This article will reflect on the compensation paid to Dominic Charles Agace who has served as CEO of M Winkworth PLC (LON:WINK) since 2006. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for M Winkworth

How Does Total Compensation For Dominic Charles Agace Compare With Other Companies In The Industry?

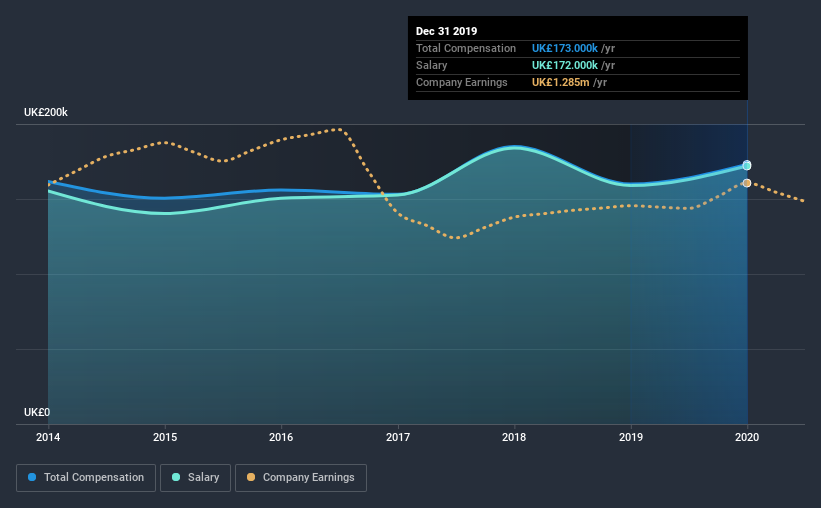

At the time of writing, our data shows that M Winkworth PLC has a market capitalization of UK£19m, and reported total annual CEO compensation of UK£173k for the year to December 2019. That's a notable increase of 8.1% on last year. In particular, the salary of UK£172.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below UK£150m, we found that the median total CEO compensation was UK£426k. This suggests that Dominic Charles Agace is paid below the industry median. What's more, Dominic Charles Agace holds UK£1.2m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | UK£172k | UK£159k | 99% |

| Other | UK£1.0k | UK£1.0k | 1% |

| Total Compensation | UK£173k | UK£160k | 100% |

Speaking on an industry level, nearly 51% of total compensation represents salary, while the remainder of 49% is other remuneration. Investors will find it interesting that M Winkworth pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

M Winkworth PLC's Growth

M Winkworth PLC has seen its earnings per share (EPS) increase by 6.2% a year over the past three years. Its revenue is up 11% over the last year.

We would argue that the modest growth in revenue is a notable positive. And, while modest, the EPS growth is noticeable. Although we'll stop short of calling the stock a top performer, we think the company has potential. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has M Winkworth PLC Been A Good Investment?

Boasting a total shareholder return of 82% over three years, M Winkworth PLC has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

M Winkworth pays its CEO a majority of compensation through a salary. As previously discussed, Dominic Charles is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. On the other hand, shareholder returns have been have been very pleasing, over the last three years, and that should put a smile on the faces of investors. As a result of the juicy return to investors, CEO compensation may well be quite reasonable.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 2 warning signs for M Winkworth you should be aware of, and 1 of them is a bit unpleasant.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade M Winkworth, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:WINK

M Winkworth

Operates as a franchisor to the Winkworth estate agencies in the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026