Caffyns plc's (LON:CFYN) investors are due to receive a payment of £0.05 per share on 7th of January. Including this payment, the dividend yield on the stock will be 2.4%, which is a modest boost for shareholders' returns.

Caffyns' Distributions May Be Difficult To Sustain

If it is predictable over a long period, even low dividend yields can be attractive. Even though Caffyns is not generating a profit, it is still paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

Over the next year, EPS might fall by 42.0% based on recent performance. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

Check out our latest analysis for Caffyns

Dividend Volatility

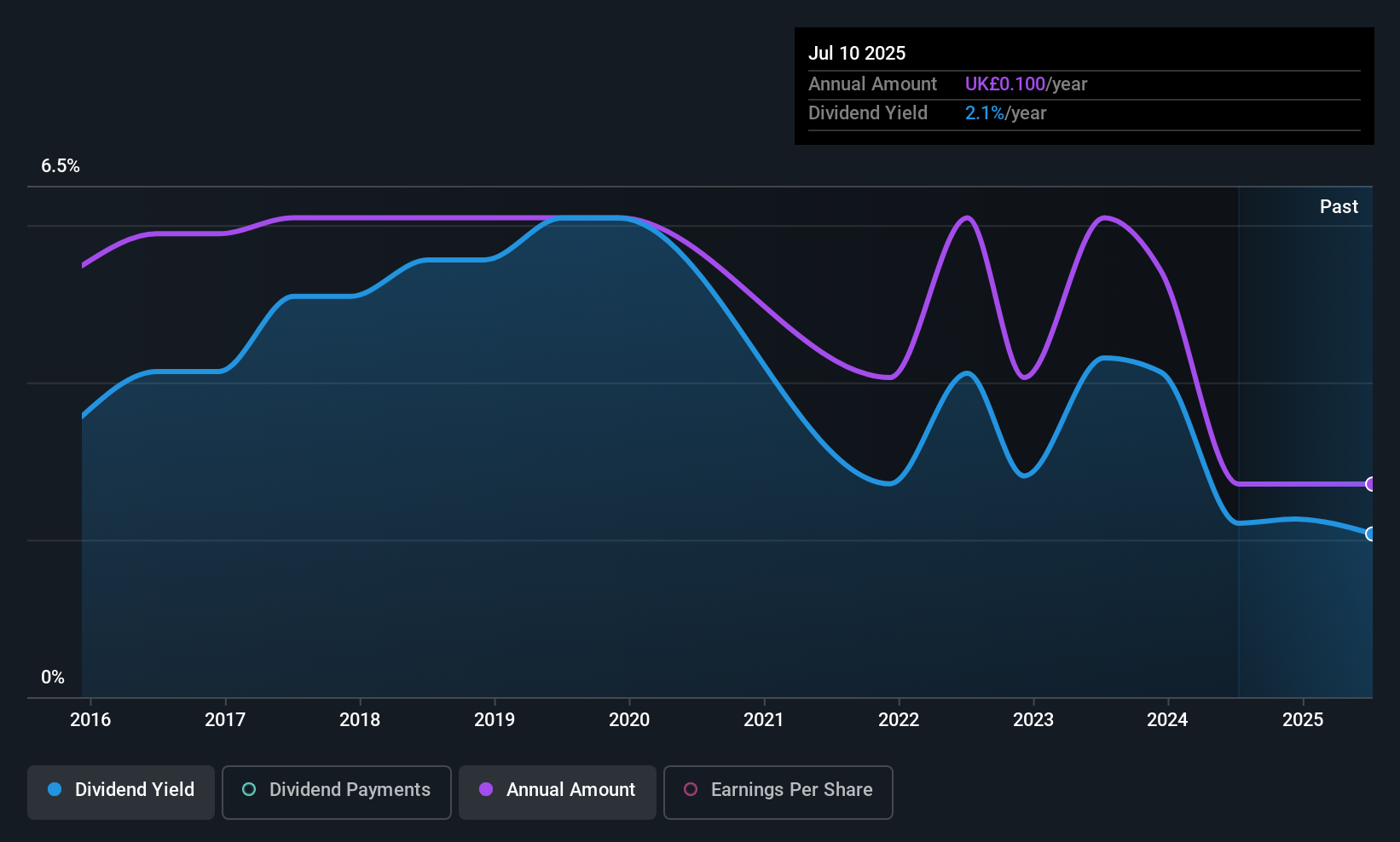

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2015, the dividend has gone from £0.203 total annually to £0.10. The dividend has shrunk at around 6.8% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Has Limited Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Earnings per share has been sinking by 42% over the last five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

Caffyns' Dividend Doesn't Look Great

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. The dividend doesn't inspire confidence that it will provide solid income in the future.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for Caffyns (of which 2 make us uncomfortable!) you should know about. Is Caffyns not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CFYN

Caffyns

Operates as a motor vehicle retailer in the south-east of the United Kingdom.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026