- United Kingdom

- /

- Commercial Services

- /

- LSE:MTO

Undervalued Small Caps In UK With Insider Action For February 2025

Reviewed by Simply Wall St

The United Kingdom's market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties. In this environment, small-cap stocks in the UK might present opportunities for investors looking for potential growth at attractive valuations, especially those showing insider action that could signal confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 20.8x | 5.3x | 21.72% | ★★★★★★ |

| Warpaint London | 19.2x | 3.3x | 34.40% | ★★★★★☆ |

| 4imprint Group | 17.9x | 1.5x | 28.36% | ★★★★★☆ |

| Stelrad Group | 11.7x | 0.6x | 18.27% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 24.74% | ★★★★★☆ |

| Telecom Plus | 17.8x | 0.7x | 26.67% | ★★★★☆☆ |

| Gamma Communications | 23.1x | 2.4x | 32.76% | ★★★★☆☆ |

| CVS Group | 29.0x | 1.2x | 37.55% | ★★★★☆☆ |

| Franchise Brands | 41.5x | 2.1x | 20.50% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 47.32% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

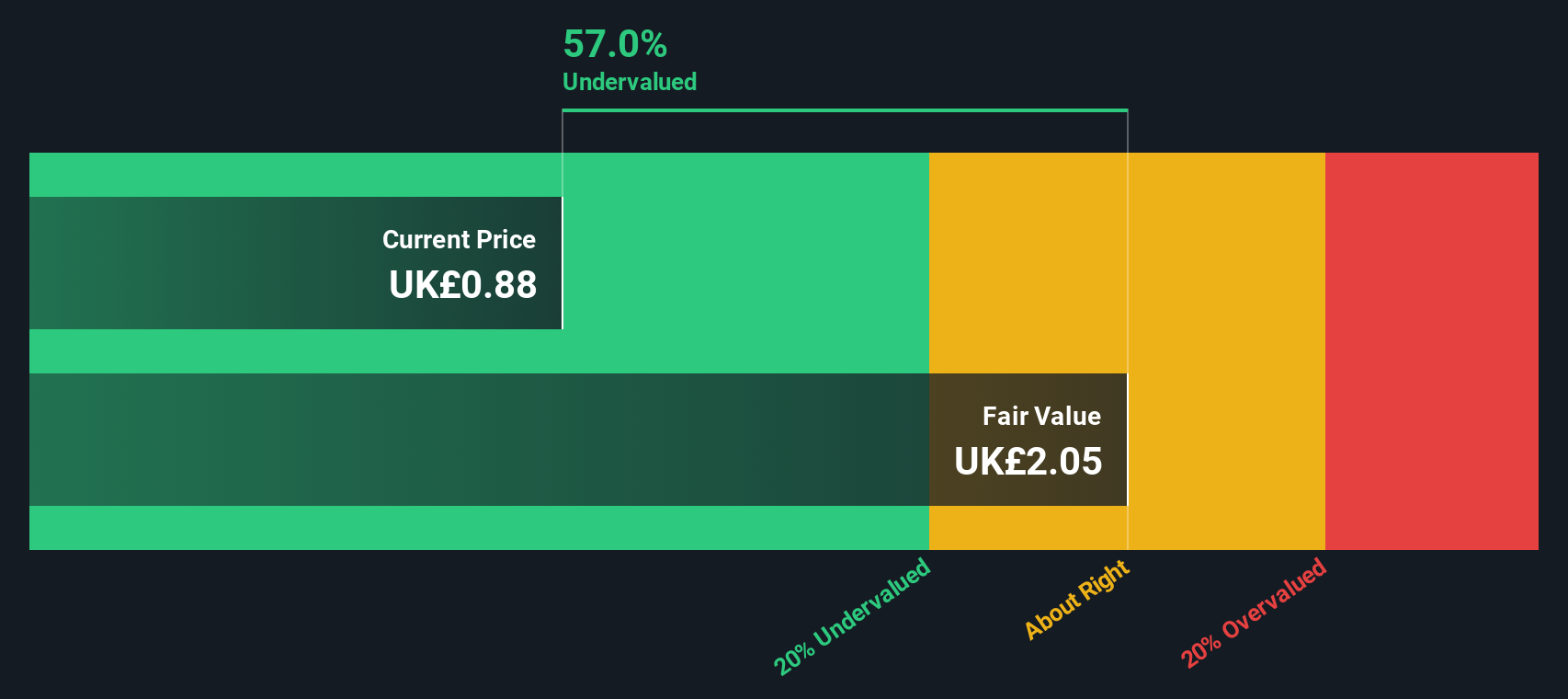

Card Factory (LSE:CARD)

Simply Wall St Value Rating: ★★★★★★

Overview: Card Factory operates as a retailer specializing in greeting cards and gifts, with a market capitalization of approximately £0.41 billion.

Operations: Card Factory's revenue primarily comes from its stores, contributing £491.90 million, with additional income from online sales and partnerships. The company experienced fluctuations in its net income margin, peaking at 17.40% in early 2016 and later declining to around 7.79% by mid-2024. Operating expenses have generally increased over time, reaching £108.9 million by July 2024, impacting overall profitability.

PE: 7.9x

Card Factory, a notable player in the UK retail sector, recently reported £506.6 million in sales for the eleven months ending December 2024, marking a 6.2% increase compared to the prior year. This growth comes despite challenges in the non-food retail market. Insider confidence is evident with recent share purchases by company insiders during this period. The company's reliance on external borrowing highlights potential risks but also suggests room for strategic maneuvering as earnings are projected to grow annually by 14%.

- Click here to discover the nuances of Card Factory with our detailed analytical valuation report.

Gain insights into Card Factory's past trends and performance with our Past report.

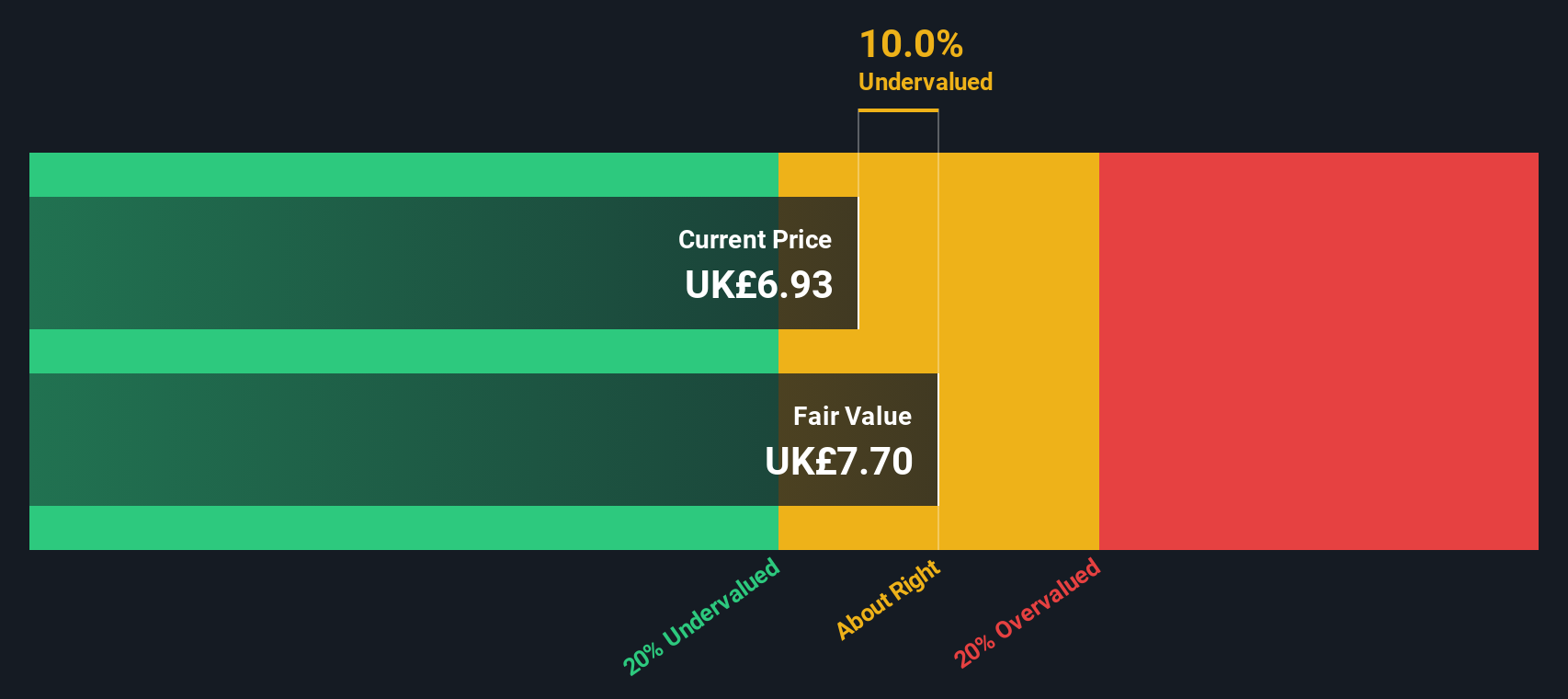

discoverIE Group (LSE:DSCV)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: discoverIE Group is a company that designs, manufactures, and supplies customized electronics for industrial applications, with a market capitalization of approximately £0.85 billion.

Operations: The company generates revenue primarily from its Magnetics & Controls segment (£256.50 million) and Sensing & Connectivity segment (£169.60 million). Over the observed periods, the gross profit margin has shown an upward trend, reaching 50.74% by September 2024.

PE: 35.3x

DiscoverIE Group, a smaller UK company, is catching attention with its strategic focus on growth despite recent flat sales. Their earnings for the half-year ending September 2024 showed a slight increase in net income to £12 million. Notably, insider confidence is evident with purchases made between December 2024 and January 2025. The company’s progressive dividend policy supports both shareholder returns and future acquisitions, aiming for sustainable growth as they navigate through external borrowing challenges.

- Navigate through the intricacies of discoverIE Group with our comprehensive valuation report here.

Assess discoverIE Group's past performance with our detailed historical performance reports.

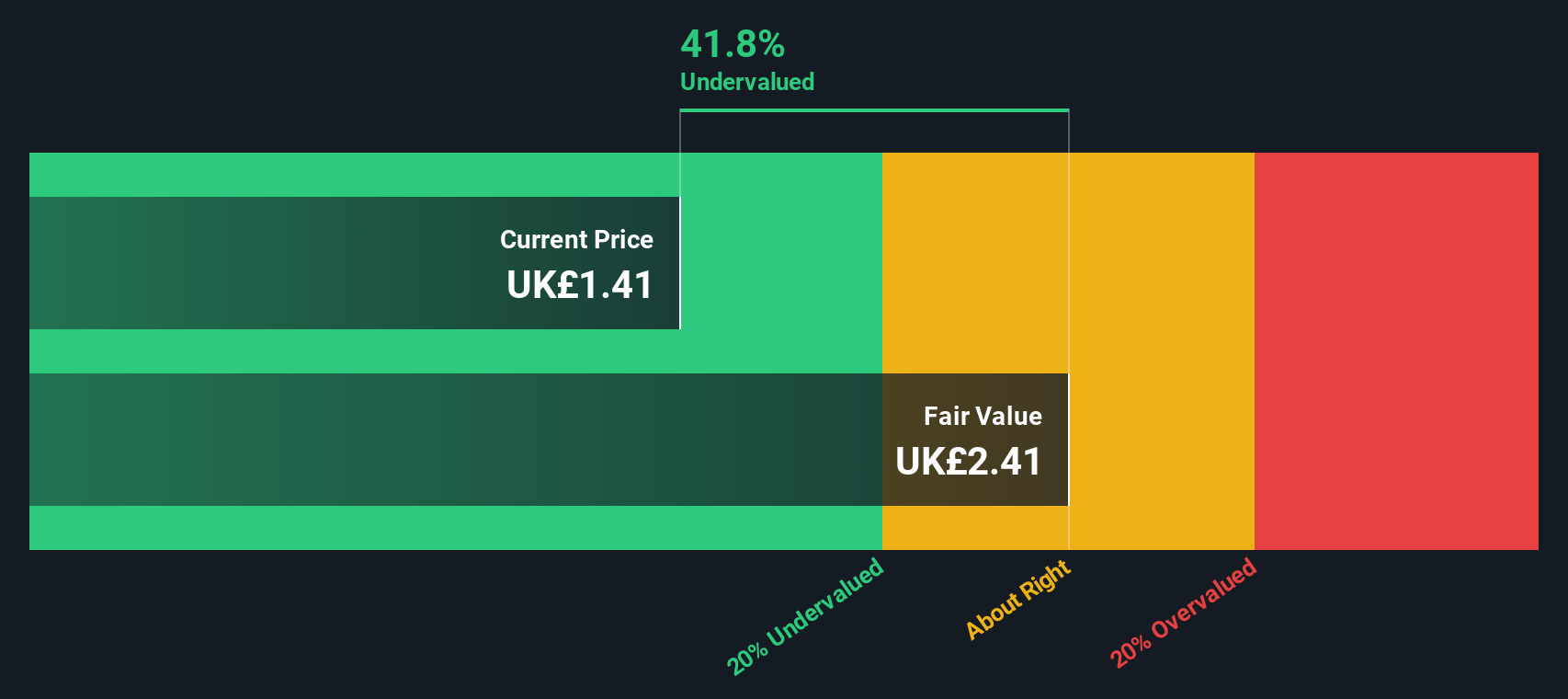

Mitie Group (LSE:MTO)

Simply Wall St Value Rating: ★★★★★★

Overview: Mitie Group is a facilities management and professional services company with operations primarily in the UK, focusing on communities, business services, and technical services, with a market cap of approximately £1.37 billion.

Operations: Mitie Group's revenue is primarily derived from Business Services (£1.61 billion), Technical Services (£1.41 billion), and Communities (£843.7 million). The company's gross profit margin has shown fluctuations, with the most recent figure at 11.17% as of September 2024, reflecting changes in cost management and operational efficiency over time. Operating expenses have been a significant component of the cost structure, impacting net income margins which have varied across periods but recently stood at 2.52% in September 2024.

PE: 12.3x

Mitie Group, a UK-based company, is attracting attention in the small cap space. Recent insider confidence is evident with share purchases, signaling belief in its future. The company completed a significant buyback of 45.2 million shares for £54.6 million between April and September 2024, enhancing shareholder value. For fiscal year 2025, Mitie anticipates low double-digit revenue growth despite moderating Q4 performance due to reduced 'surge response' security work contributions. Earnings are expected to grow annually by 10.2%, suggesting potential for continued expansion within the facilities management sector amidst stable dividend payouts and strategic financial maneuvers like buybacks and dividends adjustments.

Key Takeaways

- Unlock our comprehensive list of 34 Undervalued UK Small Caps With Insider Buying by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MTO

Mitie Group

Provides facilities management and professional services in the United Kingdom and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives