- United Kingdom

- /

- Health Care REITs

- /

- LSE:THRL

If You Had Bought Target Healthcare REIT's (LON:THRL) Shares Three Years Ago You Would Be Down 12%

It can certainly be frustrating when a stock does not perform as hoped. But no-one can make money on every call, especially in a declining market. While the Target Healthcare REIT PLC (LON:THRL) share price is down 12% in the last three years, the total return to shareholders (which includes dividends) was 5.5%. That's better than the market which declined 3.2% over the last three years. It's down 2.2% in the last seven days.

Check out our latest analysis for Target Healthcare REIT

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate three years of share price decline, Target Healthcare REIT actually saw its earnings per share (EPS) improve by 6.6% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

We're actually a quite surprised to see the share price down while EPS have grown strongly. So we'll have to take a look at other metrics to try to understand the price action.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. We like that Target Healthcare REIT has actually grown its revenue over the last three years. But it's not clear to us why the share price is down. It might be worth diving deeper into the fundamentals, lest an opportunity goes begging.

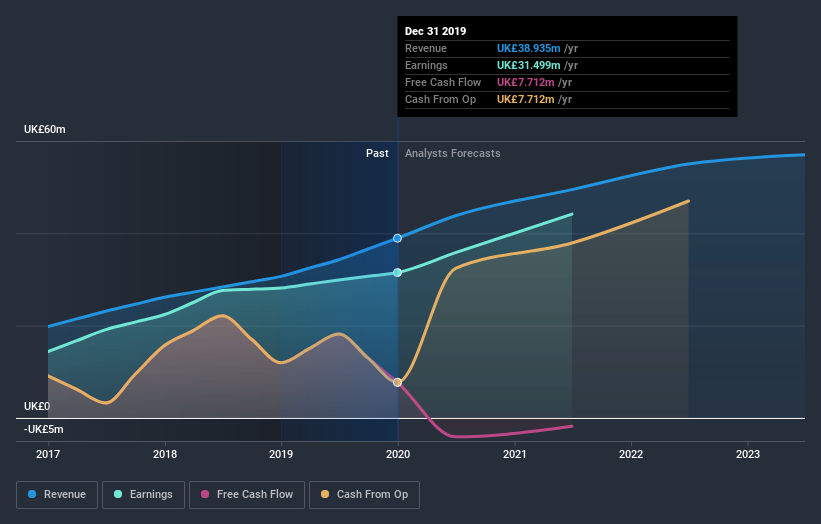

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Target Healthcare REIT's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Target Healthcare REIT, it has a TSR of 5.5% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Although it hurts that Target Healthcare REIT returned a loss of 2.6% in the last twelve months, the broader market was actually worse, returning a loss of 10.0%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 5.7% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Target Healthcare REIT , and understanding them should be part of your investment process.

We will like Target Healthcare REIT better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you’re looking to trade Target Healthcare REIT, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Target Healthcare REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:THRL

Target Healthcare REIT

UK listed Target Healthcare REIT plc (THRL) is an externally managed FTSE 250 Real Estate Investment Trust which provides shareholders with an attractive level of income, together with the potential for capital and income growth, from investing in a diversified portfolio of modern, purpose-built care homes.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026