Stock Analysis

- United Kingdom

- /

- Basic Materials

- /

- LSE:FORT

Top 3 UK Stocks Estimated To Be Below Market Value In July 2024

Reviewed by Simply Wall St

As the FTSE 100 experiences a slight downturn and broader financial markets show mixed signals, investors might be looking for opportunities that diverge from the prevailing trends. In this context, identifying stocks that appear undervalued relative to their market value could offer a strategic advantage in navigating current economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Begbies Traynor Group (AIM:BEG) | £1.05 | £1.99 | 47.2% |

| Gaming Realms (AIM:GMR) | £0.362 | £0.69 | 47.2% |

| WPP (LSE:WPP) | £7.314 | £14.07 | 48% |

| LSL Property Services (LSE:LSL) | £3.39 | £6.43 | 47.3% |

| Velocity Composites (AIM:VEL) | £0.42 | £0.81 | 47.9% |

| Loungers (AIM:LGRS) | £2.82 | £5.52 | 48.9% |

| Accsys Technologies (AIM:AXS) | £0.549 | £1.05 | 47.9% |

| Ricardo (LSE:RCDO) | £4.97 | £9.46 | 47.4% |

| Nexxen International (AIM:NEXN) | £2.36 | £4.71 | 49.8% |

| M&C Saatchi (AIM:SAA) | £2.05 | £3.99 | 48.6% |

Underneath we present a selection of stocks filtered out by our screen.

Restore (AIM:RST)

Overview: Restore plc operates primarily in the UK, offering services to offices and workplaces across both public and private sectors, with a market capitalization of approximately £376.54 million.

Operations: The company generates revenue through two main segments: Secure Lifecycle Services at £107 million and Digital & Information Management at £170.10 million.

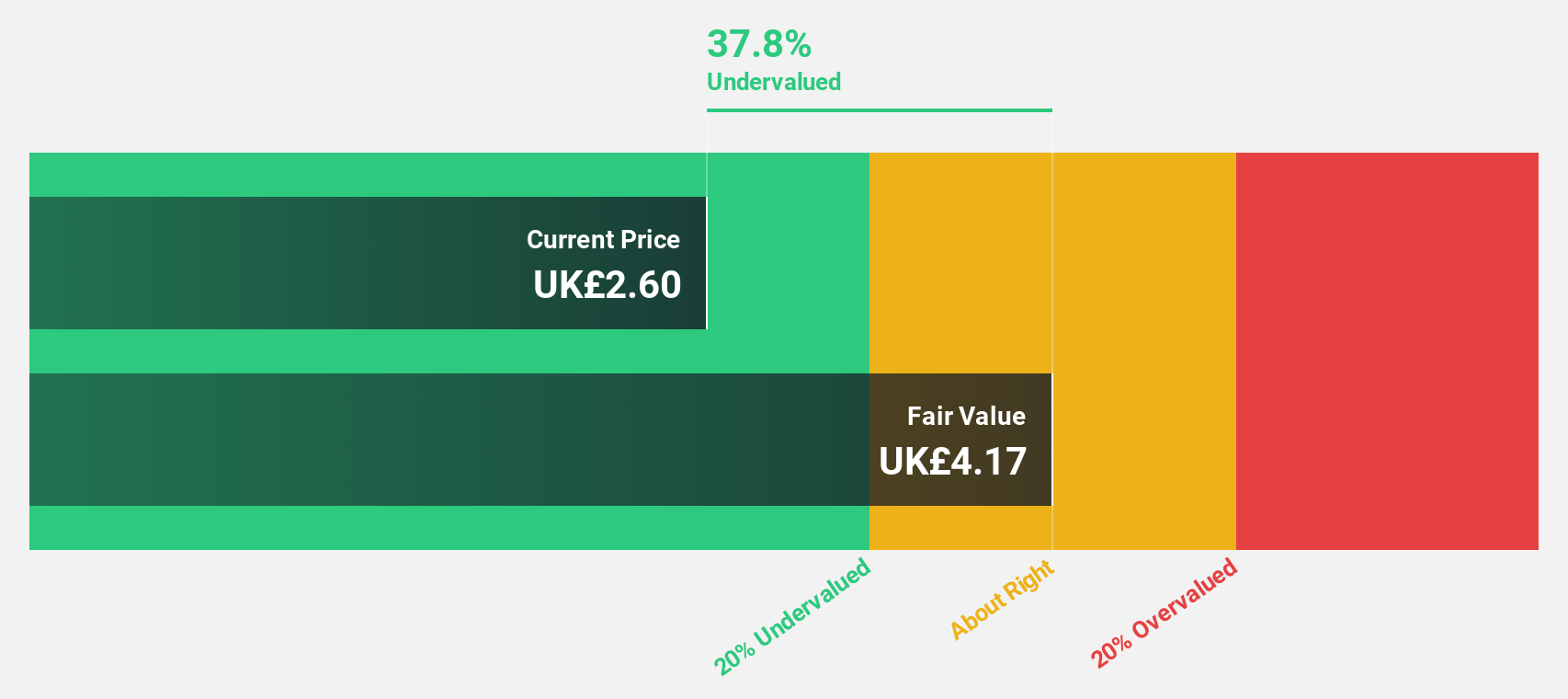

Estimated Discount To Fair Value: 26.8%

Restore, currently priced at £2.75, is significantly undervalued with our fair value estimate at £3.76. Despite challenges in covering interest payments with earnings and a modest forecasted Return on Equity of 11.6%, RST's financial outlook shows promise with expected revenue growth of 3.9% per year—outpacing the UK market average of 3.5%. Additionally, earnings are projected to surge by an impressive rate annually and RST is anticipated to turn profitable within three years, aligning above average market growth expectations.

- Our expertly prepared growth report on Restore implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Restore stock in this financial health report.

Forterra (LSE:FORT)

Overview: Forterra plc is a UK-based company specializing in the manufacture and sale of building products, with a market capitalization of approximately £388.14 million.

Operations: The company's revenue is derived primarily from two segments: Bespoke Products, generating £72.70 million, and Bricks and Blocks, contributing £277.40 million.

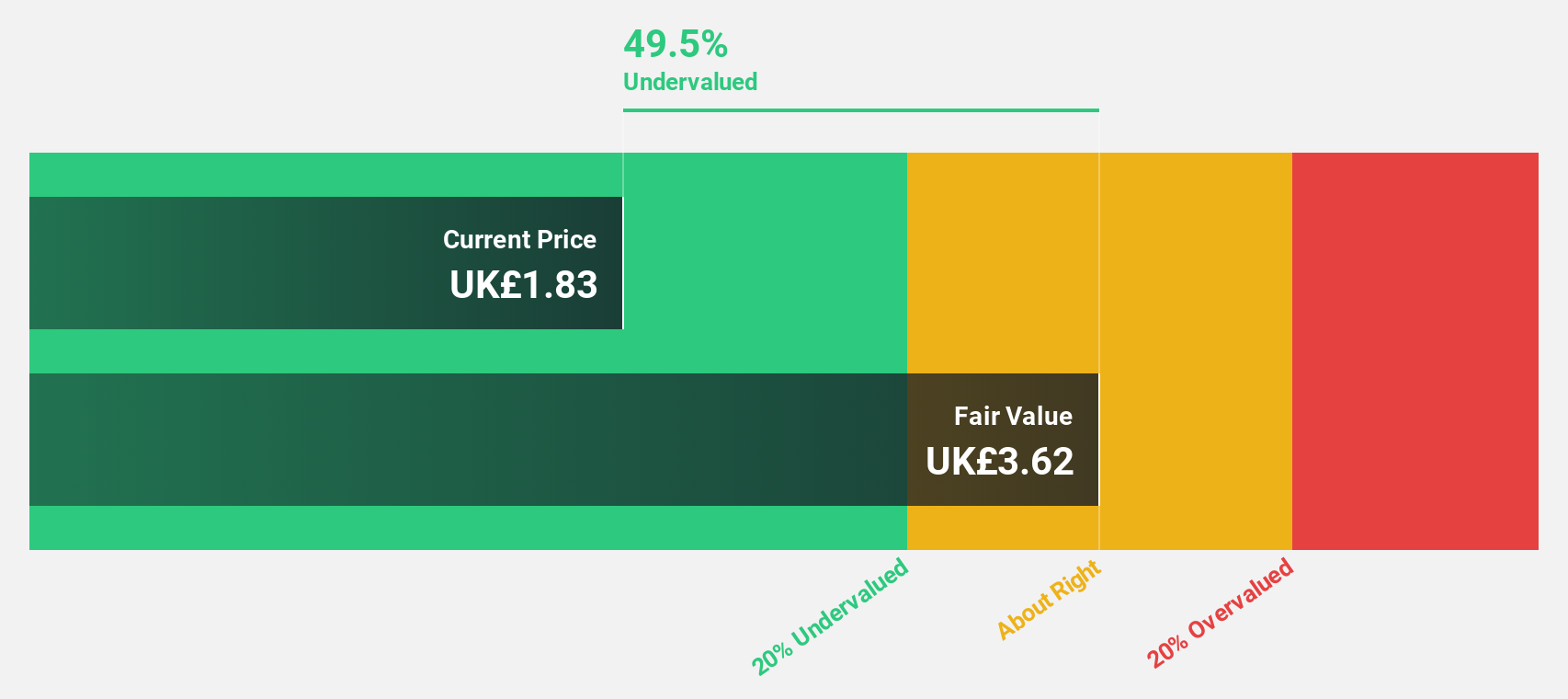

Estimated Discount To Fair Value: 39.4%

Forterra, trading at £1.88, is markedly below our fair value estimate of £3.09, indicating significant undervaluation based on discounted cash flows. Despite a recent dividend cut to 2.0 pence and a 6% revenue drop in early 2024, Forterra's earnings are expected to grow robustly by 26.2% annually, outperforming the UK market projection of 12.6%. However, its debt is poorly covered by operating cash flow and profit margins have declined from last year’s levels.

- The growth report we've compiled suggests that Forterra's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Forterra.

Deliveroo (LSE:ROO)

Overview: Deliveroo plc is a holding company that operates an online food delivery platform across several countries including the UK, Ireland, France, Italy, Belgium, and parts of Asia and the Middle East, with a market capitalization of approximately £2.02 billion.

Operations: The company generates revenue primarily through its operation of an on-demand food delivery platform, totaling £2.03 billion.

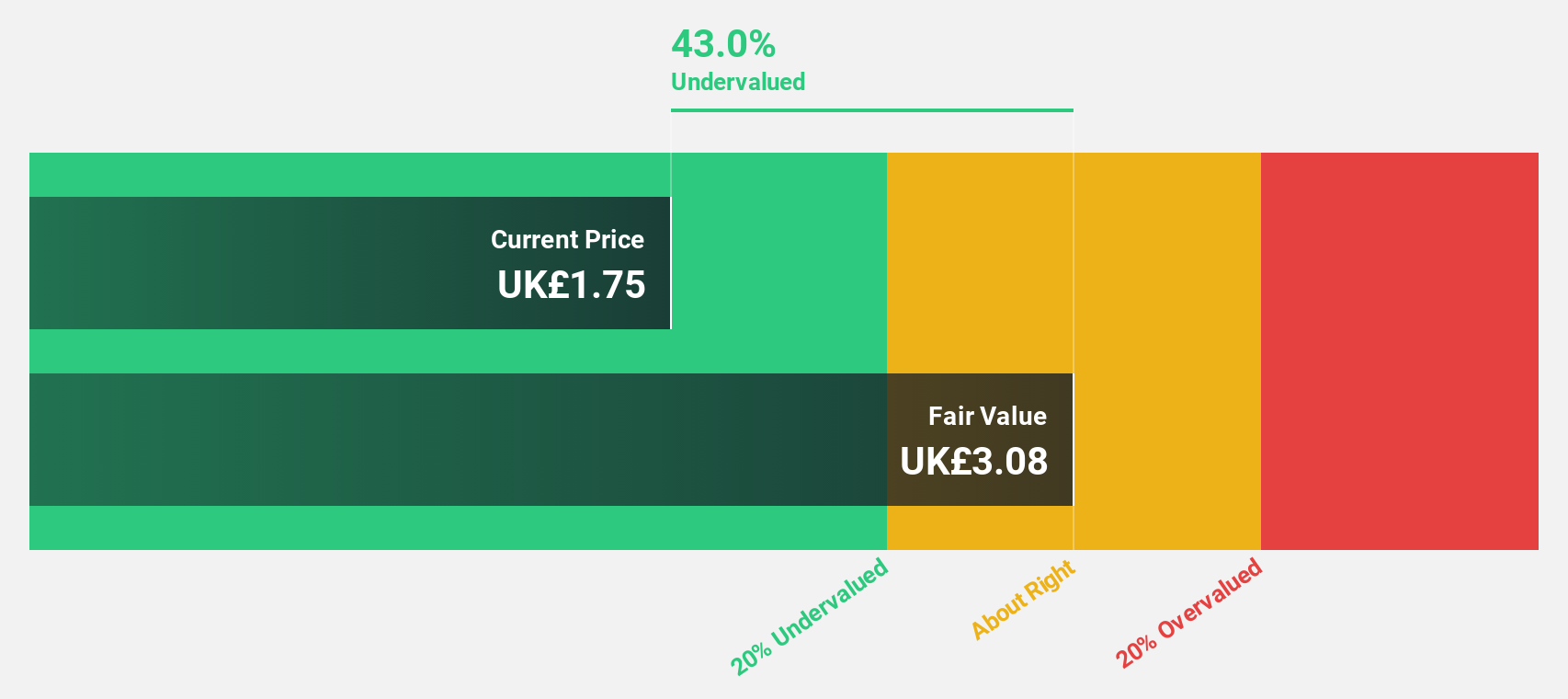

Estimated Discount To Fair Value: 44.6%

Deliveroo, currently trading at £1.29, is significantly undervalued by 44.6% against our fair value estimate of £2.33, highlighting potential in cash flow perspectives despite recent market fluctuations due to failed takeover talks with US-based DoorDash. While its revenue growth at 7.7% annually outpaces the UK market's 3.5%, Deliveroo's forecast to turn profitable within three years aligns with an above-market average growth trajectory, although its projected return on equity remains modest at 15.1%.

- Insights from our recent growth report point to a promising forecast for Deliveroo's business outlook.

- Click here to discover the nuances of Deliveroo with our detailed financial health report.

Seize The Opportunity

- Explore the 64 names from our Undervalued UK Stocks Based On Cash Flows screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Forterra is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FORT

Forterra

Engages in the manufacture and sale of building products in the United Kingdom.

Reasonable growth potential low.