- United Kingdom

- /

- Retail Distributors

- /

- AIM:LIKE

Likewise Group Plc (LON:LIKE) Stock Is Going Strong But Fundamentals Look Uncertain: What Lies Ahead ?

Likewise Group's (LON:LIKE) stock is up by a considerable 52% over the past three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Specifically, we decided to study Likewise Group's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Likewise Group is:

2.0% = UK£775k ÷ UK£40m (Based on the trailing twelve months to December 2024).

The 'return' is the yearly profit. So, this means that for every £1 of its shareholder's investments, the company generates a profit of £0.02.

See our latest analysis for Likewise Group

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Likewise Group's Earnings Growth And 2.0% ROE

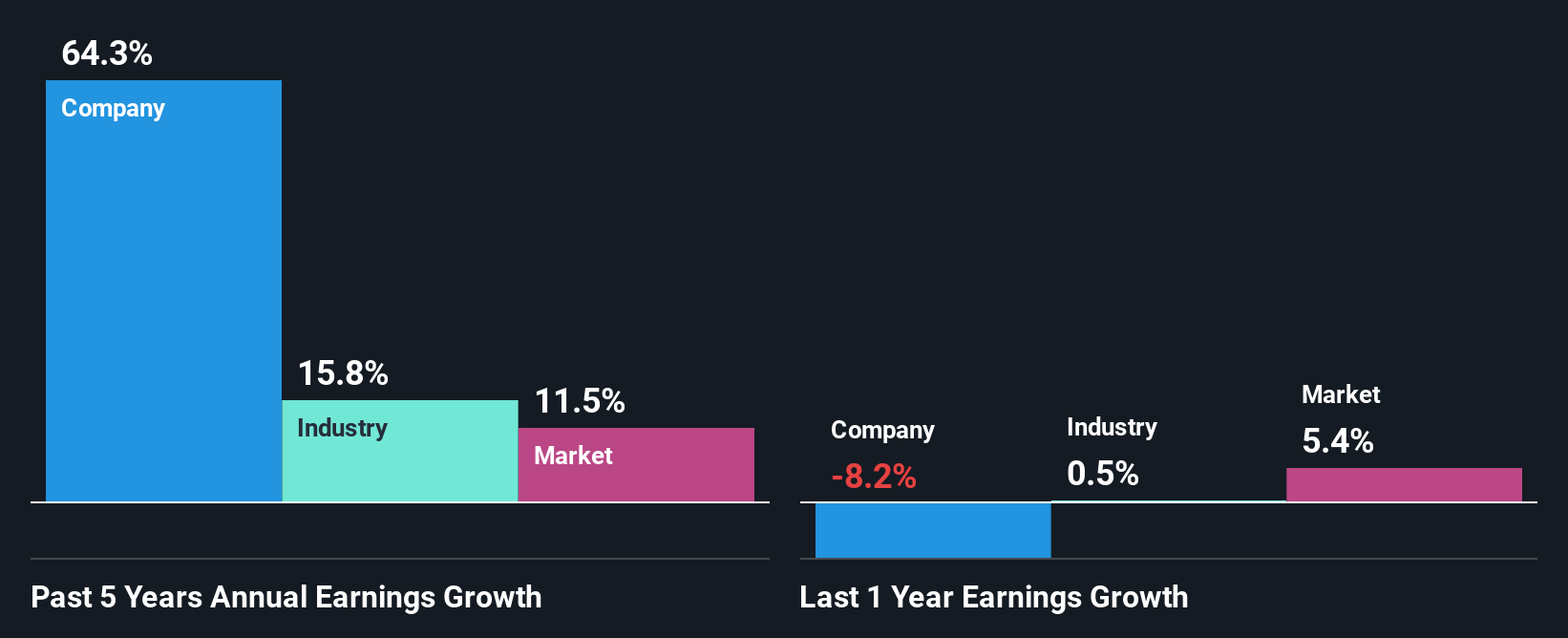

It is hard to argue that Likewise Group's ROE is much good in and of itself. Even compared to the average industry ROE of 9.4%, the company's ROE is quite dismal. Despite this, surprisingly, Likewise Group saw an exceptional 64% net income growth over the past five years. We believe that there might be other aspects that are positively influencing the company's earnings growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

As a next step, we compared Likewise Group's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 16%.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Likewise Group fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Likewise Group Making Efficient Use Of Its Profits?

Likewise Group has very a high LTM (or last twelve month) payout ratio of 119% suggesting that the company's shareholders are getting paid from more than just the company's earnings. Despite this, the company's earnings grew significantly as we saw above. Having said that, the high payout ratio is definitely risky and something to keep an eye on. You can see the 2 risks we have identified for Likewise Group by visiting our risks dashboard for free on our platform here.

Moreover, Likewise Group is determined to keep sharing its profits with shareholders which we infer from its long history of three years of paying a dividend. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to drop to 27% over the next three years.

Summary

Overall, we have mixed feelings about Likewise Group. While the company has posted impressive earnings growth, its poor ROE and low earnings retention makes us doubtful if that growth could continue, if by any chance the business is faced with any sort of risk. The latest industry analyst forecasts show that the company is expected to maintain its current growth rate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:LIKE

Likewise Group

Likewise Group Plc, together with its subsidiaries, wholesales and distributes floorcoverings, rugs, and matting products for domestic and commercial flooring markets in the United Kingdom and Rest of Europe.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives