- United Kingdom

- /

- Real Estate

- /

- AIM:FLK

Spotlight On Fletcher King And 2 Other UK Penny Stocks

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, which highlighted the ongoing challenges faced by global markets. In such a fluctuating environment, identifying stocks with strong financial health becomes crucial for investors seeking potential growth opportunities. Penny stocks, though often overlooked and considered niche investments, can offer hidden value in smaller or newer companies that demonstrate balance sheet strength and long-term potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.20 | £828.88M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.575 | £183.66M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.44 | £355.43M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.81 | £61.34M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.21 | £103.3M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.33 | £205.12M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.405 | £435.71M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.372 | $216.25M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.475 | £187.85M | ★★★★★☆ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Fletcher King (AIM:FLK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fletcher King Plc offers a variety of property advice services in the United Kingdom and has a market cap of £3.69 million.

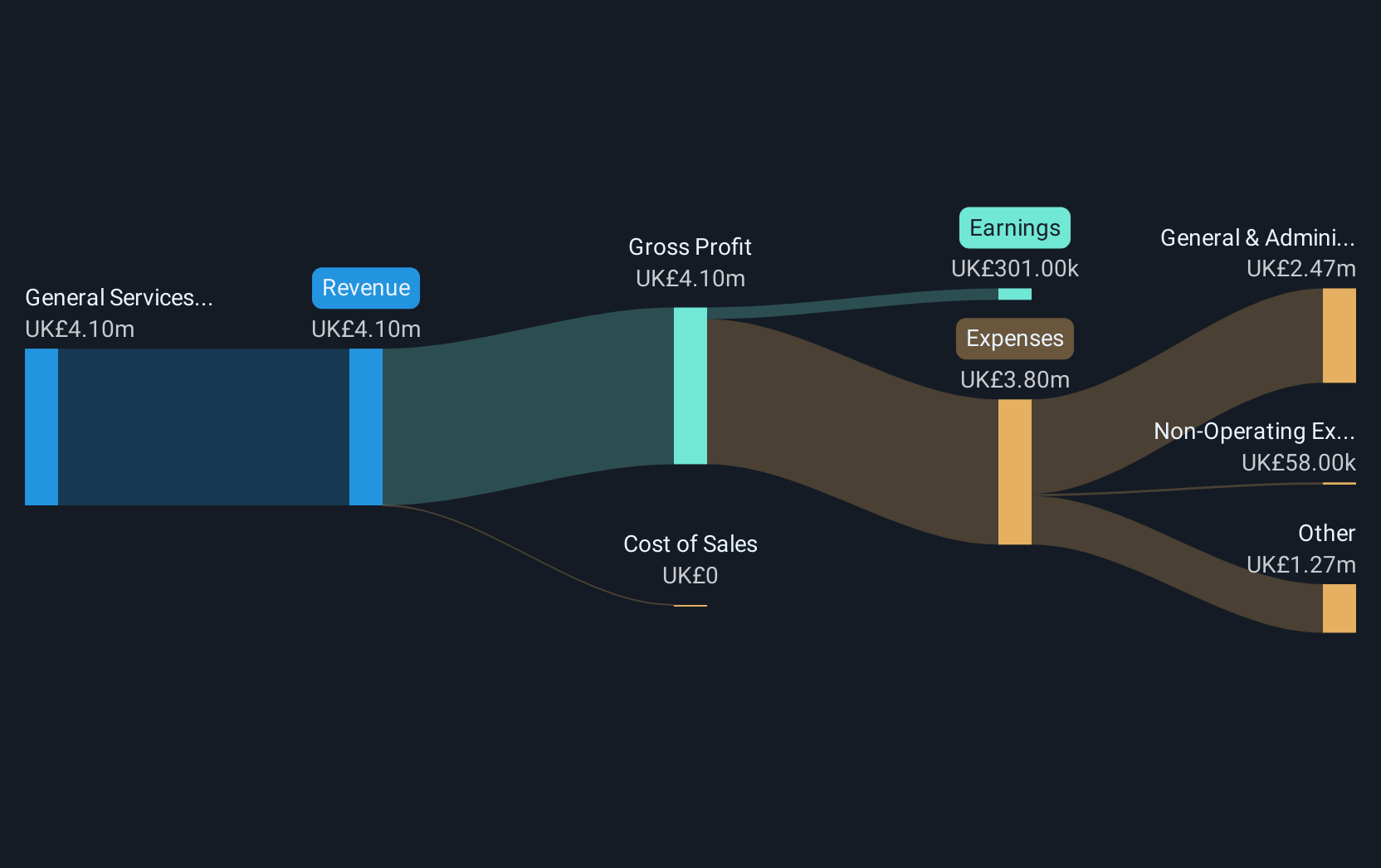

Operations: The company generates £3.83 million in revenue from its General Services segment.

Market Cap: £3.69M

Fletcher King Plc, with a market cap of £3.69 million, shows financial stability through its debt-free status and sufficient short-term assets (£5.8M) to cover liabilities (£1.6M). Despite trading significantly below estimated fair value, it has achieved consistent profit growth of 21% over the past year, although this is slightly below its five-year average growth rate of 23.9%. The company’s earnings quality is high despite lower net profit margins compared to last year and an unstable dividend track record. Experienced board members bolster governance but management tenure data remains insufficient for assessment.

- Click to explore a detailed breakdown of our findings in Fletcher King's financial health report.

- Examine Fletcher King's past performance report to understand how it has performed in prior years.

Public Policy Holding Company (AIM:PPHC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Public Policy Holding Company, Inc. offers consulting services in the United States and has a market capitalization of £157.92 million.

Operations: The company generates revenue through three main segments: Diversified Services ($9.84 million), Government Relations ($99.27 million), and Public Affairs Consulting ($31.29 million).

Market Cap: £157.92M

Public Policy Holding Company, Inc., with a market cap of £157.92 million, operates in the consulting sector and faces several financial challenges. Despite revenue growth from US$65.71 million to US$71.13 million for the first half of 2024, the company remains unprofitable with increasing net losses (US$10.08 million from US$3.5 million). Shareholders experienced dilution over the past year as shares outstanding grew by 4.3%. The management and board are relatively new, indicating potential instability in leadership experience. However, PPHC maintains a sufficient cash runway exceeding three years due to positive free cash flow growth of 46.8% annually despite its current negative return on equity (-26.08%).

- Unlock comprehensive insights into our analysis of Public Policy Holding Company stock in this financial health report.

- Examine Public Policy Holding Company's earnings growth report to understand how analysts expect it to perform.

Vianet Group (AIM:VNET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vianet Group plc offers smart, cloud-based, and Internet of Things solutions to the hospitality, unattended retail vending, and remote asset management sectors across the UK, Europe, the US, and Canada with a market cap of £30.87 million.

Operations: The company's revenue is divided into two segments: Smart Zones, generating £8.62 million, and Smart Machines, contributing £6.56 million.

Market Cap: £30.87M

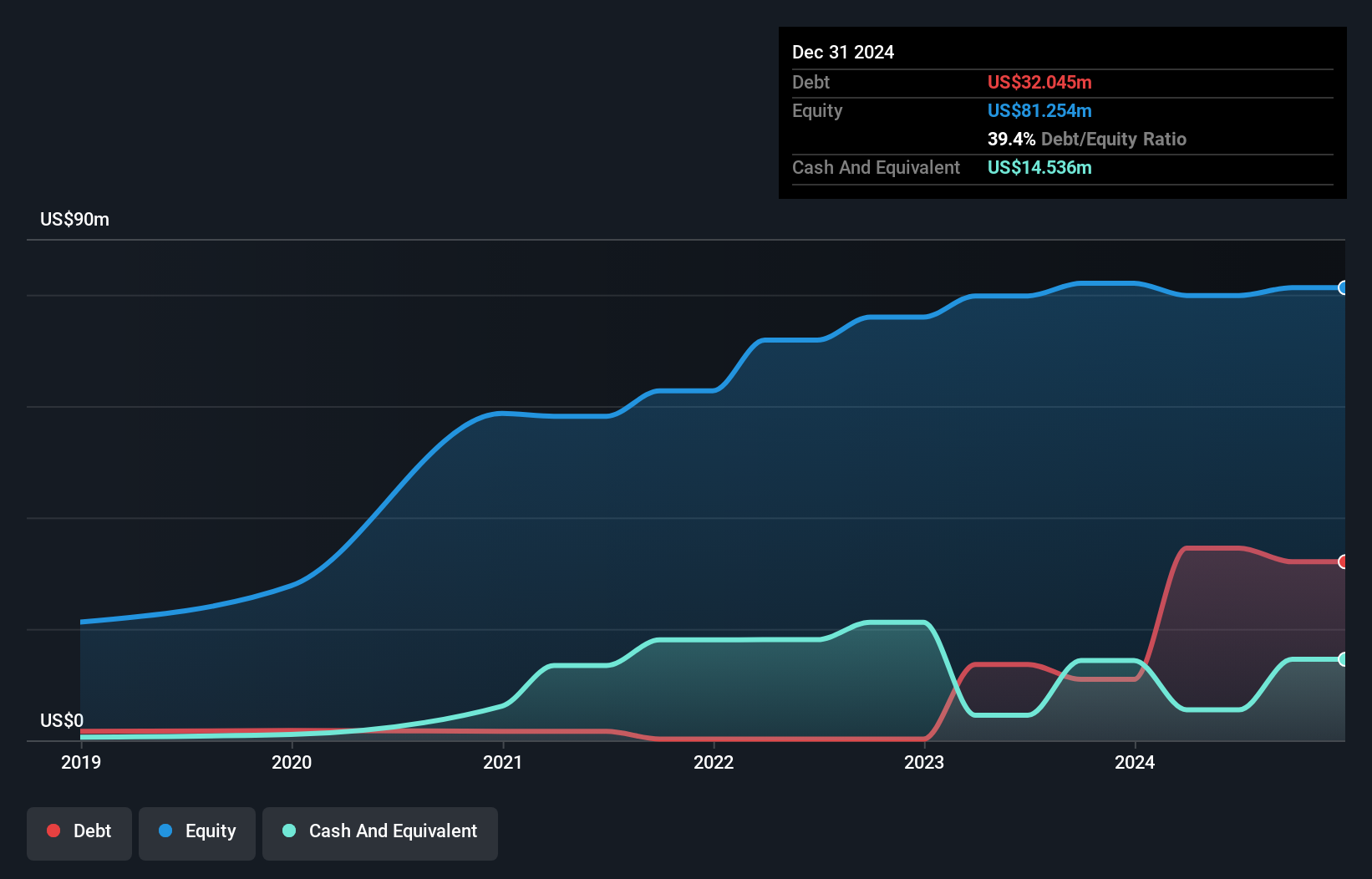

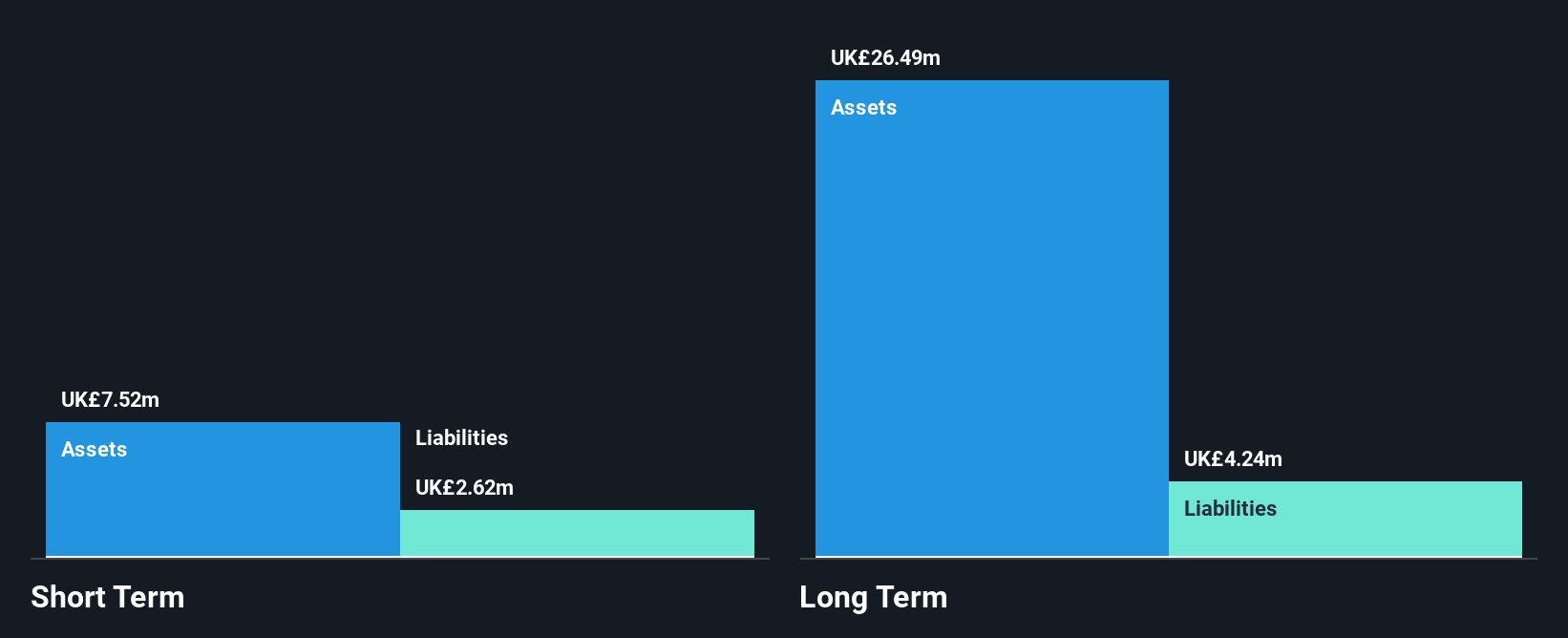

Vianet Group plc, with a market cap of £30.87 million, demonstrates financial stability with satisfactory net debt to equity ratio (5.6%) and short-term assets (£7.9M) exceeding both short and long-term liabilities (£3.4M and £4.4M respectively). The company's earnings grew significantly by 397.5% over the past year, although this contrasts with a five-year decline rate of 38.7%. Despite low return on equity (2.9%), Vianet's interest payments are well covered by EBIT (4.4x), and its board is experienced with an average tenure of 6.6 years, providing seasoned oversight amidst recent shareholder dilution concerns.

- Get an in-depth perspective on Vianet Group's performance by reading our balance sheet health report here.

- Gain insights into Vianet Group's historical outcomes by reviewing our past performance report.

Next Steps

- Access the full spectrum of 465 UK Penny Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FLK

Fletcher King

Provides a range of property advice services in the United Kingdom.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives