Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Circle Property Plc (LON:CRC) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Circle Property

What Is Circle Property's Debt?

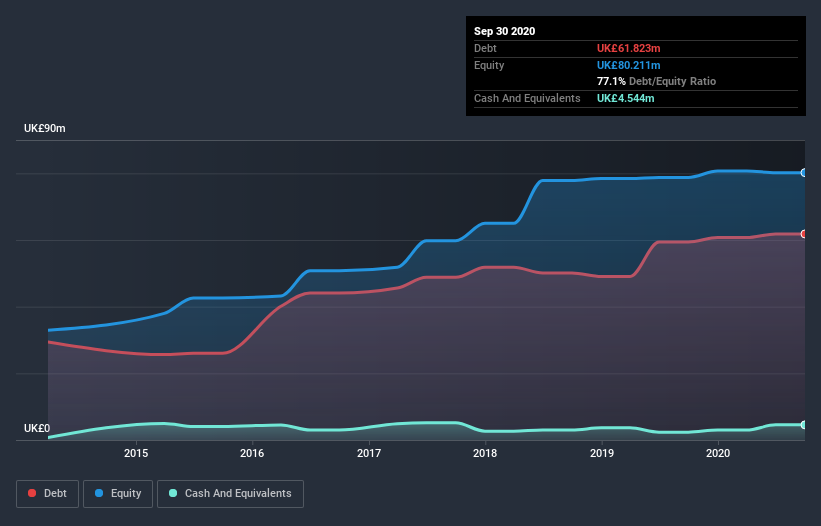

The image below, which you can click on for greater detail, shows that at September 2020 Circle Property had debt of UK£61.8m, up from UK£59.4m in one year. However, it also had UK£4.54m in cash, and so its net debt is UK£57.3m.

A Look At Circle Property's Liabilities

We can see from the most recent balance sheet that Circle Property had liabilities of UK£3.06m falling due within a year, and liabilities of UK£62.6m due beyond that. Offsetting this, it had UK£4.54m in cash and UK£2.41m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£58.7m.

When you consider that this deficiency exceeds the company's UK£50.5m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Circle Property shareholders face the double whammy of a high net debt to EBITDA ratio (12.9), and fairly weak interest coverage, since EBIT is just 2.4 times the interest expense. The debt burden here is substantial. On the other hand, Circle Property grew its EBIT by 24% in the last year. If it can maintain that kind of improvement, its debt load will begin to melt away like glaciers in a warming world. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Circle Property will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Circle Property recorded free cash flow of 44% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Mulling over Circle Property's attempt at managing its debt, based on its EBITDA,, we're certainly not enthusiastic. But at least it's pretty decent at growing its EBIT; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Circle Property stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 6 warning signs we've spotted with Circle Property (including 2 which shouldn't be ignored) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading Circle Property or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:CRC

Circle Property

Circle is amongst the best performing quoted UK real estate companies by NAV total return (NAV growth and dividend) having delivered consistent returns with 87% NAV growth since IPO in 2016 in absolute terms.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives