- United Kingdom

- /

- Real Estate

- /

- LSE:SVS

Exploring Undiscovered Gems in the United Kingdom September 2025

Reviewed by Simply Wall St

As the United Kingdom's market grapples with global economic challenges, highlighted by the FTSE 100's recent dip following weak trade data from China, investors are increasingly seeking opportunities beyond blue-chip stocks. In this environment, identifying small-cap companies with strong fundamentals and growth potential can be particularly appealing as these "undiscovered gems" may offer unique resilience and opportunities amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| Bioventix | NA | 7.39% | 5.15% | ★★★★★★ |

| Georgia Capital | NA | 6.53% | 10.96% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

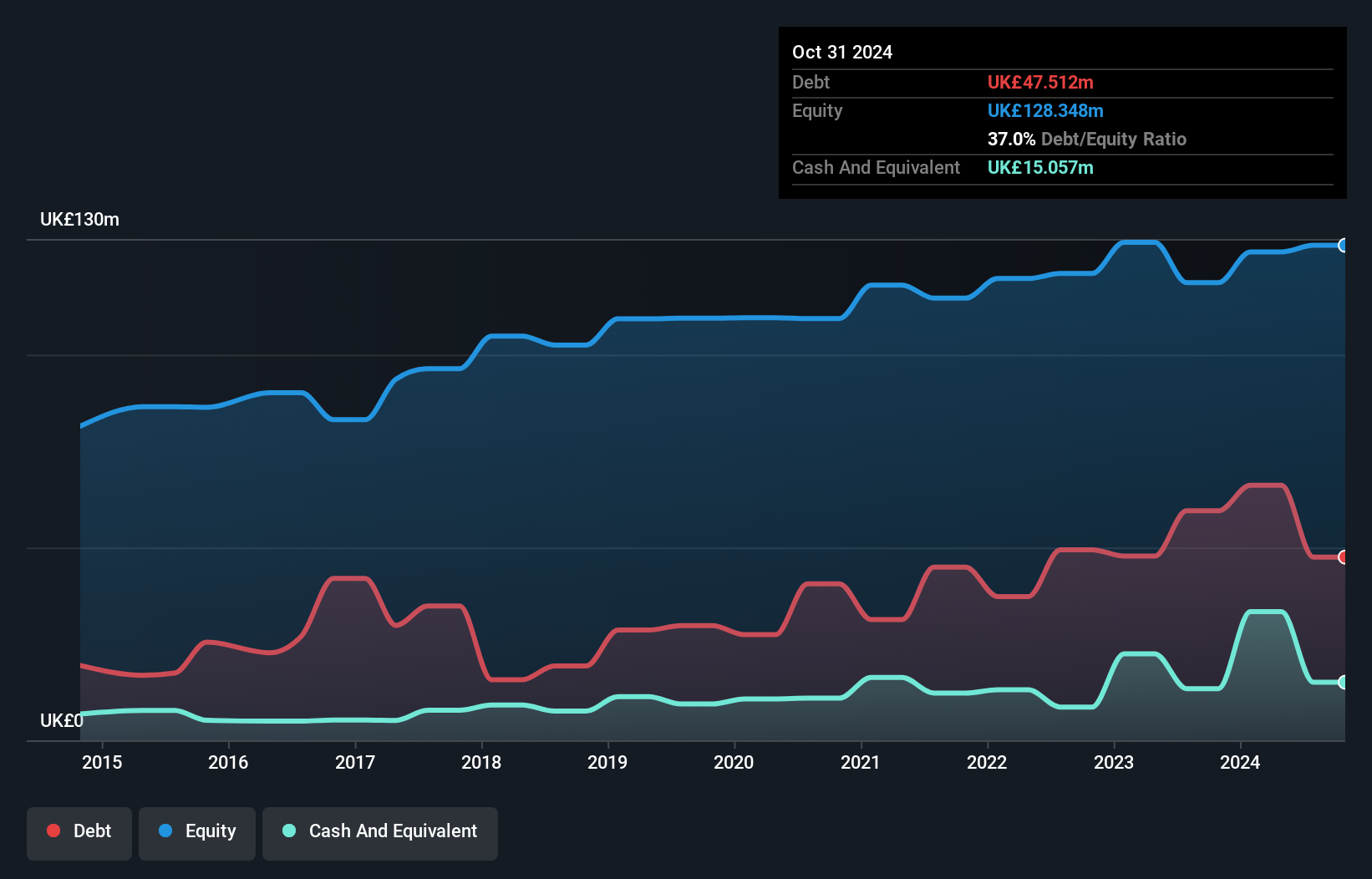

M.P. Evans Group (AIM:MPE)

Simply Wall St Value Rating: ★★★★★★

Overview: M.P. Evans Group PLC, with a market cap of £701.90 million, operates through its subsidiaries to own and develop oil palm plantations in Indonesia and Malaysia.

Operations: The primary revenue stream for M.P. Evans Group comes from its plantation operations in Indonesia, generating $368.49 million. The company has a market capitalization of £701.90 million.

Focusing on expanding its oil palm plantations in Indonesia, M.P. Evans Group has shown impressive financial strength with a 61% earnings growth over the past year, surpassing the Food industry's 11%. The company has reduced its debt-to-equity ratio from 27% to 3.7% over five years and maintains more cash than total debt, reflecting a robust balance sheet. Trading at about half of its estimated fair value, it offers potential undervaluation opportunities despite environmental risks and tax levies in Indonesia. Recent results show sales of $179 million and net income of $48 million for H1 2025, indicating strong operational performance.

