- United Kingdom

- /

- Life Sciences

- /

- LSE:ONT

New Forecasts: Here's What Analysts Think The Future Holds For Oxford Nanopore Technologies plc (LON:ONT)

Shareholders in Oxford Nanopore Technologies plc (LON:ONT) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

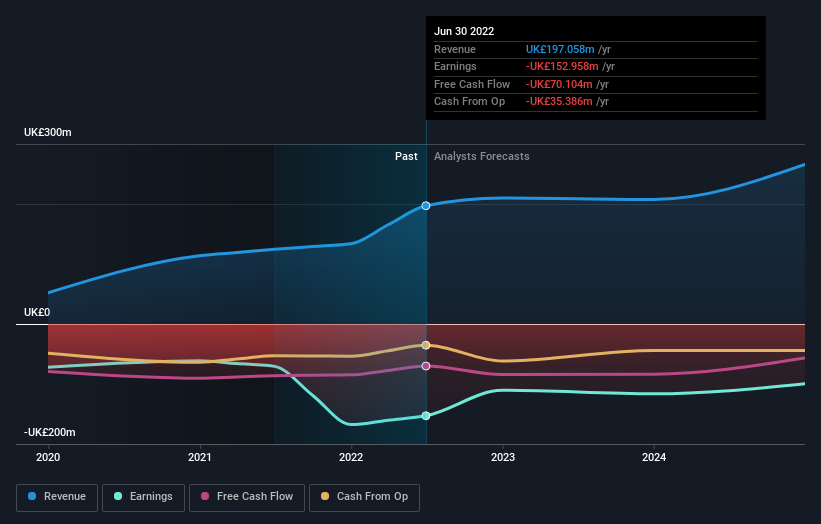

Following the upgrade, the latest consensus from Oxford Nanopore Technologies' seven analysts is for revenues of UK£210m in 2022, which would reflect an okay 6.6% improvement in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 28% to UK£0.13. However, before this estimates update, the consensus had been expecting revenues of UK£173m and UK£0.14 per share in losses. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to this year's revenue estimates, while at the same time reducing their loss estimates.

View our latest analysis for Oxford Nanopore Technologies

There was no major change to the consensus price target of UK£5.49, perhaps suggesting that the analysts remain concerned about ongoing losses despite the improved earnings and revenue outlook. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Oxford Nanopore Technologies, with the most bullish analyst valuing it at UK£7.50 and the most bearish at UK£4.00 per share. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that Oxford Nanopore Technologies' revenue growth is expected to slow, with the forecast 14% annualised growth rate until the end of 2022 being well below the historical 58% growth over the last year. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 18% annually. Factoring in the forecast slowdown in growth, it seems obvious that Oxford Nanopore Technologies is also expected to grow slower than other industry participants.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses this year, perhaps suggesting Oxford Nanopore Technologies is moving incrementally towards profitability. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Oxford Nanopore Technologies.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Oxford Nanopore Technologies analysts - going out to 2024, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ONT

Oxford Nanopore Technologies

Engages in the research, development, manufacture, and commercialization of a novel generation of deoxyribonucleic acid (DNA) or ribonucleic acid (RNA) sequencing technology that allows the real-time analysis of DNA or RNA.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives