- United Kingdom

- /

- Office REITs

- /

- LSE:CLI

Results: CLS Holdings plc Beat Earnings Expectations And Analysts Now Have New Forecasts

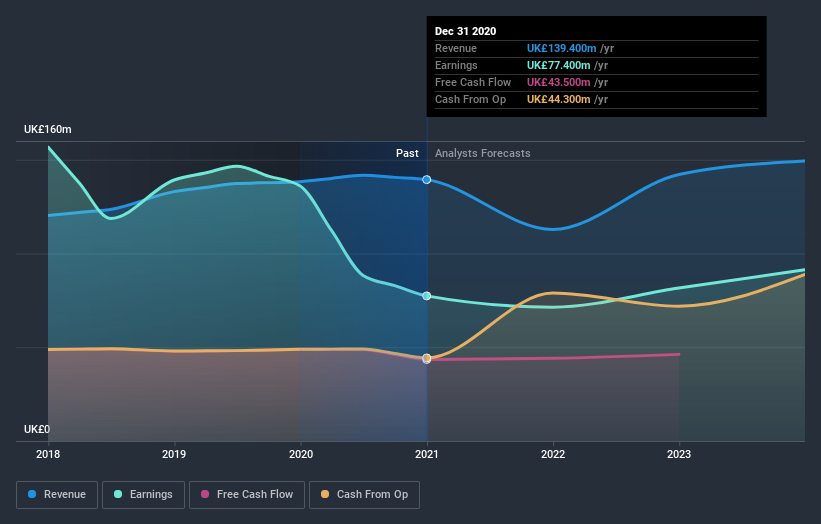

CLS Holdings plc (LON:CLI) investors will be delighted, with the company turning in some strong numbers with its latest results. It was overall a positive result, with revenues beating expectations by 7.4% to hit UK£139m. CLS Holdings also reported a statutory profit of UK£0.19, which was an impressive 77% above what the analysts had forecast. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

Check out our latest analysis for CLS Holdings

After the latest results, the consensus from CLS Holdings' dual analysts is for revenues of UK£112.8m in 2021, which would reflect a chunky 19% decline in sales compared to the last year of performance. Statutory earnings per share are expected to plunge 35% to UK£0.12 in the same period. Before this earnings report, the analysts had been forecasting revenues of UK£139.8m and earnings per share (EPS) of UK£0.18 in 2021. It looks like sentiment has declined substantially in the aftermath of these results, with a real cut to revenue estimates and a pretty serious reduction to earnings per share numbers as well.

The analysts made no major changes to their price target of UK£2.66, suggesting the downgrades are not expected to have a long-term impact on CLS Holdings' valuation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that sales are expected to reverse, with a forecast 19% annualised revenue decline to the end of 2021. That is a notable change from historical growth of 3.5% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 0.6% annually for the foreseeable future. It's pretty clear that CLS Holdings' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider industry. The consensus price target held steady at UK£2.66, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2023, which can be seen for free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 4 warning signs for CLS Holdings (1 is a bit concerning) you should be aware of.

If you’re looking to trade CLS Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:CLI

CLS Holdings

Engages in the investment, development, and management of commercial properties in the United Kingdom, Germany, and France.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives