- United Kingdom

- /

- Real Estate

- /

- LSE:SVS

3 UK Stocks That May Be Trading Below Estimated Value In November 2024

Reviewed by Simply Wall St

As the UK market navigates through challenging global conditions, highlighted by the recent faltering of the FTSE 100 due to weak trade data from China, investors are increasingly focused on identifying opportunities that may be trading below their estimated value. In such an environment, a good stock is often characterized by strong fundamentals and resilience against external economic pressures, offering potential for growth despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.375 | £0.74 | 49.1% |

| CAB Payments Holdings (LSE:CABP) | £1.142 | £2.22 | 48.6% |

| AstraZeneca (LSE:AZN) | £112.06 | £220.62 | 49.2% |

| Gulf Keystone Petroleum (LSE:GKP) | £1.287 | £2.48 | 48% |

| Redcentric (AIM:RCN) | £1.2075 | £2.38 | 49.3% |

| Mpac Group (AIM:MPAC) | £4.575 | £8.94 | 48.8% |

| Foxtons Group (LSE:FOXT) | £0.606 | £1.19 | 49.2% |

| Auction Technology Group (LSE:ATG) | £4.52 | £8.41 | 46.3% |

| Quartix Technologies (AIM:QTX) | £1.60 | £3.07 | 47.9% |

| Genel Energy (LSE:GENL) | £0.77 | £1.53 | 49.5% |

Here's a peek at a few of the choices from the screener.

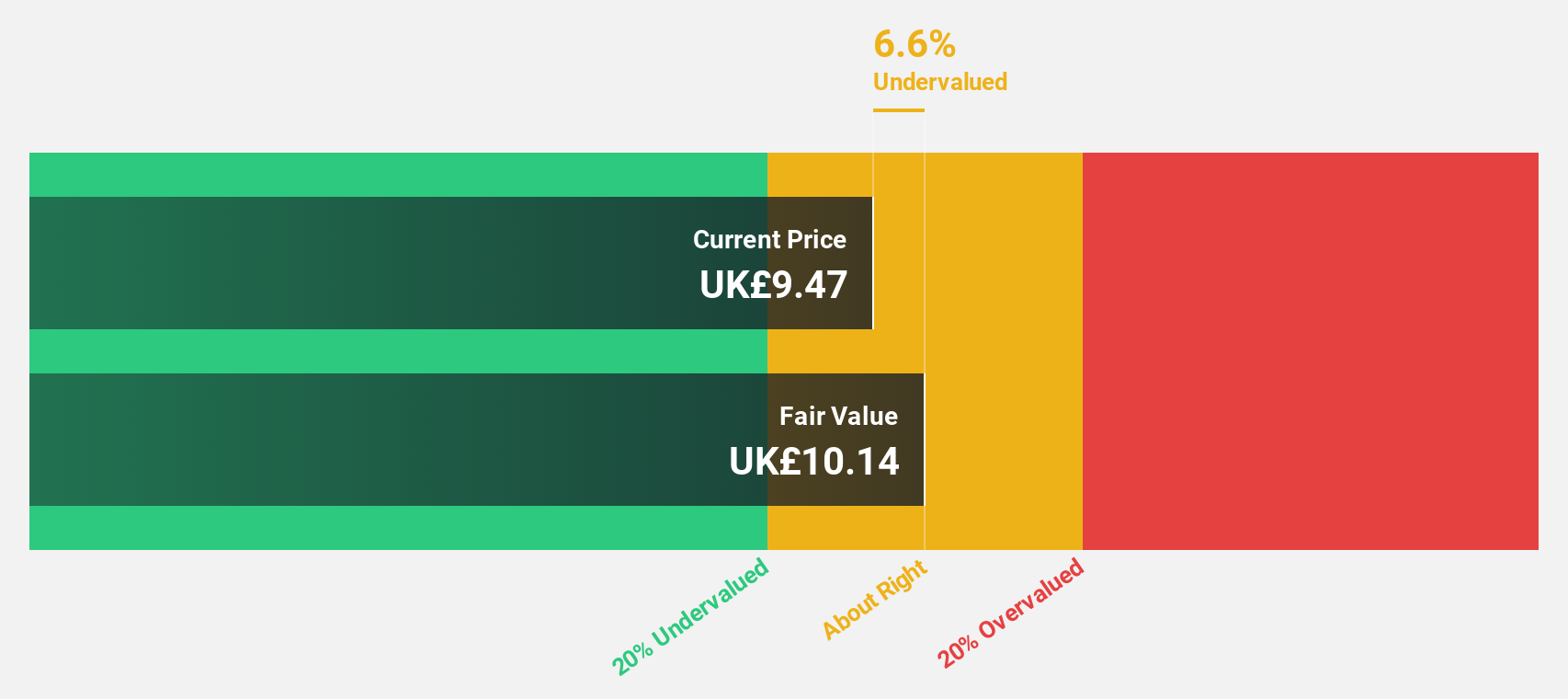

Young's Brewery (AIM:YNGA)

Overview: Young & Co.'s Brewery, P.L.C. operates and manages pubs and hotels in the United Kingdom with a market cap of £503.99 million.

Operations: The company's revenue primarily comes from its Managed Houses segment, which generated £388.20 million.

Estimated Discount To Fair Value: 13.3%

Young's Brewery, trading at £9.18, is undervalued compared to its estimated fair value of £10.59 and analysts expect a 49.7% price rise. Despite recent board changes and lower profit margins, revenue growth forecasts of 7.7% annually surpass the UK market average of 3.6%. However, earnings are impacted by large one-off items and shareholder dilution has occurred recently, affecting dividend sustainability currently at 2.37%.

- Our comprehensive growth report raises the possibility that Young's Brewery is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Young's Brewery stock in this financial health report.

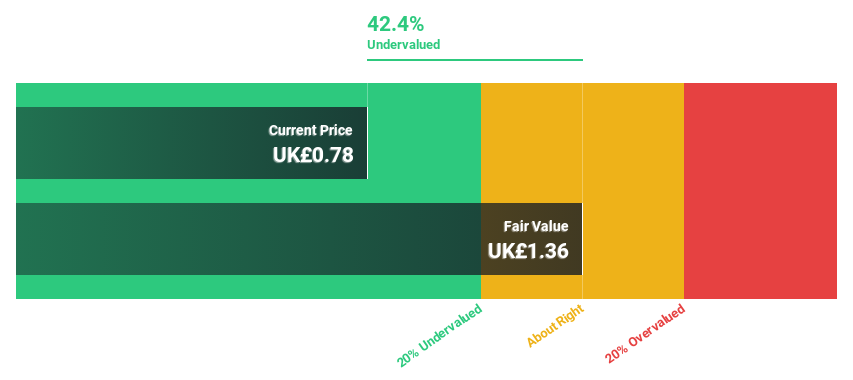

Rank Group (LSE:RNK)

Overview: The Rank Group Plc, with a market cap of £416 million, operates gaming services in Great Britain, Spain, and India through its subsidiaries.

Operations: Rank Group's revenue is derived from four main segments: Digital (£226 million), Mecca Venues (£138.90 million), Enracha Venues (£38.50 million), and Grosvenor Venues (£331.30 million).

Estimated Discount To Fair Value: 34.4%

Rank Group is trading at £0.89, significantly below its estimated fair value of £1.35, indicating potential undervaluation based on cash flows. Earnings are forecasted to grow substantially at 35.71% annually, outpacing the UK market's average growth rate of 14.1%. However, revenue growth is slower at 5.9% per year and large one-off items have impacted financial results recently despite a return to profitability with net income reaching £12.5 million this year from a prior loss.

- Insights from our recent growth report point to a promising forecast for Rank Group's business outlook.

- Dive into the specifics of Rank Group here with our thorough financial health report.

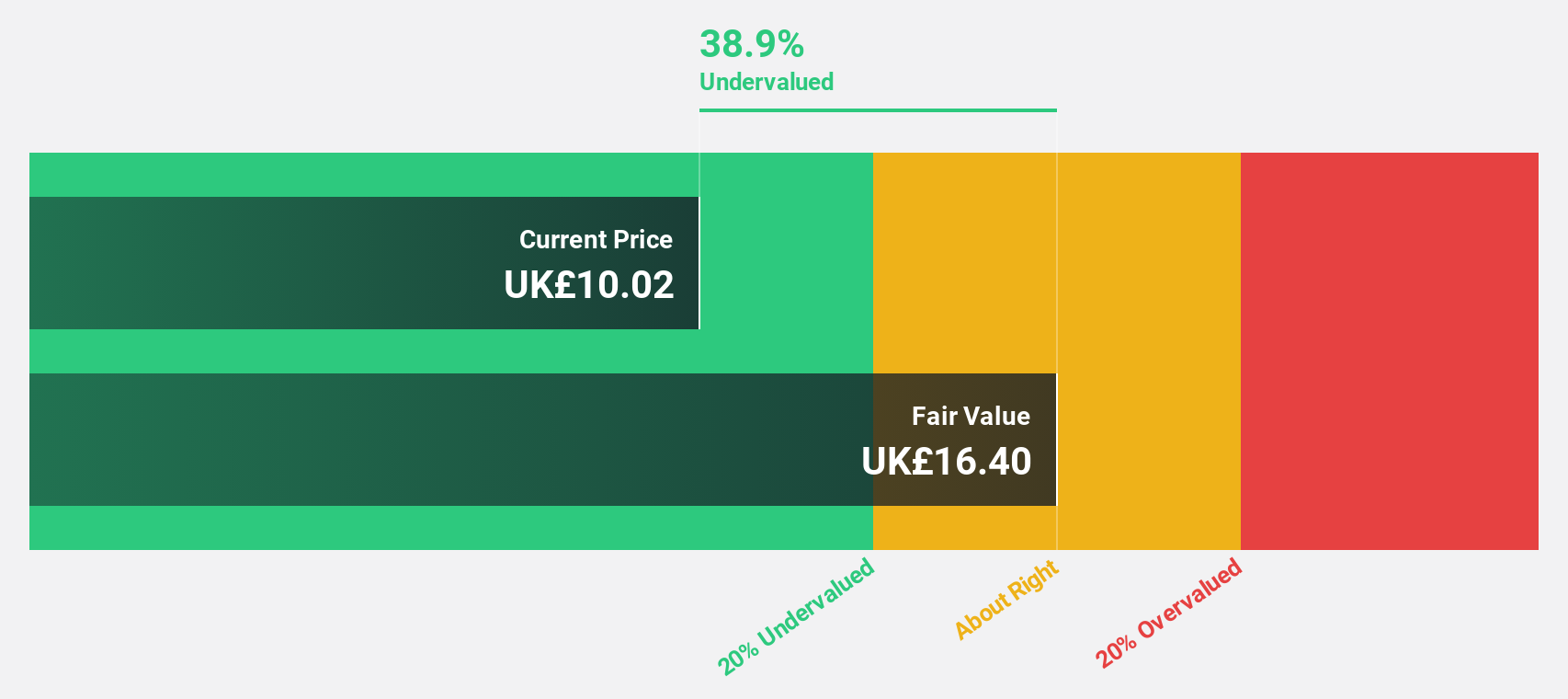

Savills (LSE:SVS)

Overview: Savills plc, along with its subsidiaries, provides real estate services across the UK, Continental Europe, Asia Pacific, Africa, North America and the Middle East and has a market cap of £1.50 billion.

Operations: The company's revenue is derived from four main segments: Consultancy (£464.80 million), Transaction Advisory (£803.60 million), Investment Management (£100.50 million), and Property and Facilities Management (£920.90 million).

Estimated Discount To Fair Value: 26.3%

Savills is trading at £11.1, below its estimated fair value of £15.06, suggesting it may be undervalued based on cash flows. Earnings are projected to grow significantly at 33.3% annually, surpassing the UK market's average growth rate of 14.1%. Despite this positive outlook, profit margins have decreased from last year due to large one-off items impacting results. Recent executive changes aim to strengthen Savills' presence in the UAE's growing commercial sector.

- Our growth report here indicates Savills may be poised for an improving outlook.

- Click here to discover the nuances of Savills with our detailed financial health report.

Next Steps

- Dive into all 60 of the Undervalued UK Stocks Based On Cash Flows we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SVS

Savills

Engages in the provision of real estate services in the United Kingdom, Continental Europe, the Asia Pacific, Africa, North America, and the Middle East.

Flawless balance sheet with reasonable growth potential and pays a dividend.