- United Kingdom

- /

- Specialty Stores

- /

- AIM:ANG

Angling Direct Leads Our Trio Of UK Penny Stocks

Reviewed by Simply Wall St

The UK market has experienced recent fluctuations, with the FTSE 100 index closing lower amid concerns over weak trade data from China, highlighting global economic challenges. In light of these conditions, investors may find potential in penny stocks—smaller or newer companies that can offer unexpected value despite their outdated name. By focusing on those with solid financial foundations and growth potential, investors might uncover opportunities for stability and upside in this unique segment of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.15 | £313.29M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.04 | £459.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.235 | £842.18M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.25 | £160.52M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.16 | £79.34M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £4.026 | £2.24B | ★★★★★☆ |

Click here to see the full list of 444 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Angling Direct (AIM:ANG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Angling Direct PLC, with a market cap of £30.25 million, operates in the sale of fishing tackle products and equipment across the United Kingdom, Europe, and internationally.

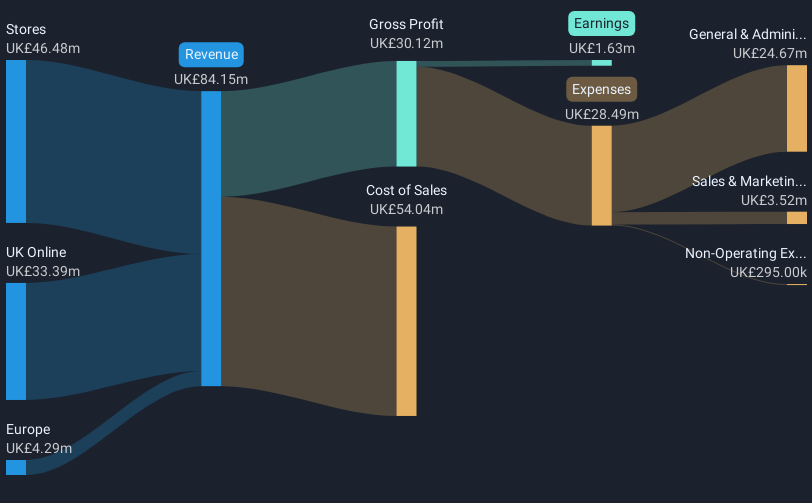

Operations: The company's revenue is generated from £46.48 million in-store sales, £33.39 million from UK online operations, and £4.29 million from European markets.

Market Cap: £30.25M

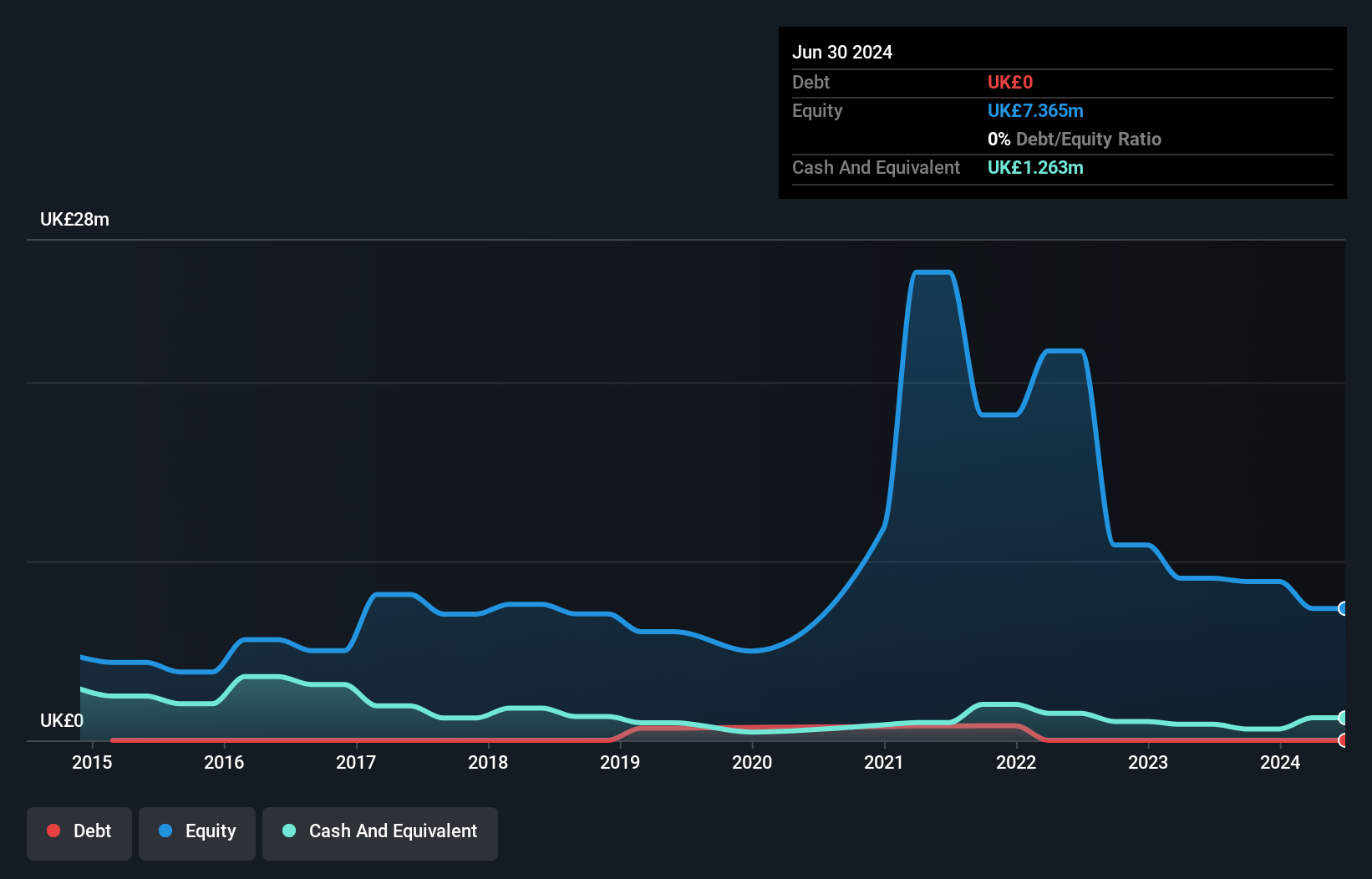

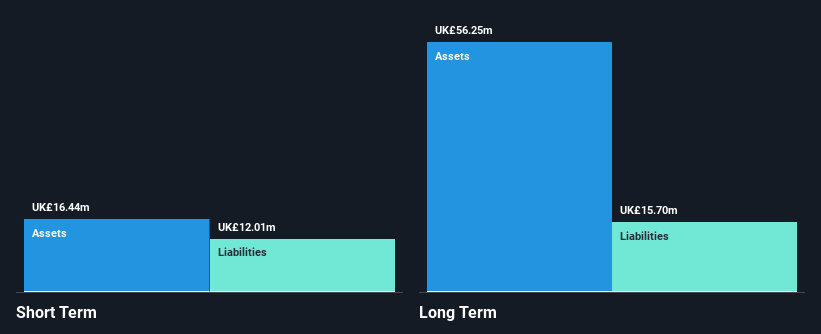

Angling Direct PLC, with a market cap of £30.25 million, has shown significant earnings growth of 66.1% over the past year, surpassing its five-year average growth rate of 19.8%. Despite having low return on equity at 4.1%, the company maintains high-quality earnings and improved net profit margins to 1.9%. Angling Direct is debt-free, with short-term assets covering both short and long-term liabilities comfortably. The company's shares are trading significantly below estimated fair value and have not been diluted recently. A share repurchase program worth up to £4 million reflects strategic capital deployment by management amidst stable weekly volatility.

- Click to explore a detailed breakdown of our findings in Angling Direct's financial health report.

- Evaluate Angling Direct's prospects by accessing our earnings growth report.

OptiBiotix Health (AIM:OPTI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OptiBiotix Health Plc is a life sciences company focused on discovering and developing microbiome modulators across the United Kingdom, the United States, China, and internationally, with a market cap of £15.67 million.

Operations: The company's revenue is primarily generated from identifying and developing microbial strains, compounds, and formulations, amounting to £0.57 million.

Market Cap: £15.67M

OptiBiotix Health Plc, with a market cap of £15.67 million, is a pre-revenue life sciences company focusing on microbiome modulators. Despite being unprofitable and experiencing a 35.4% annual decline in earnings over five years, it remains debt-free with short-term assets exceeding liabilities. Recent strategic initiatives include the launch of SlimBiome®-based products in the U.S. and India through partnerships with Daily Nouri and Dr. Morepen's LightLife brand, respectively, highlighting its focus on expanding market presence via ecommerce channels and significant marketing investments to capture consumer interest in weight management solutions amidst rising obesity rates globally.

- Jump into the full analysis health report here for a deeper understanding of OptiBiotix Health.

- Learn about OptiBiotix Health's historical performance here.

TPXimpact Holdings (AIM:TPX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TPXimpact Holdings plc, along with its subsidiaries, offers digital native technology services across several countries including the United Kingdom, Norway, Switzerland, Germany, the United States, and Malaysia with a market cap of £24.66 million.

Operations: TPXimpact Holdings plc does not report specific revenue segments.

Market Cap: £24.66M

TPXimpact Holdings plc, with a market cap of £24.66 million, is navigating financial challenges as it remains unprofitable, yet demonstrates some resilience through positive free cash flow and a satisfactory net debt to equity ratio of 17.5%. The company experienced a decline in half-year sales to £37.78 million from £41.62 million year-on-year but reduced its net loss significantly. Despite high share price volatility and negative return on equity at -36.16%, TPX's short-term assets cover both short- and long-term liabilities, providing some stability amidst anticipated revenue declines for Fiscal Year 2025 before expected growth in 2026 under new CFO leadership.

- Click here and access our complete financial health analysis report to understand the dynamics of TPXimpact Holdings.

- Assess TPXimpact Holdings' future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Jump into our full catalog of 444 UK Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ANG

Angling Direct

Engages in the sale of fishing tackle products and equipment in the United Kingdom, Europe, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives