Dixons Carphone has net debt of 0.71 times its EBITDA, which we think is not too troublesome.

Net interest cover can be calculated by dividing earnings before interest and tax (EBIT) by the company's net interest expense. With EBIT of 2.95 times its interest expense, Dixons Carphone's interest cover is starting to look a bit thin.

Consider getting our latest analysis on Dixons Carphone's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the last decade of data, we can see that Dixons Carphone paid its first dividend at least nine years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past nine-year period, the first annual payment was UK£0.045 in 2011, compared to UK£0.068 last year. This works out to be a compound annual growth rate (CAGR) of approximately 4.6% a year over that time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? It's not great to see that Dixons Carphone's have fallen at approximately 8.2% over the past five years. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're a bit uncomfortable with its high payout ratio, although at least the dividend was covered by free cash flow. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. In summary, Dixons Carphone has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are likely more attractive alternatives out there.

Given that earnings are not growing, the dividend does not look nearly so attractive. See if the 9 analysts are forecasting a turnaround in our free collection of analyst estimates here.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:CURY

Currys

Operates as a omnichannel retailer of technology products and services in the United Kingdom, Ireland, Norway, Sweden, Finland, Denmark, Iceland, Greenland, and the Faroe Islands.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives