The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China, highlighting global economic interconnections. In such fluctuating markets, discerning investors often look beyond the giants of the FTSE indices to explore opportunities in lesser-known sectors. Penny stocks, though a somewhat outdated term, still represent a niche investment area where smaller or newer companies can offer potential value and growth when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.825 | £465.11M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £791.31M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £176.46M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.922 | £146.94M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.76 | £428.23M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.42 | £84.3M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.425 | £340.64M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.06 | £90.27M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.09 | £149.11M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.425 | £181.48M | ★★★★★☆ |

Click here to see the full list of 446 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Fletcher King (AIM:FLK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fletcher King Plc offers a variety of property advisory services in the United Kingdom and has a market cap of £3.74 million.

Operations: The company's revenue segment is derived from General Services, amounting to £4.10 million.

Market Cap: £3.74M

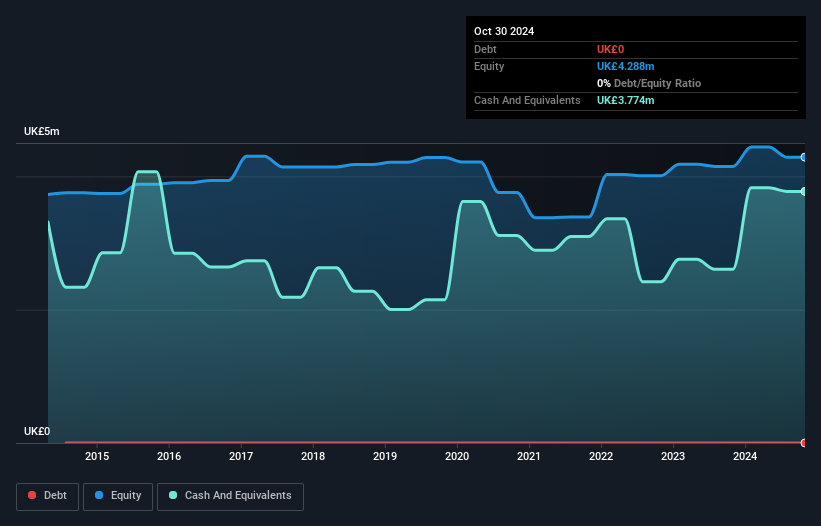

Fletcher King Plc, with a market cap of £3.74 million, has demonstrated significant earnings growth over the past five years at 44.2% annually, though recent growth slowed to 23.9%. The company is debt-free and its short-term assets (£5 million) comfortably cover both short-term (£965K) and long-term liabilities (£107K). While trading significantly below estimated fair value, its return on equity remains low at 7%. Recent earnings reports show improved sales of £1.6 million for the half year ended October 2024 compared to £1.33 million previously, with net income increasing to £0.053 million from £0.034 million year-on-year.

- Dive into the specifics of Fletcher King here with our thorough balance sheet health report.

- Gain insights into Fletcher King's historical outcomes by reviewing our past performance report.

Lexington Gold (AIM:LEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lexington Gold Ltd explores and develops gold projects in the United States and South Africa, with a market cap of £15.86 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: £15.86M

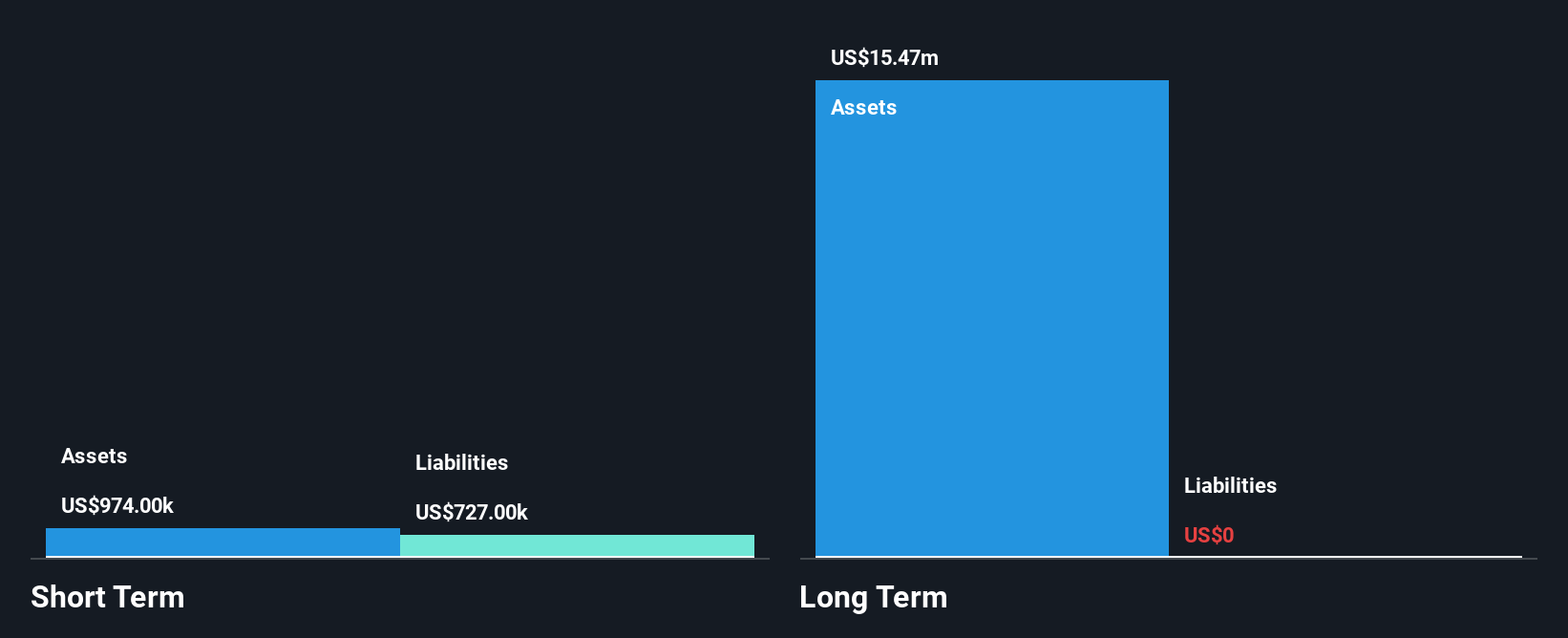

Lexington Gold Ltd, with a market cap of £15.86 million, is a pre-revenue company exploring gold projects in the U.S. and South Africa. It recently announced an Exploration Target for its Bothaville Project in South Africa's Witwatersrand Basin, known for significant historical gold production. The project benefits from favorable geological structures that enhance exploration potential but remains conceptual without defined Mineral Resources under JORC guidelines. Lexington Gold is debt-free and has become profitable this year with short-term assets ($1.6M) exceeding liabilities ($875K). Collaboration talks with Gold One Africa could further bolster project viability through shared resources and expertise.

- Click here to discover the nuances of Lexington Gold with our detailed analytical financial health report.

- Assess Lexington Gold's previous results with our detailed historical performance reports.

Microsaic Systems (AIM:MSYS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Microsaic Systems plc manufactures and sells equipment for monitoring water for toxins and pathogens in various regions globally, with a market cap of £1.57 million.

Operations: The company's revenue of £0.61 million is derived from the research, development, and commercialisation of scientific instruments.

Market Cap: £1.57M

Microsaic Systems plc, with a market cap of £1.57 million, is a pre-revenue company focusing on scientific instruments for water monitoring. Despite its unprofitability, the company has reduced losses over the past five years by 3.9% annually and reported improved sales of £0.26 million for the half-year ending June 2024. The management team is relatively new with an average tenure of 1.3 years, while the board has more experience at 7.7 years average tenure. Financially stable with no debt and short-term assets (£1.7M) exceeding liabilities (£424K), Microsaic faces challenges due to high share price volatility and limited cash runway under one year.

- Click to explore a detailed breakdown of our findings in Microsaic Systems' financial health report.

- Evaluate Microsaic Systems' historical performance by accessing our past performance report.

Key Takeaways

- Discover the full array of 446 UK Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MET

Metir

Manufactures and sells equipment used monitoring water for toxins and pathogens in the United Kingdom, the United States, Europe, China, and internationally.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success