- United Kingdom

- /

- Specialty Stores

- /

- LSE:CARD

Shareholders May Not Be So Generous With Card Factory plc's (LON:CARD) CEO Compensation And Here's Why

Key Insights

- Card Factory will host its Annual General Meeting on 20th of June

- CEO Darcy Willson-Rymer's total compensation includes salary of UK£468.8k

- The total compensation is 36% higher than the average for the industry

- Card Factory's EPS grew by 89% over the past three years while total shareholder return over the past three years was 49%

Under the guidance of CEO Darcy Willson-Rymer, Card Factory plc (LON:CARD) has performed reasonably well recently. As shareholders go into the upcoming AGM on 20th of June, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for Card Factory

Comparing Card Factory plc's CEO Compensation With The Industry

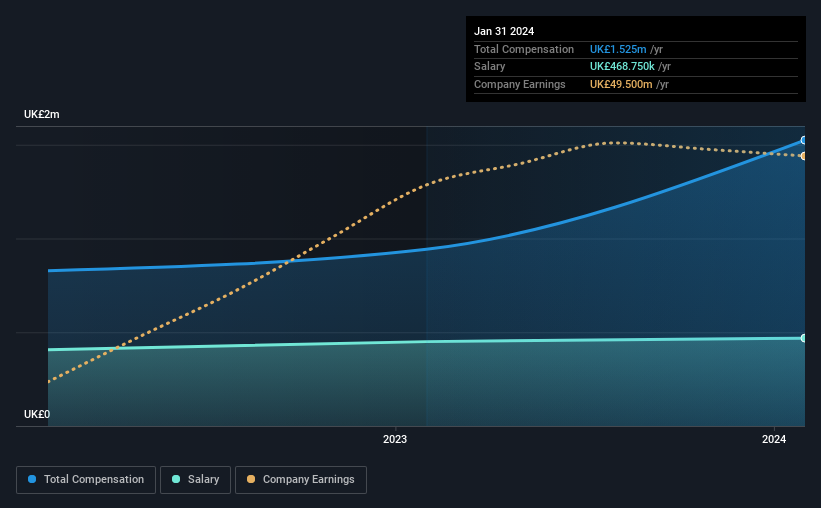

According to our data, Card Factory plc has a market capitalization of UK£316m, and paid its CEO total annual compensation worth UK£1.5m over the year to January 2024. We note that's an increase of 62% above last year. While we always look at total compensation first, our analysis shows that the salary component is less, at UK£469k.

In comparison with other companies in the British Specialty Retail industry with market capitalizations ranging from UK£157m to UK£627m, the reported median CEO total compensation was UK£1.1m. Accordingly, our analysis reveals that Card Factory plc pays Darcy Willson-Rymer north of the industry median. Moreover, Darcy Willson-Rymer also holds UK£326k worth of Card Factory stock directly under their own name.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | UK£469k | UK£450k | 31% |

| Other | UK£1.1m | UK£493k | 69% |

| Total Compensation | UK£1.5m | UK£943k | 100% |

Speaking on an industry level, nearly 58% of total compensation represents salary, while the remainder of 42% is other remuneration. In Card Factory's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Card Factory plc's Growth

Over the past three years, Card Factory plc has seen its earnings per share (EPS) grow by 89% per year. It achieved revenue growth of 10% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Card Factory plc Been A Good Investment?

We think that the total shareholder return of 49%, over three years, would leave most Card Factory plc shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 1 warning sign for Card Factory that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CARD

Card Factory

Operates as a specialist retailer of cards, gifts, and celebration essentials in the United Kingdom, South Africa, Republic of Ireland, the United States, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026