Stock Analysis

- United Kingdom

- /

- Real Estate

- /

- LSE:IWG

High Insider Ownership Growth Companies On The UK Exchange

Reviewed by Simply Wall St

As the FTSE 100 faces a potential second consecutive day of losses and broader economic concerns loom, investors are closely monitoring market dynamics and regulatory developments within the UK. In this context, exploring growth companies with high insider ownership can offer valuable insights, as such firms often demonstrate strong confidence from those most familiar with the business amidst uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 36.8% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 46.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.1% | 14.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 38.6% | 117.8% |

| Velocity Composites (AIM:VEL) | 27.8% | 173.3% |

| Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

| Hochschild Mining (LSE:HOC) | 38.4% | 42.6% |

Let's dive into some prime choices out of from the screener.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc operates globally, offering workspace solutions across the Americas, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of approximately £1.76 billion.

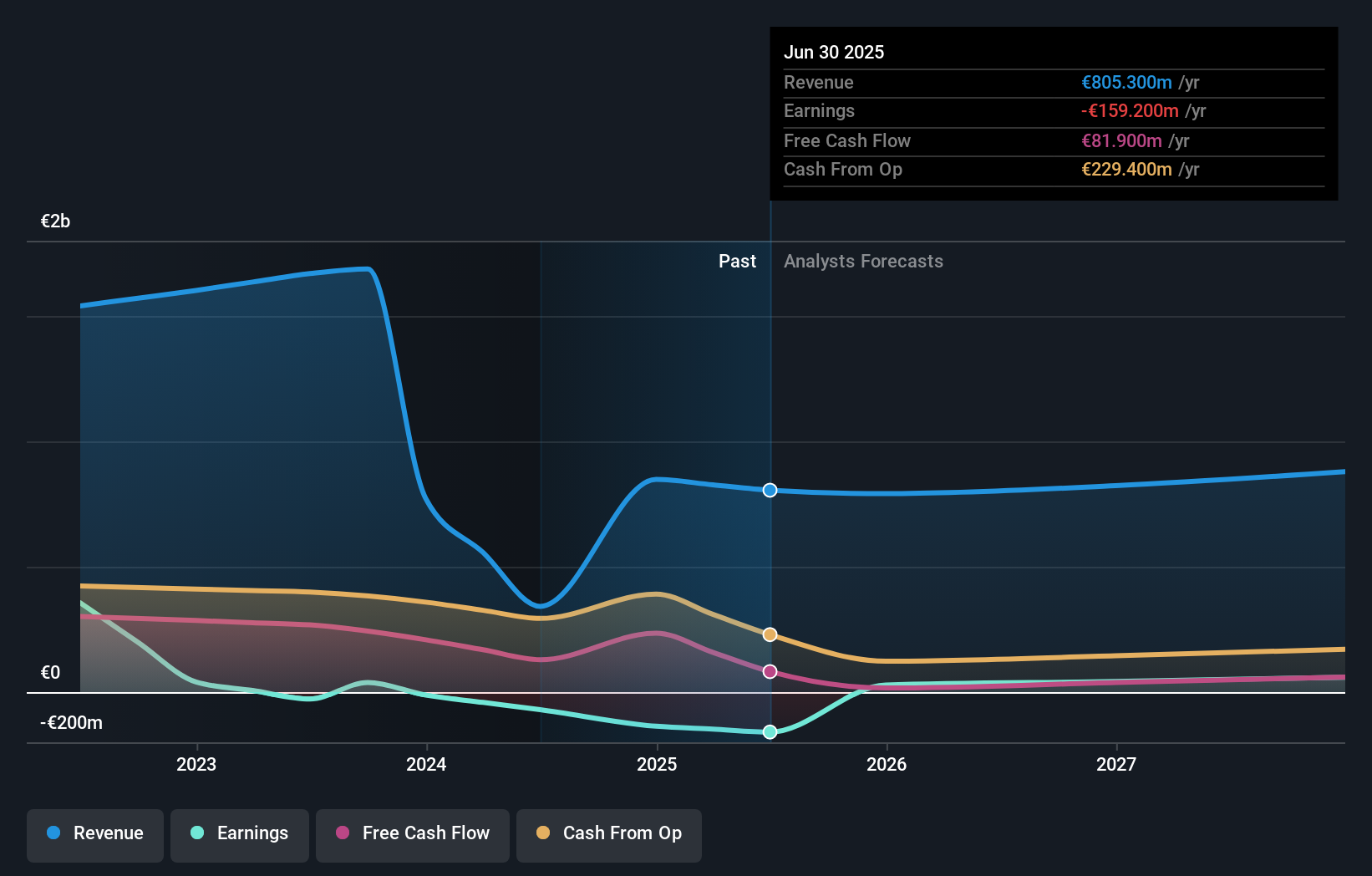

Operations: The company generates its revenue from various regions, with £1.32 billion from Europe, the Middle East, and Africa, £1.05 billion from the Americas, £273 million from Asia Pacific, and £319 million from its Worka segment.

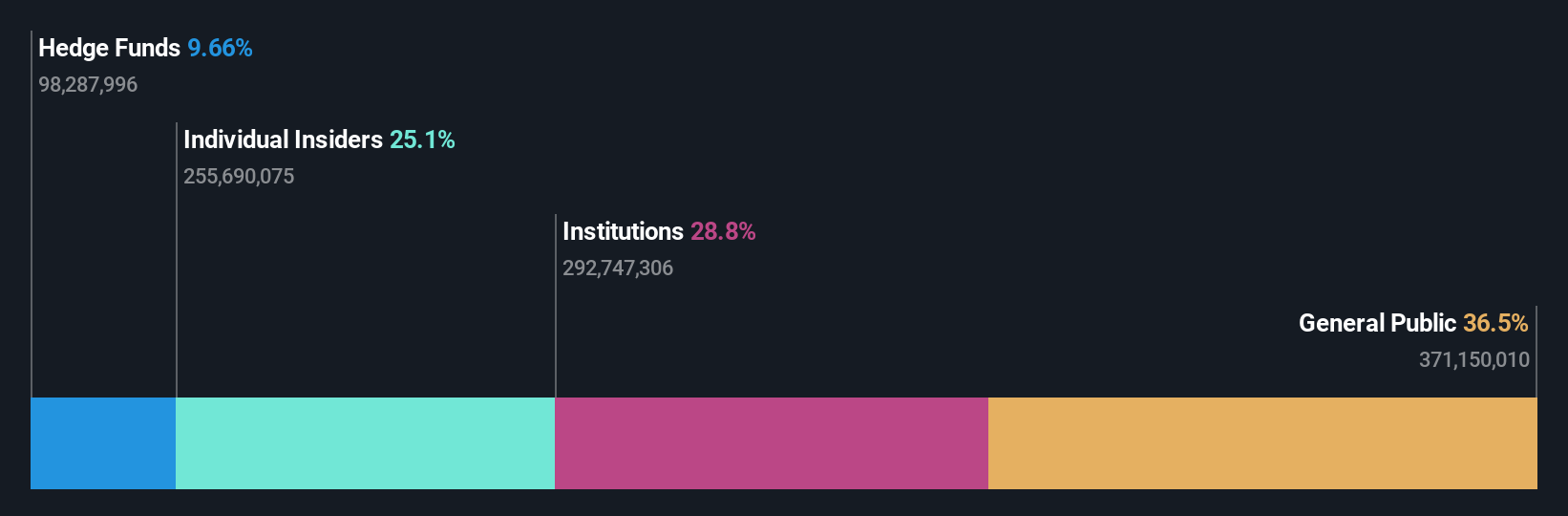

Insider Ownership: 25.2%

Earnings Growth Forecast: 108.2% p.a.

International Workplace Group (IWG) is poised for significant growth, with revenue expected to increase by 7.8% annually, outpacing the UK market's 3.5%. The company is forecast to become profitable within three years, a notable achievement given its current non-profitable status. Insider activity has been balanced, with more shares bought than sold recently, although not in substantial volumes. Recent debt financing activities have strengthened IWG's financial structure without increasing total debt levels, supporting future growth initiatives and repayment plans for existing obligations.

- Navigate through the intricacies of International Workplace Group with our comprehensive analyst estimates report here.

- Our valuation report here indicates International Workplace Group may be undervalued.

Playtech (LSE:PTEC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtech plc is a global technology company specializing in gambling software, services, content, and platform technologies with a market capitalization of approximately £1.67 billion.

Operations: Playtech's revenue segments include €684.10 million from Gaming B2B and €946.60 million from Gaming B2C, with additional contributions of €18.20 million from HAPPYBET and €73.40 million from Sun Bingo and other B2C activities.

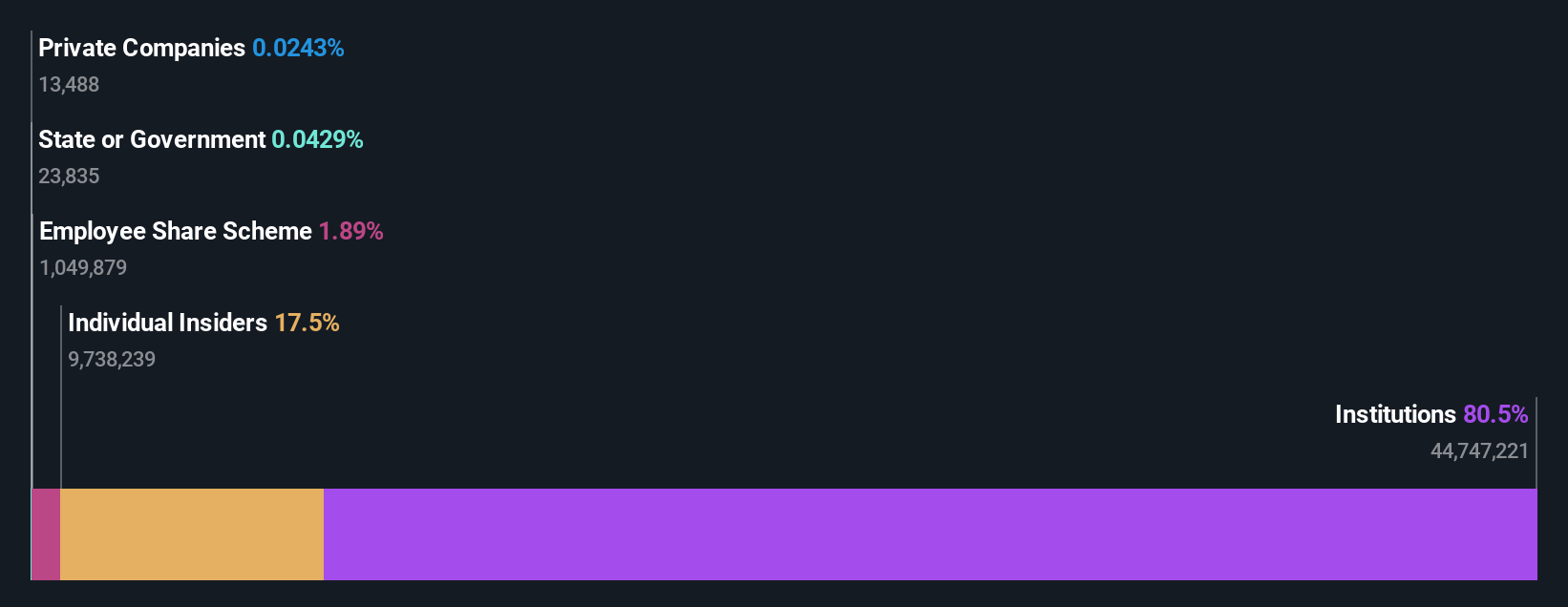

Insider Ownership: 13.5%

Earnings Growth Forecast: 20.6% p.a.

Playtech, a UK-based gaming technology company, has shown promising growth prospects with its recent strategic partnership with MGM Resorts to launch live casino content. Despite trading 50.2% below its estimated fair value and expected revenue growth slightly above the market at 4% per year, concerns remain due to large one-off items impacting earnings quality and a low forecasted return on equity of 8.9%. However, earnings are anticipated to grow significantly by 20.62% annually over the next three years.

- Click here and access our complete growth analysis report to understand the dynamics of Playtech.

- The analysis detailed in our Playtech valuation report hints at an deflated share price compared to its estimated value.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates primarily in Georgia, Azerbaijan, and Uzbekistan, offering a range of services including banking, leasing, insurance, brokerage, and card processing with a market cap of approximately £1.63 billion.

Operations: The company generates its revenue from banking, leasing, insurance, brokerage, and card processing services across Georgia, Azerbaijan, and Uzbekistan.

Insider Ownership: 18%

Earnings Growth Forecast: 15.2% p.a.

TBC Bank Group, a prominent UK financial institution, recently announced a private placement and share buyback, signaling strong insider confidence and strategic capital management. Despite its highly volatile share price in the past three months, the bank has demonstrated robust financial growth with net income and interest income significantly increasing from the previous year. Forecasted to outpace UK market trends with an 18.3% annual revenue increase and 15.2% earnings growth, TBC Bank balances this promising expansion trajectory against challenges like a high bad loans ratio (2.1%) and unstable dividend history.

- Get an in-depth perspective on TBC Bank Group's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, TBC Bank Group's share price might be too pessimistic.

Summing It All Up

- Explore the 62 names from our Fast Growing UK Companies With High Insider Ownership screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether International Workplace Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IWG

International Workplace Group

Provides workspace solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Good value with reasonable growth potential.