- United Kingdom

- /

- Real Estate

- /

- AIM:PNS

We Think The Compensation For Panther Securities PLC's (LON:PNS) CEO Looks About Right

Key Insights

- Panther Securities will host its Annual General Meeting on 18th of June

- Salary of UK£118.0k is part of CEO Simon Peters's total remuneration

- Total compensation is 41% below industry average

- Over the past three years, Panther Securities' EPS fell by 20% and over the past three years, the total shareholder return was 18%

Performance at Panther Securities PLC (LON:PNS) has been rather uninspiring recently and shareholders may be wondering how CEO Simon Peters plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 18th of June. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out our latest analysis for Panther Securities

Comparing Panther Securities PLC's CEO Compensation With The Industry

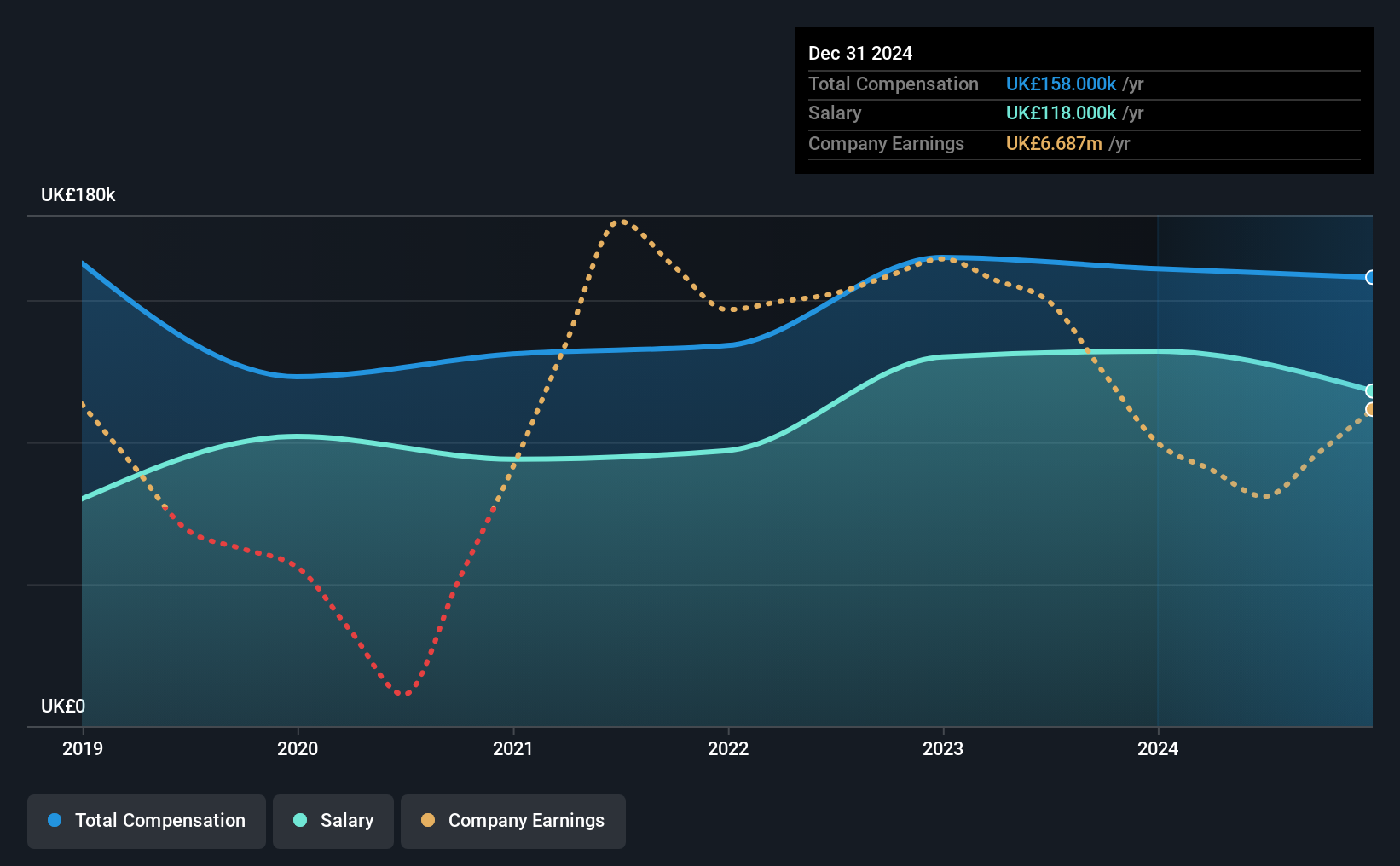

Our data indicates that Panther Securities PLC has a market capitalization of UK£52m, and total annual CEO compensation was reported as UK£158k for the year to December 2024. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at UK£118.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the British Real Estate industry with market capitalizations below UK£148m, we found that the median total CEO compensation was UK£268k. That is to say, Simon Peters is paid under the industry median. Furthermore, Simon Peters directly owns UK£684k worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | UK£118k | UK£132k | 75% |

| Other | UK£40k | UK£29k | 25% |

| Total Compensation | UK£158k | UK£161k | 100% |

Speaking on an industry level, nearly 56% of total compensation represents salary, while the remainder of 44% is other remuneration. It's interesting to note that Panther Securities pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Panther Securities PLC's Growth

Panther Securities PLC has reduced its earnings per share by 20% a year over the last three years. In the last year, its revenue is up 4.1%.

Overall this is not a very positive result for shareholders. The fairly low revenue growth fails to impress given that the EPS is down. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Panther Securities PLC Been A Good Investment?

Panther Securities PLC has served shareholders reasonably well, with a total return of 18% over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. These are are some concerns that shareholders may want to address the board when they revisit their investment thesis.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 3 warning signs (and 1 which is a bit concerning) in Panther Securities we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:PNS

Panther Securities

Panther Securities PLC ("the Company" or "the Group") is a property investment company quoted on the AIM market (AIM) since 2013.

Proven track record average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success