- United Kingdom

- /

- Specialty Stores

- /

- AIM:MTC

Mothercare plc's (LON:MTC) Shares Climb 49% But Its Business Is Yet to Catch Up

Mothercare plc (LON:MTC) shares have had a really impressive month, gaining 49% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 29% in the last year.

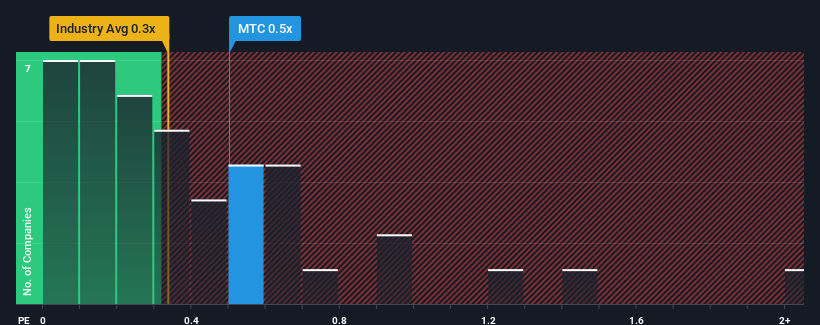

Although its price has surged higher, there still wouldn't be many who think Mothercare's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in the United Kingdom's Specialty Retail industry is similar at about 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Mothercare

What Does Mothercare's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Mothercare's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Mothercare's future stacks up against the industry? In that case, our free report is a great place to start.How Is Mothercare's Revenue Growth Trending?

In order to justify its P/S ratio, Mothercare would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. As a result, revenue from three years ago have also fallen 34% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 1.1% per annum as estimated by the dual analysts watching the company. That's not great when the rest of the industry is expected to grow by 6.1% per annum.

With this in consideration, we think it doesn't make sense that Mothercare's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From Mothercare's P/S?

Mothercare appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our check of Mothercare's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Before you take the next step, you should know about the 5 warning signs for Mothercare (4 can't be ignored!) that we have uncovered.

If these risks are making you reconsider your opinion on Mothercare, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:MTC

Mothercare

Through its subsidiaries, operates as a specialist franchisor of products for parents and young children under the Mothercare brand.

Solid track record with moderate risk.

Similar Companies

Market Insights

Community Narratives