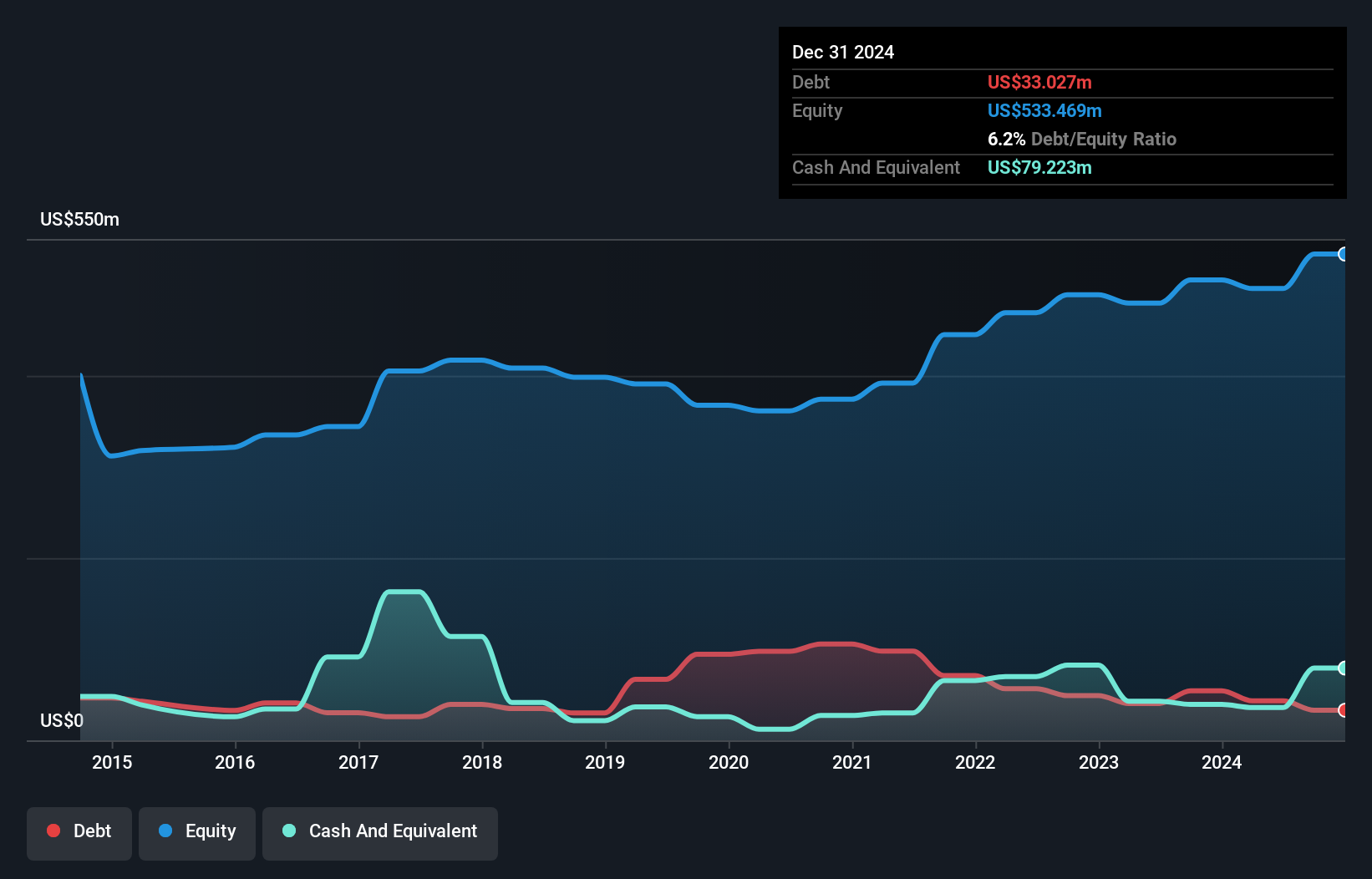

Goodwin (LSE:GDWN)

Simply Wall St Value Rating: ★★★★★★

Overview: Goodwin PLC, with a market cap of £811.04 million, operates globally through its subsidiaries to deliver mechanical and refractory engineering solutions across various regions including the United Kingdom, Europe, the United States, and the Pacific Basin.

Operations: Goodwin PLC generates revenue primarily from its Mechanical Engineering segment (£193.05 million) and Refractory Engineering segment (£78.16 million).

Trading significantly below its estimated fair value, Goodwin has shown impressive growth with earnings increasing by 45.4% over the past year, outpacing the broader machinery industry. The company's net debt to equity ratio stands at a satisfactory 6.2%, having decreased from 25% five years ago, indicating prudent financial management. With interest payments well covered by EBIT at 12.7 times, Goodwin's financial health seems robust. Recent announcements highlight a substantial dividend increase to 280 pence per share from last year's 133 pence, reflecting confidence in continued profitability and strong cash flow generation of £41.9 million as of April 2025.

- Click here and access our complete health analysis report to understand the dynamics of Goodwin.

Assess Goodwin's past performance with our detailed historical performance reports.

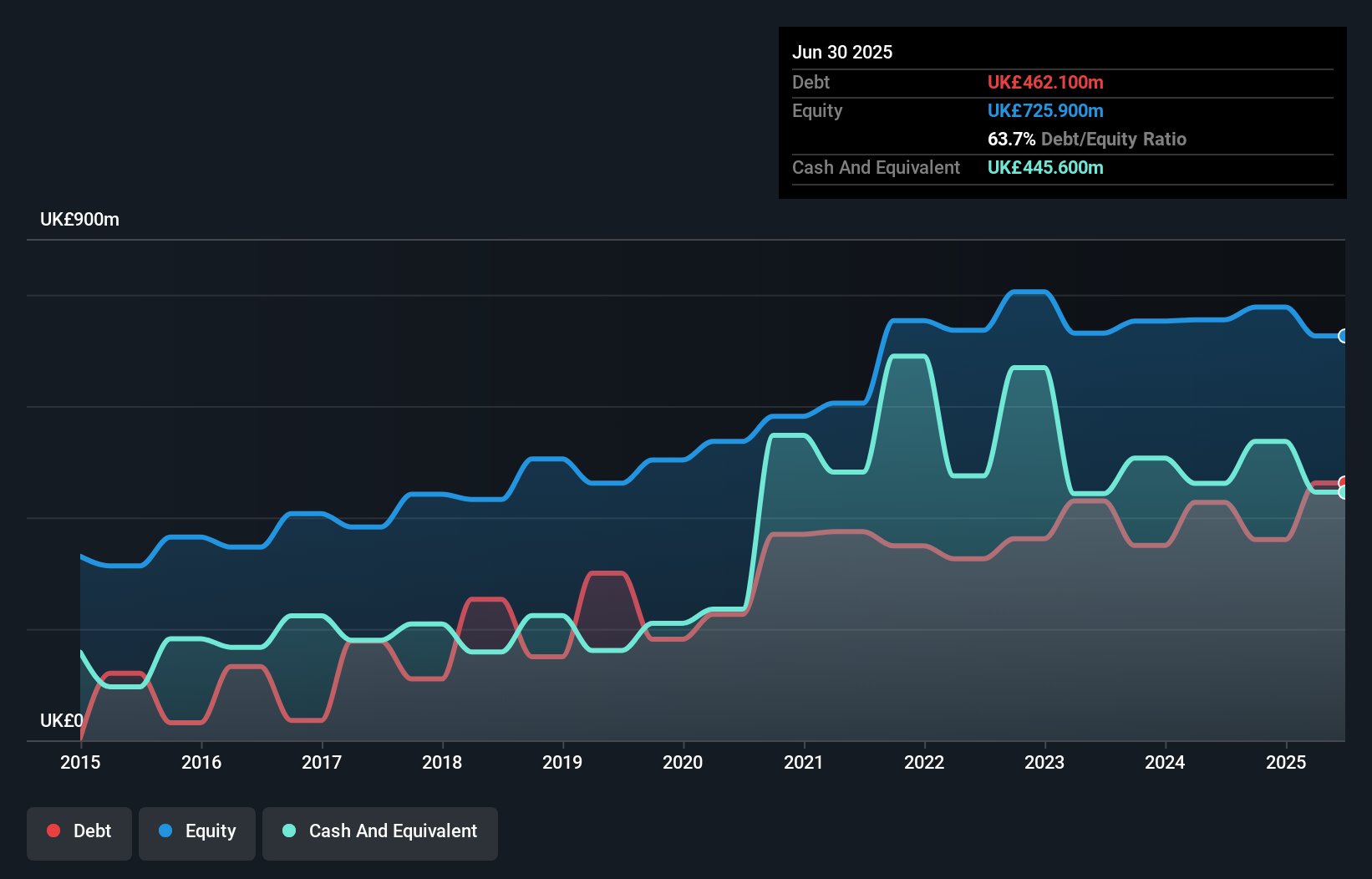

Savills (LSE:SVS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Savills plc is a global real estate services provider operating across the United Kingdom, Continental Europe, the Asia Pacific, Africa, North America, and the Middle East with a market capitalization of approximately £1.30 billion.

Operations: Savills generates revenue primarily from four segments: Consultancy (£534.90 million), Transaction Advisory (£877.30 million), Investment Management (£91.20 million), and Property and Facilities Management (£965.20 million).

Savills, a notable player in the real estate sector, has shown promising growth with earnings rising 23% last year, outpacing the industry average of 15.6%. The company reported half-year sales of £1.13 billion and net income of £9.2 million, reflecting steady progress from the previous year. With a net debt to equity ratio at a satisfactory 2.3%, Savills is poised for stability despite an increase over five years from 42.2% to 63.7%. Trading at about 30% below its estimated fair value suggests potential investment appeal amid ongoing global real estate recovery and expansion efforts in EMEA and APAC regions.

Summing It All Up

- Explore the 62 names from our UK Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SVS

Savills

Engages in the provision of real estate services in the United Kingdom, Continental Europe, the Asia Pacific, Africa, North America, and the Middle East.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives