- United Kingdom

- /

- Office REITs

- /

- LSE:GPE

Most Shareholders Will Probably Find That The CEO Compensation For Great Portland Estates Plc (LON:GPOR) Is Reasonable

Despite Great Portland Estates Plc's (LON:GPOR) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. Some of these issues will occupy shareholders' minds as the AGM rolls around on 08 July 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for Great Portland Estates

Comparing Great Portland Estates Plc's CEO Compensation With the industry

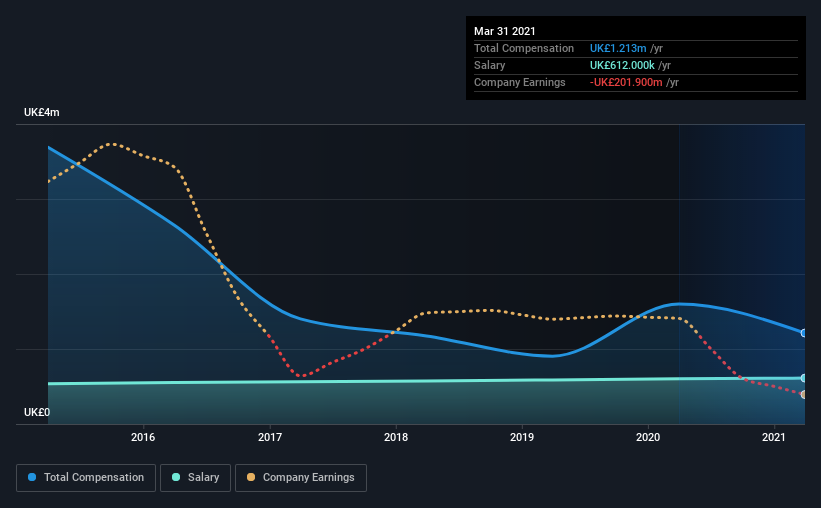

Our data indicates that Great Portland Estates Plc has a market capitalization of UK£1.8b, and total annual CEO compensation was reported as UK£1.2m for the year to March 2021. That's a notable decrease of 24% on last year. We note that the salary of UK£612.0k makes up a sizeable portion of the total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between UK£1.4b and UK£4.6b had a median total CEO compensation of UK£1.1m. From this we gather that Toby Courtauld is paid around the median for CEOs in the industry. Furthermore, Toby Courtauld directly owns UK£9.9m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£612k | UK£603k | 50% |

| Other | UK£601k | UK£996k | 50% |

| Total Compensation | UK£1.2m | UK£1.6m | 100% |

Talking in terms of the industry, salary represented approximately 45% of total compensation out of all the companies we analyzed, while other remuneration made up 55% of the pie. Great Portland Estates pays out 50% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Great Portland Estates Plc's Growth

Great Portland Estates Plc has reduced its earnings per share by 103% a year over the last three years. It saw its revenue drop 16% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Great Portland Estates Plc Been A Good Investment?

Great Portland Estates Plc has generated a total shareholder return of 8.5% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Great Portland Estates that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Great Portland Estates or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Great Portland Estates, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:GPE

Great Portland Estates

We are a FTSE 250 property investment and development company owning £2.5 billion of real estate in central London.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives