- United Kingdom

- /

- Specialty Stores

- /

- AIM:SCHO

Scholium Group (LON:SCHO) Is Looking To Continue Growing Its Returns On Capital

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So on that note, Scholium Group (LON:SCHO) looks quite promising in regards to its trends of return on capital.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Scholium Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.045 = UK£469k ÷ (UK£13m - UK£3.1m) (Based on the trailing twelve months to March 2022).

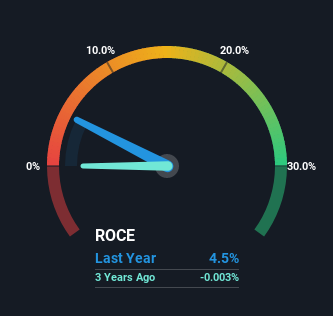

Thus, Scholium Group has an ROCE of 4.5%. In absolute terms, that's a low return and it also under-performs the Specialty Retail industry average of 14%.

View our latest analysis for Scholium Group

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Scholium Group, check out these free graphs here.

How Are Returns Trending?

Shareholders will be relieved that Scholium Group has broken into profitability. While the business was unprofitable in the past, it's now turned things around and is earning 4.5% on its capital. While returns have increased, the amount of capital employed by Scholium Group has remained flat over the period. With no noticeable increase in capital employed, it's worth knowing what the company plans on doing going forward in regards to reinvesting and growing the business. After all, a company can only become a long term multi-bagger if it continually reinvests in itself at high rates of return.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. Essentially the business now has suppliers or short-term creditors funding about 23% of its operations, which isn't ideal. It's worth keeping an eye on this because as the percentage of current liabilities to total assets increases, some aspects of risk also increase.

The Key Takeaway

As discussed above, Scholium Group appears to be getting more proficient at generating returns since capital employed has remained flat but earnings (before interest and tax) are up. Astute investors may have an opportunity here because the stock has declined 30% in the last five years. With that in mind, we believe the promising trends warrant this stock for further investigation.

On a final note, we've found 1 warning sign for Scholium Group that we think you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SCHO

Scholium Group

Engages in trading, retailing, and selling of rare books and fine arts in the United Kingdom.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives