- United Kingdom

- /

- Office REITs

- /

- LSE:HLCL

Helical plc's (LON:HLCL) CEO Compensation Is Looking A Bit Stretched At The Moment

Helical plc (LON:HLCL) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 15 July 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

View our latest analysis for Helical

How Does Total Compensation For Gerald Kaye Compare With Other Companies In The Industry?

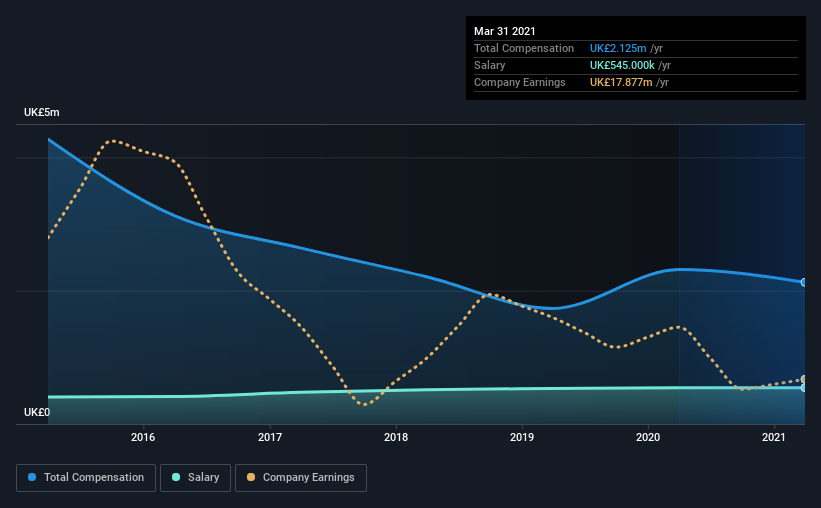

Our data indicates that Helical plc has a market capitalization of UK£534m, and total annual CEO compensation was reported as UK£2.1m for the year to March 2021. That's a notable decrease of 8.2% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at UK£545k.

In comparison with other companies in the industry with market capitalizations ranging from UK£291m to UK£1.2b, the reported median CEO total compensation was UK£684k. Accordingly, our analysis reveals that Helical plc pays Gerald Kaye north of the industry median. What's more, Gerald Kaye holds UK£9.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£545k | UK£545k | 26% |

| Other | UK£1.6m | UK£1.8m | 74% |

| Total Compensation | UK£2.1m | UK£2.3m | 100% |

On an industry level, around 54% of total compensation represents salary and 46% is other remuneration. It's interesting to note that Helical allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Helical plc's Growth

Over the last three years, Helical plc has shrunk its earnings per share by 13% per year. In the last year, its revenue is down 27%.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Helical plc Been A Good Investment?

Boasting a total shareholder return of 37% over three years, Helical plc has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 4 warning signs (and 1 which is a bit unpleasant) in Helical we think you should know about.

Switching gears from Helical, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Helical, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Helical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Helical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:HLCL

Helical

Engages in the development, investment, and rental of real estate properties in the United Kingdom.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives