- United Kingdom

- /

- Capital Markets

- /

- AIM:BPM

European Insider Buying Highlights 3 Undervalued Small Caps

Reviewed by Simply Wall St

As European markets show signs of recovery, with the STOXX Europe 600 Index gaining 3.93% over a recent week, investor sentiment has been buoyed by the European Central Bank's rate cuts and easing trade tensions. In this environment, small-cap stocks in Europe may present intriguing opportunities for investors seeking potential value plays amidst broader market optimism.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.2x | 0.5x | 44.52% | ★★★★★★ |

| Tristel | 27.2x | 3.8x | 28.24% | ★★★★★☆ |

| Stelrad Group | 10.6x | 0.6x | 40.58% | ★★★★★☆ |

| Savills | 23.4x | 0.5x | 43.72% | ★★★★☆☆ |

| Seeing Machines | NA | 1.8x | 48.38% | ★★★★☆☆ |

| Norcros | 23.9x | 0.6x | 29.15% | ★★★☆☆☆ |

| FRP Advisory Group | 12.4x | 2.2x | 10.21% | ★★★☆☆☆ |

| Italmobiliare | 10.7x | 1.4x | -251.44% | ★★★☆☆☆ |

| Arendals Fossekompani | 20.7x | 1.6x | 48.63% | ★★★☆☆☆ |

| Speedy Hire | NA | 0.2x | -6.83% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

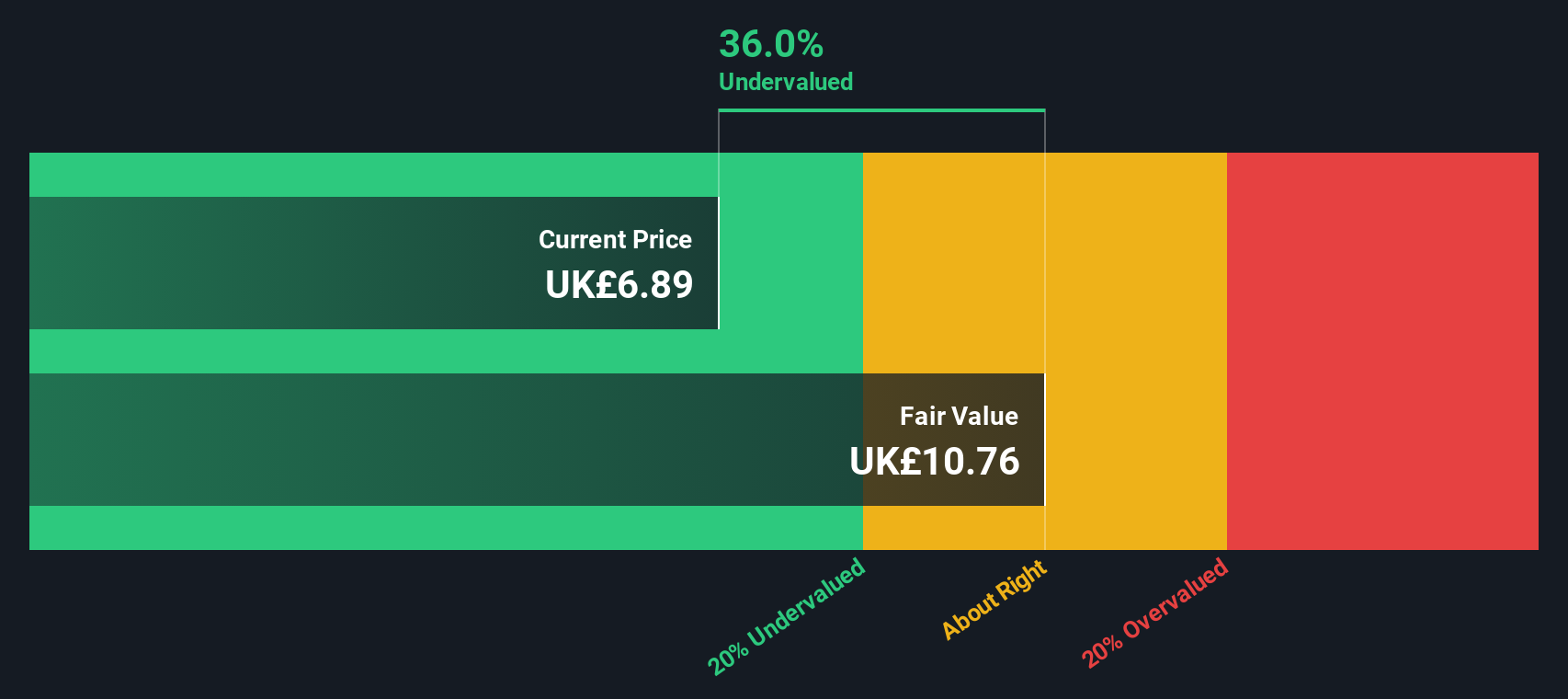

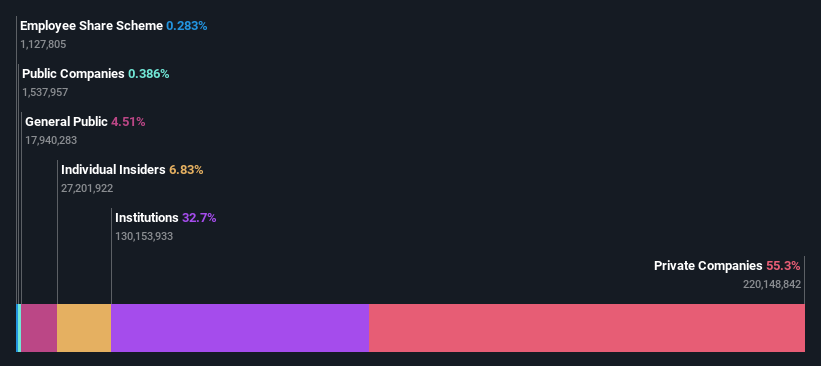

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: B.P. Marsh & Partners is a specialist private equity investor focusing on early-stage financial services businesses, with a market capitalization of £0.14 billion.

Operations: The company generates revenue primarily from consultancy services and trading investments in financial services, with recent revenue reaching £64.99 million. Over time, the net income margin has shown an upward trend, reaching 82.47%.

PE: 4.7x

B.P. Marsh & Partners, a European small cap, is gaining attention for its potential value. The company has embarked on a £2 million share repurchase program to optimize capital structure, indicating strategic financial management. Insider confidence is evident with recent purchases in 2025. Although the firm relies solely on external borrowing—considered higher risk than customer deposits—it maintains a commitment to shareholder returns with an annual £5 million dividend plan through 2028, signaling potential stability and growth prospects.

CLS Holdings (LSE:CLI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: CLS Holdings is a property investment company focusing on commercial real estate, primarily in the United Kingdom, Germany, and France, with a market capitalization of £1.17 billion.

Operations: The company's revenue is primarily derived from investment properties in the United Kingdom (£76.10 million), Germany (£51.60 million), and France (£18.10 million). Over recent periods, the gross profit margin has shown a declining trend, reaching 75.05% by December 2024 from 80.76% in June 2014. Operating expenses have remained relatively stable, with general and administrative expenses being a significant component of these costs.

PE: -2.5x

CLS Holdings, a smaller European company, faces challenges with its auditor expressing doubts about its ability to continue as a going concern. Despite this, the company reported a significant reduction in net loss for 2024, from £249.8 million to £93.6 million. Earnings are expected to grow substantially by 118% annually. A lease extension with the National Crime Agency will add £7 million in rent by 2026, and redevelopment plans at Citadel Place aim for sustainable residential growth in London’s Vauxhall area.

- Click to explore a detailed breakdown of our findings in CLS Holdings' valuation report.

Gain insights into CLS Holdings' historical performance by reviewing our past performance report.

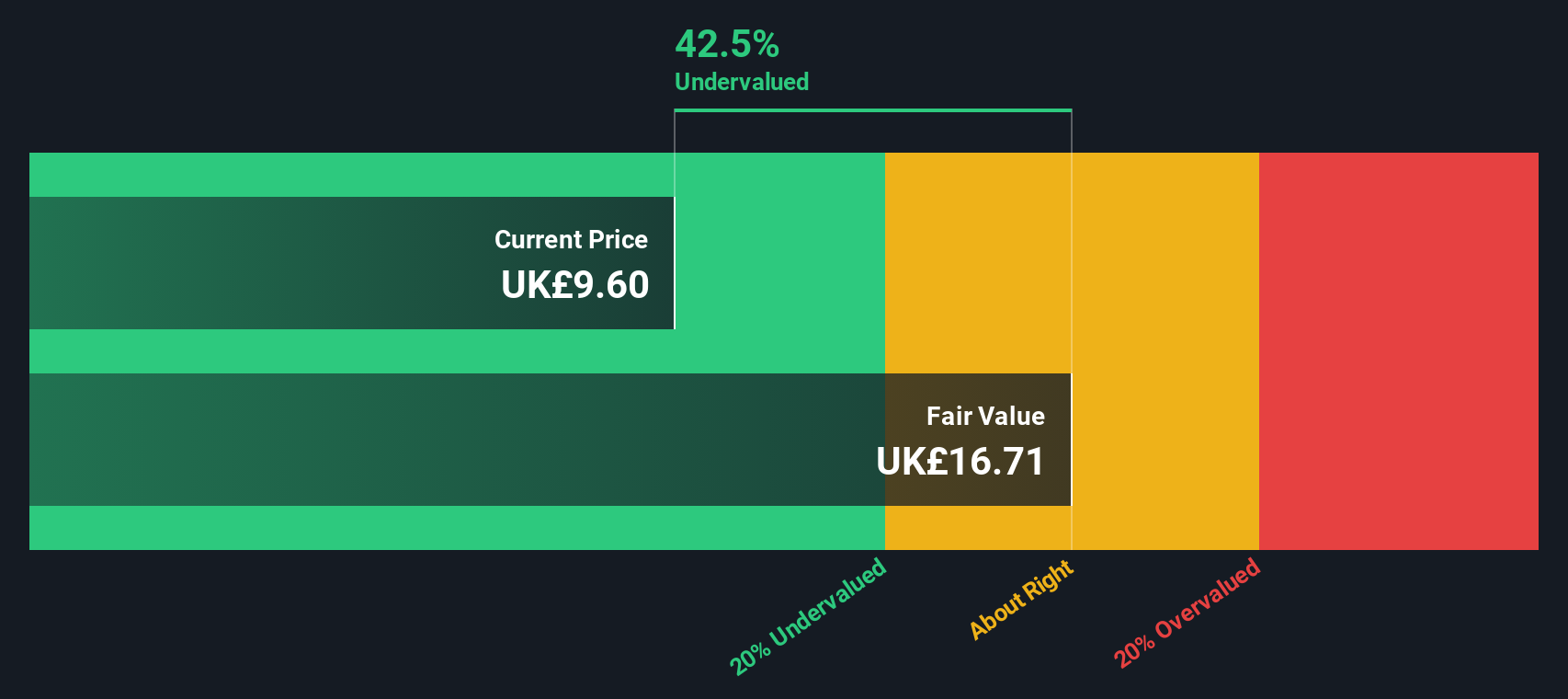

Savills (LSE:SVS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Savills is a global real estate services provider offering consultancy, transaction advisory, investment management, and property and facilities management services with a market capitalization of £1.64 billion.

Operations: Savills generates revenue from four key segments: Transaction Advisory (£870 million), Property and Facilities Management (£944.5 million), Consultancy (£495.5 million), and Investment Management (£94 million). The company has consistently achieved a gross profit margin of 100% across multiple periods, indicating that its reported cost of goods sold is negligible or zero in the financial data provided. Operating expenses are significant, with general and administrative expenses being a major component, impacting net income margins which have shown variability over time.

PE: 23.4x

Savills, a European property consultancy firm, has demonstrated financial resilience with sales reaching £2.4 billion for 2024, up from £2.2 billion the previous year. Earnings per share improved to £0.394 from £0.3, reflecting strong performance despite one-off items affecting results. Insider confidence is evident through recent purchases by executives, signaling potential value recognition within the company. Although reliant on external borrowing for funding, Savills' strategic leadership changes aim to capitalize on investment opportunities in London's real estate market.

- Click here and access our complete valuation analysis report to understand the dynamics of Savills.

Assess Savills' past performance with our detailed historical performance reports.

Summing It All Up

- Gain an insight into the universe of 63 Undervalued European Small Caps With Insider Buying by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B.P. Marsh & Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BPM

B.P. Marsh & Partners

Invests in early-stage financial services intermediary businesses in the United Kingdom and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives