- United Kingdom

- /

- Biotech

- /

- LSE:OXB

Oxford Biomedica plc (LON:OXB) Looks Inexpensive After Falling 26% But Perhaps Not Attractive Enough

The Oxford Biomedica plc (LON:OXB) share price has fared very poorly over the last month, falling by a substantial 26%. Looking at the bigger picture, even after this poor month the stock is up 91% in the last year.

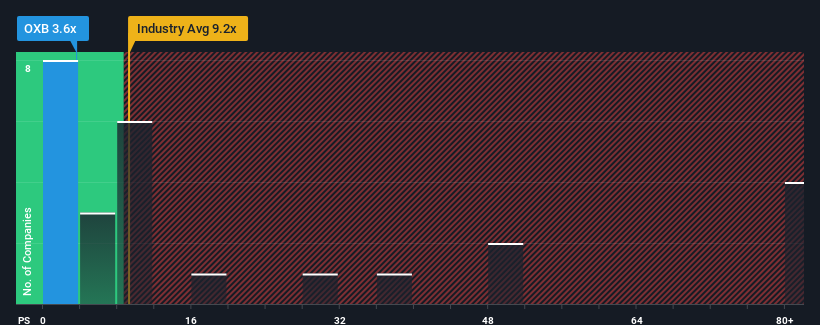

After such a large drop in price, Oxford Biomedica may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 3.6x, considering almost half of all companies in the Biotechs industry in the United Kingdom have P/S ratios greater than 10x and even P/S higher than 33x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Oxford Biomedica

How Has Oxford Biomedica Performed Recently?

Oxford Biomedica hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Oxford Biomedica's future stacks up against the industry? In that case, our free report is a great place to start.How Is Oxford Biomedica's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Oxford Biomedica's is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. This means it has also seen a slide in revenue over the longer-term as revenue is down 28% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 32% per annum over the next three years. With the industry predicted to deliver 54% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Oxford Biomedica's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Having almost fallen off a cliff, Oxford Biomedica's share price has pulled its P/S way down as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Oxford Biomedica's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Oxford Biomedica with six simple checks.

If you're unsure about the strength of Oxford Biomedica's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:OXB

Oxford Biomedica

A contract development and manufacturing organization, focuses on delivering therapies to patients worldwide.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives