- United Kingdom

- /

- Retail REITs

- /

- LSE:HMSO

3 UK Stocks Estimated To Be Trading At Discounts Of Up To 42.1%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced challenges, closing lower amid weak trade data from China, which continues to struggle with its economic recovery. Despite these broader market pressures, there are opportunities for investors to identify undervalued stocks that may be trading at significant discounts.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £1.68 | 44.2% |

| Aptitude Software Group (LSE:APTD) | £2.77 | £5.14 | 46.1% |

| AstraZeneca (LSE:AZN) | £107.54 | £191.91 | 44% |

| Gooch & Housego (AIM:GHH) | £4.11 | £7.20 | 42.9% |

| On the Beach Group (LSE:OTB) | £2.725 | £4.75 | 42.6% |

| ECO Animal Health Group (AIM:EAH) | £0.66 | £1.28 | 48.3% |

| Fintel (AIM:FNTL) | £2.40 | £4.20 | 42.9% |

| Ibstock (LSE:IBST) | £1.874 | £3.24 | 42.1% |

| Crest Nicholson Holdings (LSE:CRST) | £1.881 | £3.66 | 48.6% |

| Kromek Group (AIM:KMK) | £0.054 | £0.10 | 47.5% |

We'll examine a selection from our screener results.

Hammerson (LSE:HMSO)

Overview: Hammerson is an owner, operator, and developer of prime urban real estate in the UK, Ireland, and France with a portfolio valued at £4.7 billion and a market cap of approximately £1.25 billion.

Operations: The company's revenue segments include £80 million from UK flagship destinations, £55.30 million from France flagship destinations, and £37.70 million from Ireland flagship destinations.

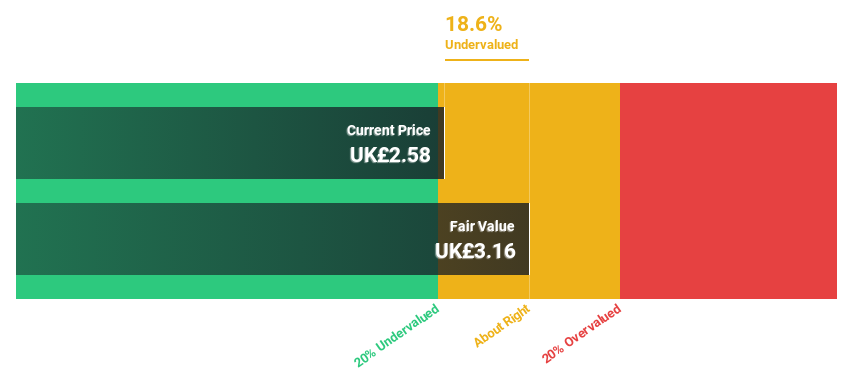

Estimated Discount To Fair Value: 18.5%

Hammerson is trading at £2.58, below its estimated fair value of £3.16, reflecting an 18.5% undervaluation based on discounted cash flows. Despite a challenging year with a net loss of £526.3 million and declining sales to £81.8 million, earnings are projected to grow 45.75% annually over the next three years as the company aims for profitability, outpacing average market growth expectations in the UK.

- The growth report we've compiled suggests that Hammerson's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Hammerson.

Hochschild Mining (LSE:HOC)

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile with a market cap of £1.41 billion.

Operations: Hochschild Mining's revenue segments include $293.34 million from San Jose, $149.82 million from Mara Rosa, $504.34 million from Inmaculada, and a slight negative contribution of -$0.26 million from Pallancata.

Estimated Discount To Fair Value: 21.2%

Hochschild Mining is trading at £2.74, significantly below its estimated fair value of £3.48, indicating a 21.2% undervaluation based on discounted cash flows. The company's earnings are expected to grow 24.7% annually over the next three years, surpassing UK market growth rates and supported by recent profitability with net income of US$97.01 million in 2024 compared to a loss the previous year, despite experiencing share price volatility recently.

- Our expertly prepared growth report on Hochschild Mining implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Hochschild Mining with our detailed financial health report.

Savills (LSE:SVS)

Overview: Savills plc, with a market cap of £1.31 billion, provides real estate services through its subsidiaries across the United Kingdom, Continental Europe, the Asia Pacific, Africa, North America, and the Middle East.

Operations: The company's revenue segments include Consultancy (£495.50 million), Transaction Advisory (£870 million), Investment Management (£94 million), and Property and Facilities Management (£944.50 million).

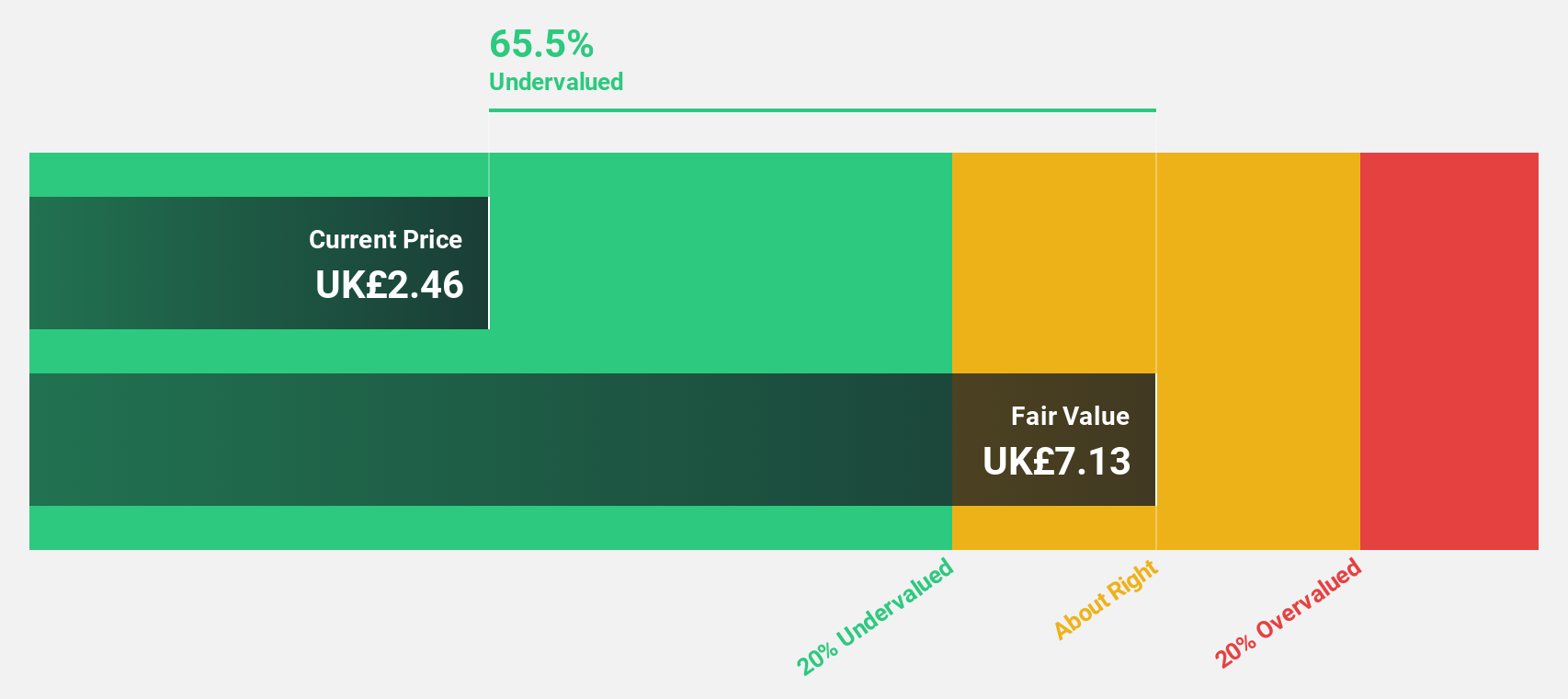

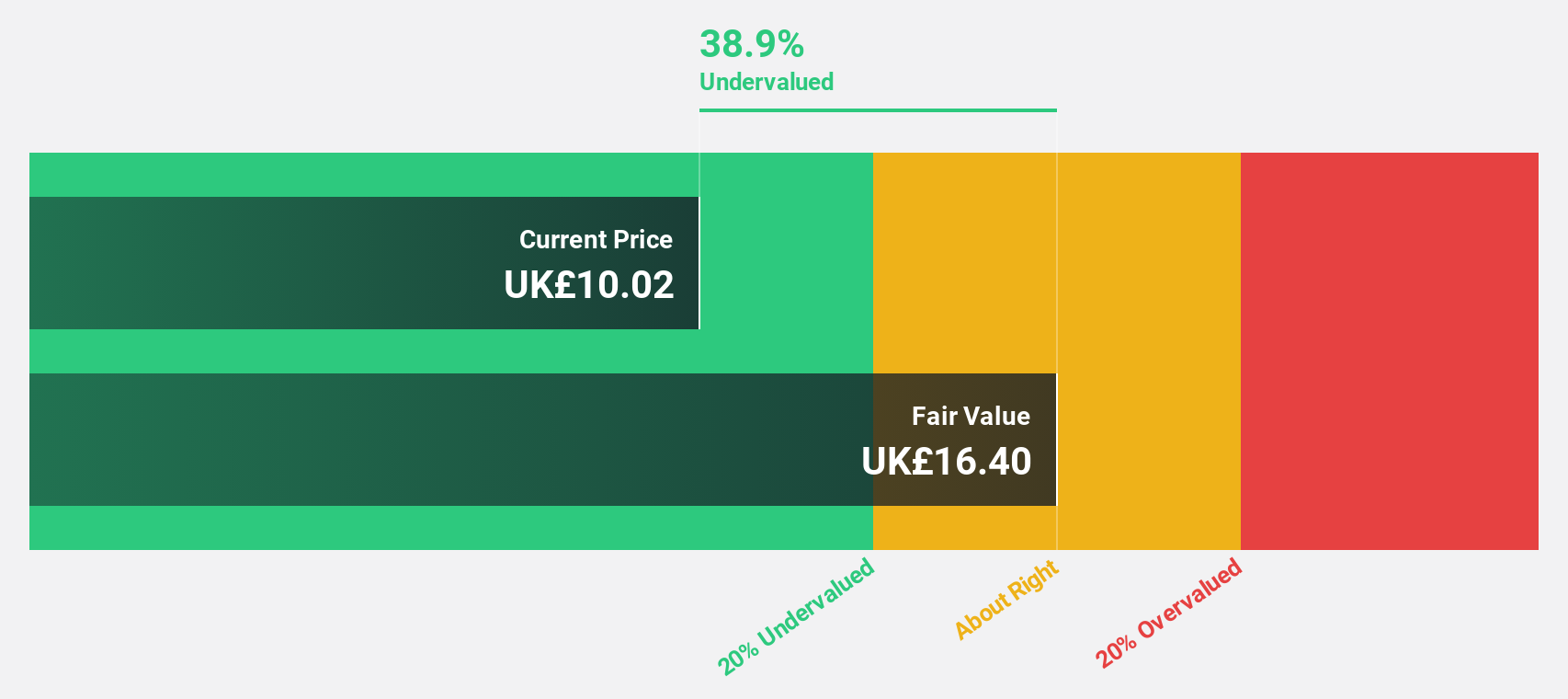

Estimated Discount To Fair Value: 42.1%

Savills is trading at £9.66, significantly below its estimated fair value of £16.69, reflecting an undervaluation exceeding 20% based on discounted cash flows. Earnings grew by 31.4% last year and are forecast to grow annually by 28.6%, outpacing the UK market's growth rate of 14.1%. Despite a low projected return on equity of 14.4% in three years and an unstable dividend track record, recent earnings reports show improved net income and sales figures for 2024.

- In light of our recent growth report, it seems possible that Savills' financial performance will exceed current levels.

- Dive into the specifics of Savills here with our thorough financial health report.

Make It Happen

- Explore the 53 names from our Undervalued UK Stocks Based On Cash Flows screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hammerson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HMSO

Hammerson

Hammerson is the largest UK-listed, pure-play owner and manager of prime retail and leisure anchored city destinations across the UK, France and Ireland.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives